Transform Bank Transfers into Smart, Self-Executing Agreements

Enable your customers to create conditional payments that execute automatically when their specified conditions are met. Give them control while you provide the trust—all on your existing rails.

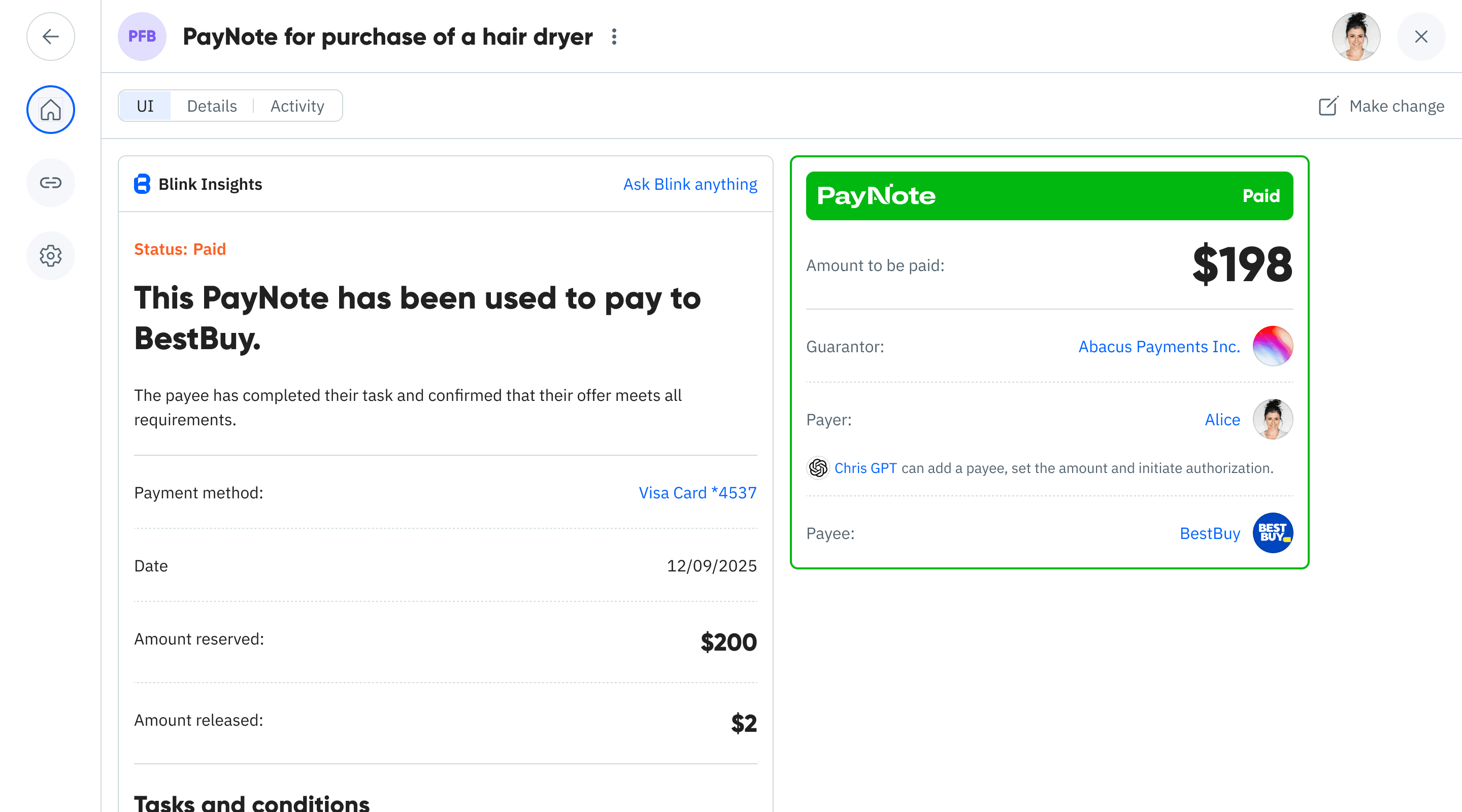

From Customer Request to Completed Payment

Watch how your customer creates a conditional payment, sets their own rules, and lets the payment execute automatically when conditions are met.

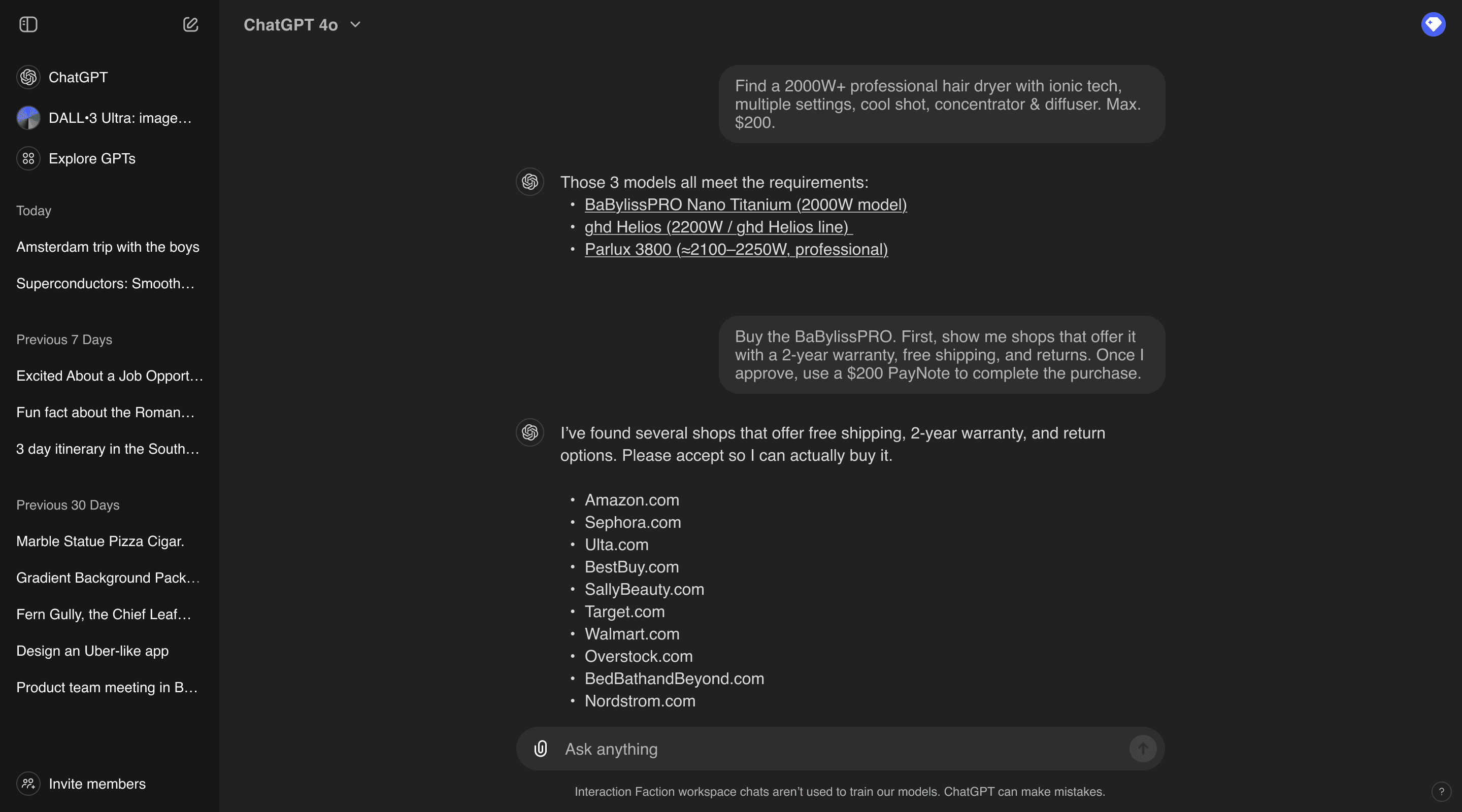

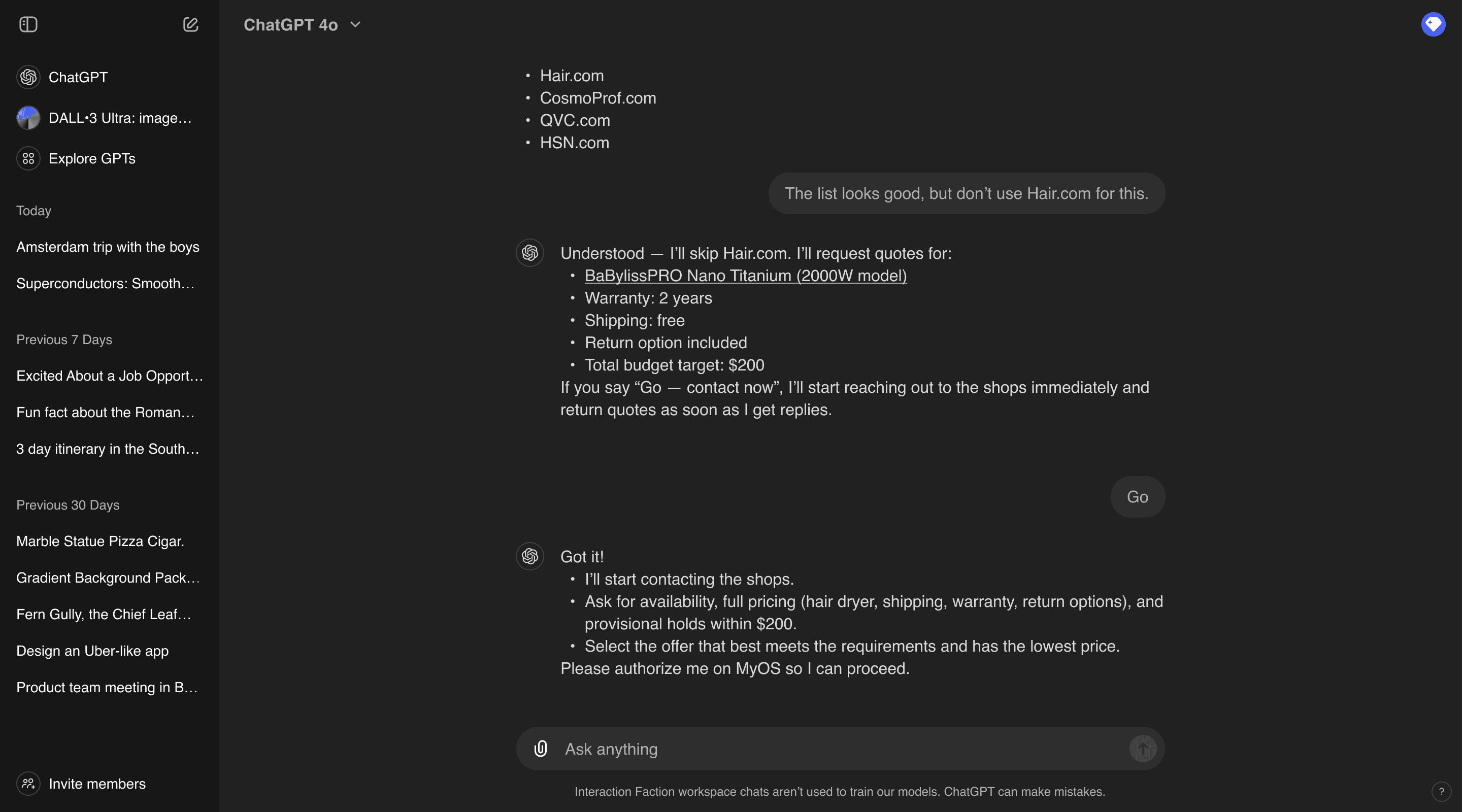

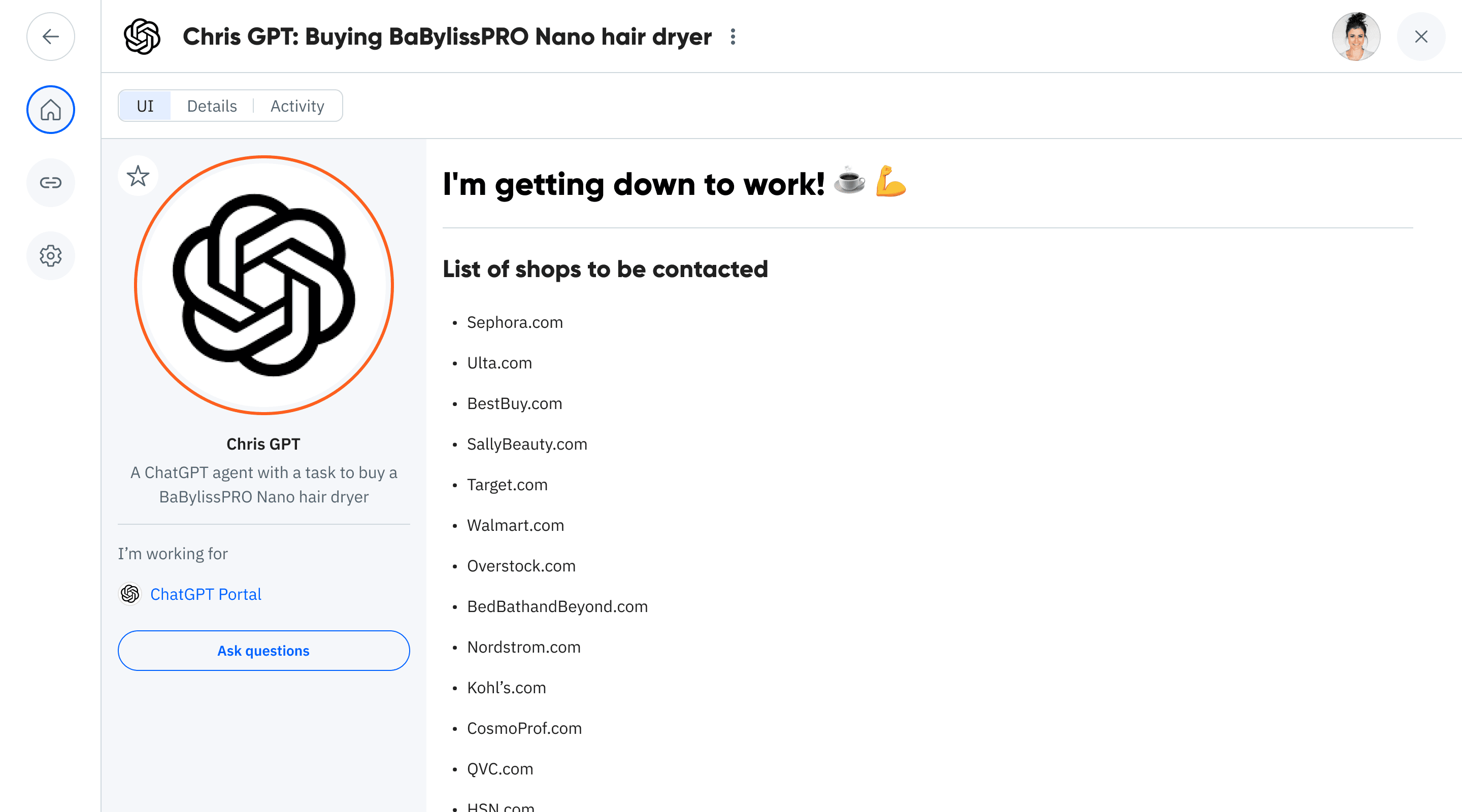

You ask for a professional hair dryer with constraints. The assistant lists eligible shops to contact.

Step 1 of 10

Everyone Sees the Same Truth

The PayNote is a shared Blue Document where all participants—payer, payee, bank, and any third parties—see the same rules, same state, and same evidence. No disputes, no confusion, just transparent execution.

PayNote Document

Payer (Your Customer)

Payee (Recipient)

Bank (You)

Third Parties (Validators)

AI Agents (Optional)

Document Events Your Bank Processes

Authorize Payment

Customer approves

Specify Payee

Recipient confirmed

Specify Amount

Final amount set

Release Payment

Conditions met

Cancel Authorization

Customer cancels

Split Payment

Multi-party disbursement

Example Use Cases

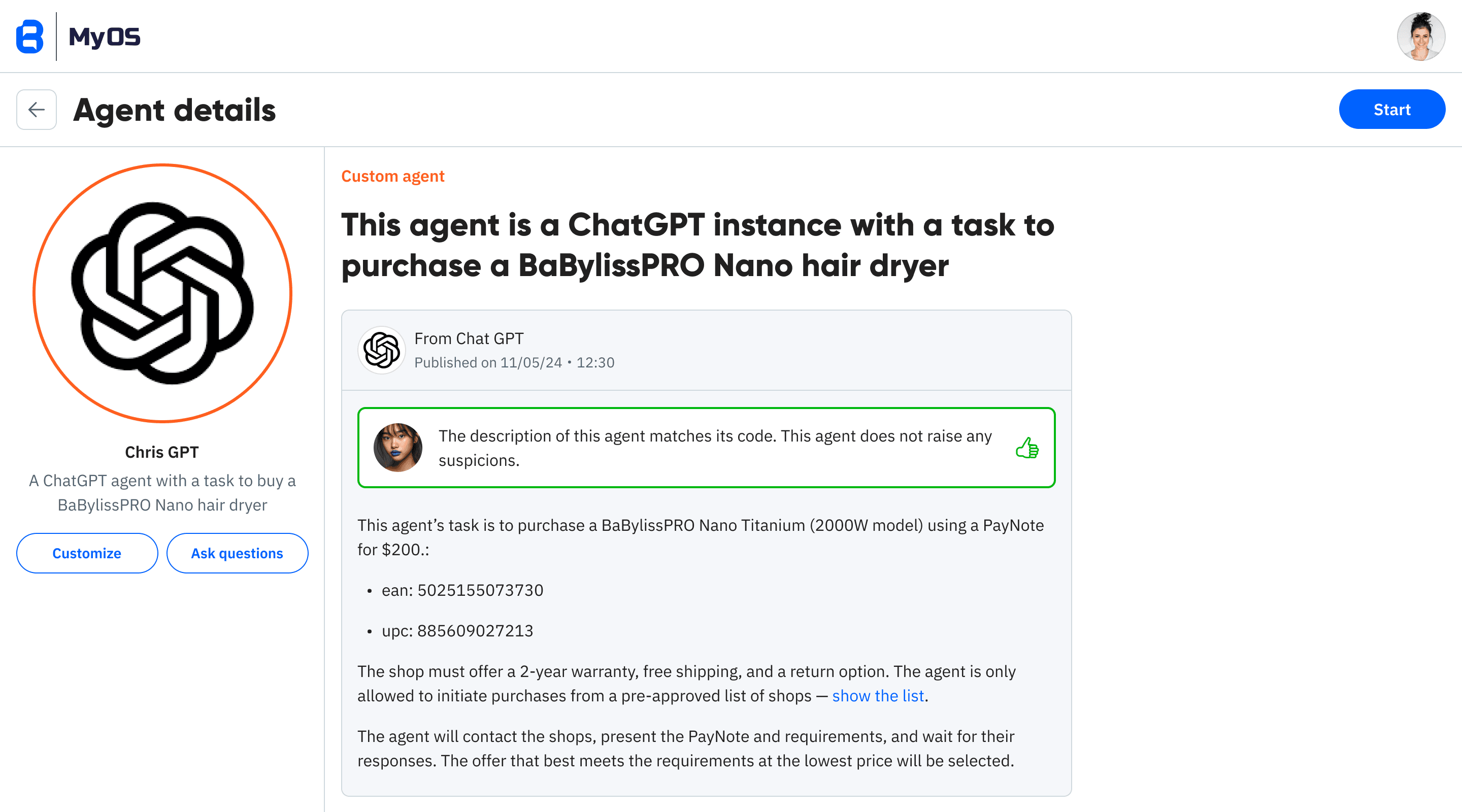

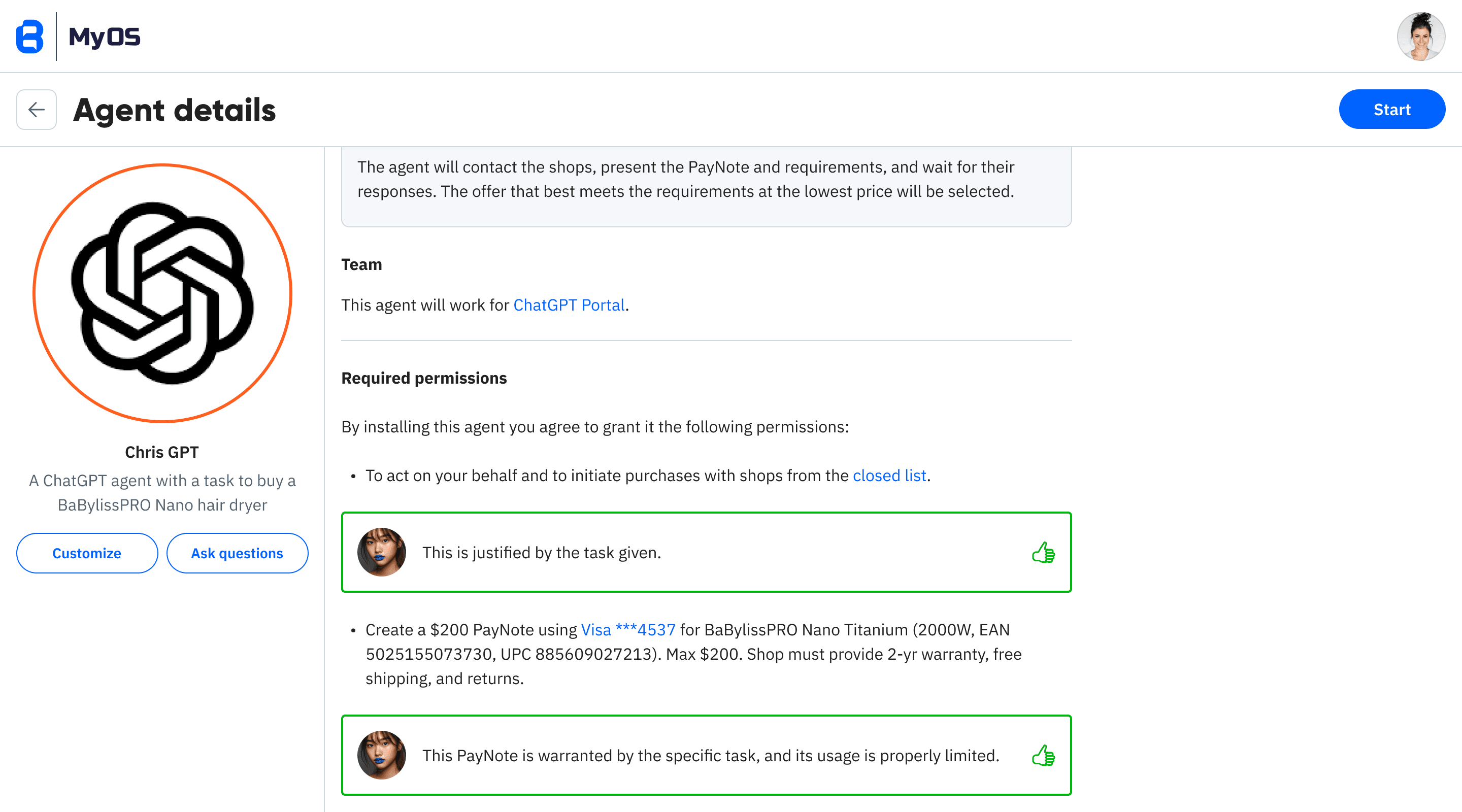

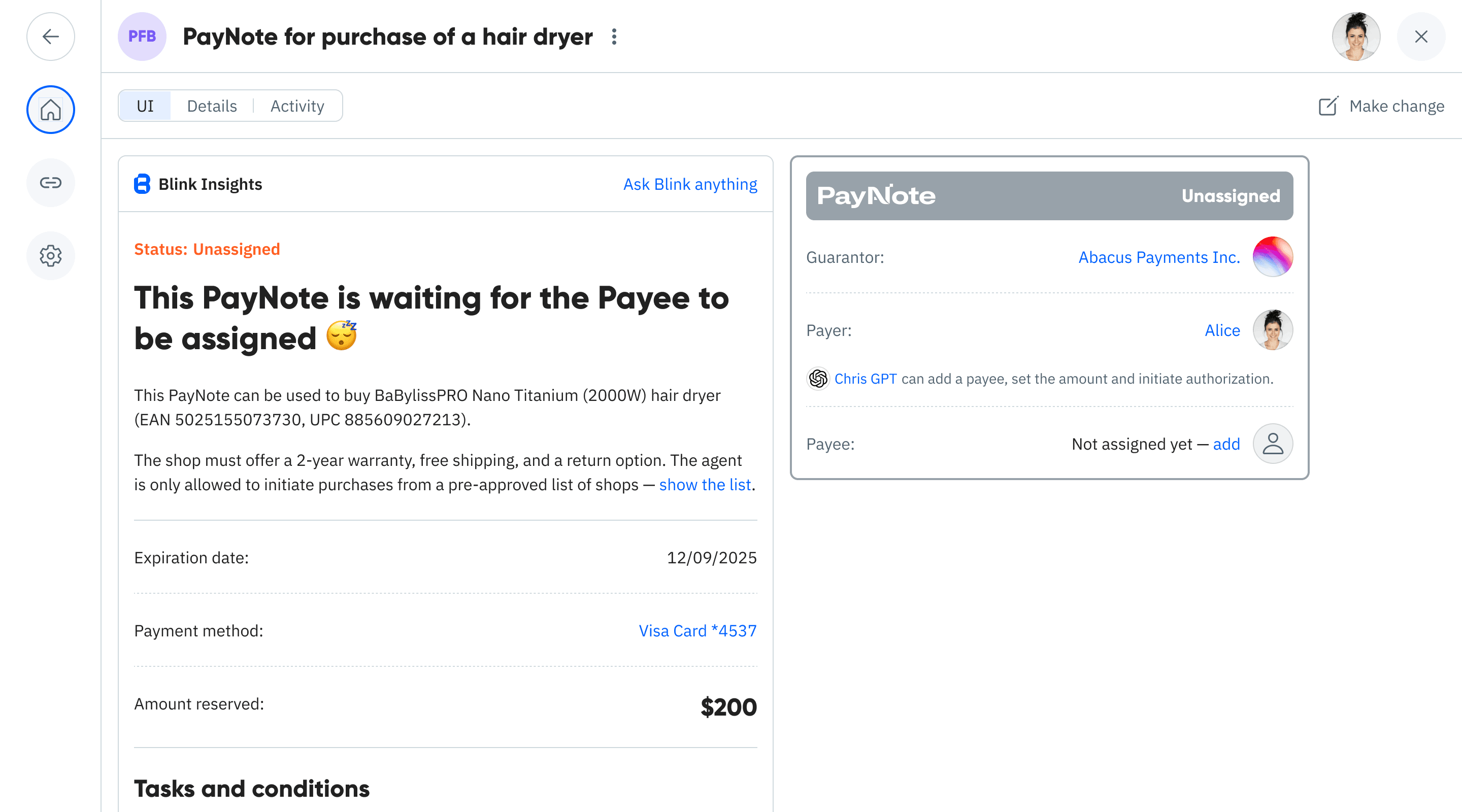

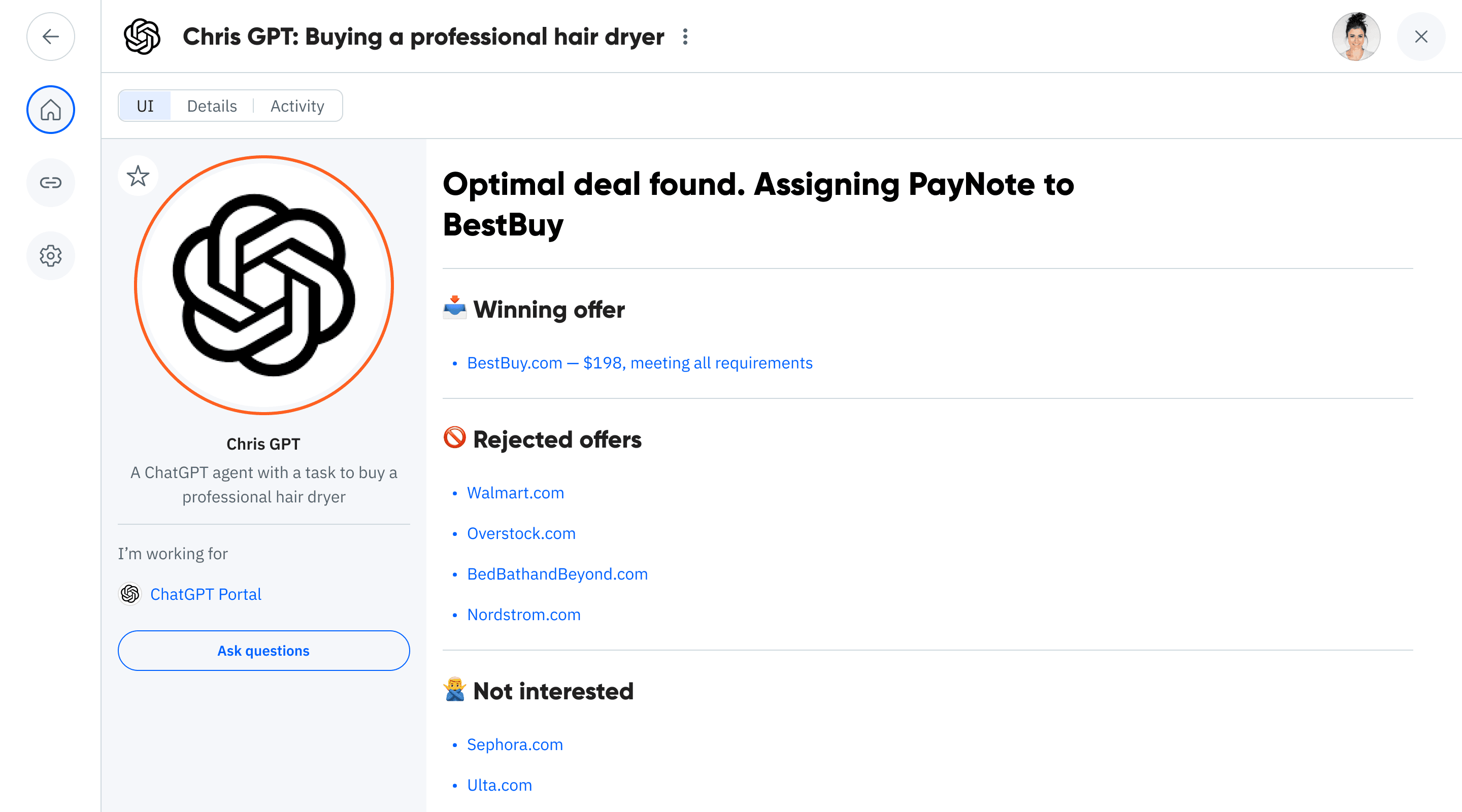

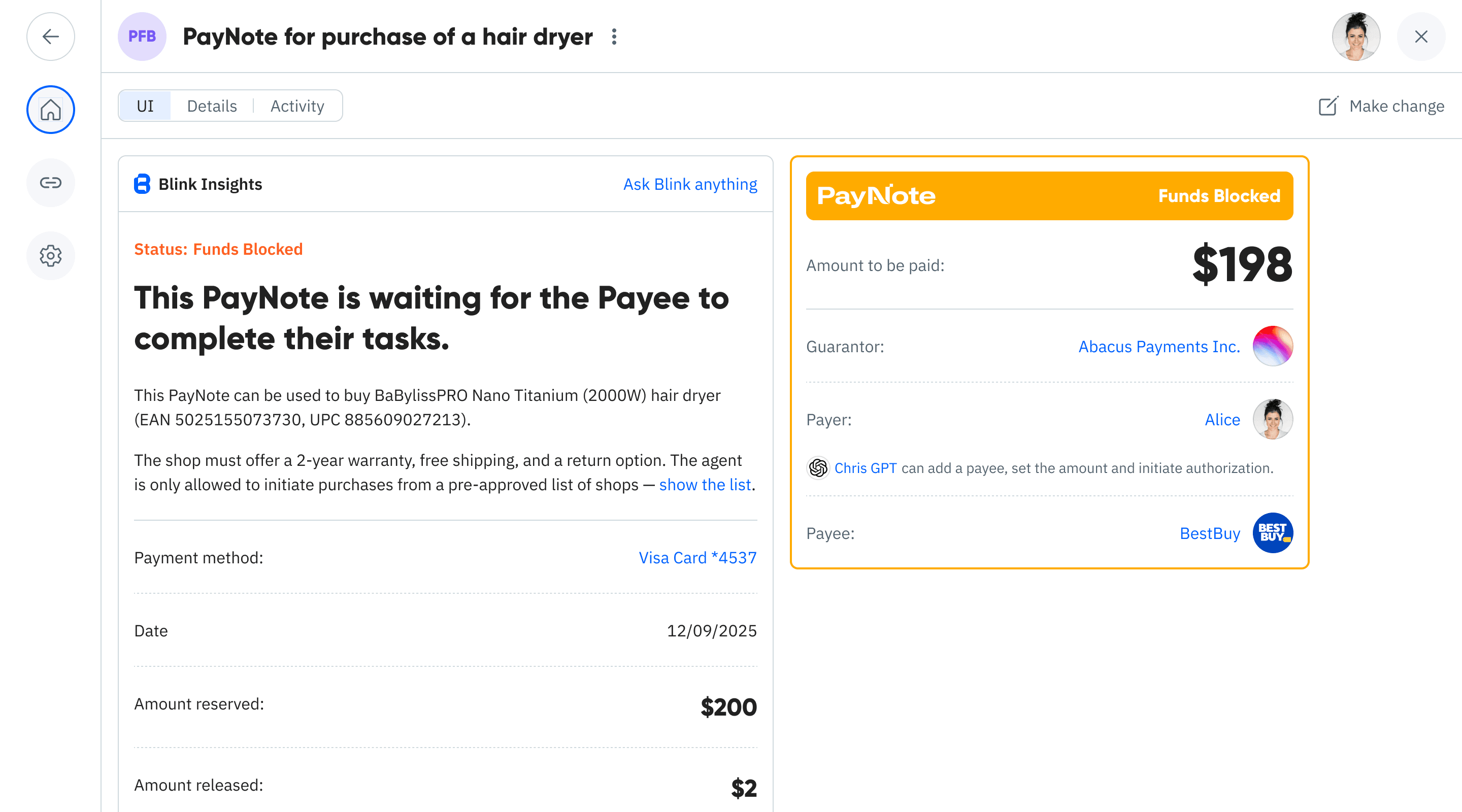

AI-Powered Procurement

Your business customers' AI agents can safely purchase within boundaries

Set spending limits, require specific vendors, demand delivery proof—the AI negotiates while the PayNote enforces the rules. Perfect for automated supply chain management.

Complex B2B Agreements

Turn any business agreement into executable code

Multi-party approvals, invoice matching, service verification—conditions that would take days of emails execute instantly. Your customers close deals faster.

Construction Milestone Payments

Release funds as work progresses, automatically

Site survey complete? 20% released. Foundation poured? Next 30%. No more site visits, photo disputes, or held payments. DHL, inspectors, and contractors all update the same document.

International Trade Finance

Simplify the most complex payments

Payment releases when: customs cleared + goods inspected + documents verified. Split automatically between freight forwarders, brokers, and suppliers. One PayNote replaces 20 documents.

Smart Payroll & Treasury

Conditional disbursements at scale

Bonus payments when KPIs are met. Vendor payments on delivery confirmation. Employee reimbursements with receipt validation. Batch processing with individual conditions.

M&A and Escrow Replacement

Complex holdbacks made simple

Time-based releases, earn-out calculations, indemnity reserves—all self-executing. No escrow agent fees, no manual calculations, just deterministic execution.

Why Banks Love This

Create New Revenue Streams

"Conditional Payment Assurance" - Your newest fee line

Charge 2-3x standard wire fees for guaranteed conditional execution. Customers gladly pay for automation and certainty. Early adopters seeing $30-50 per PayNote vs $15 standard wire.

Use Your Existing Infrastructure

Your rails, your rules, your systems

ACH, SEPA, SWIFT, RTP—all work exactly as before. PayNotes are just smart control logic on top. No new ledger, no new settlement, no integration headaches.

Slash Operational Costs

Kill the PDF-email-phone tag nightmare

80% reduction in payment disputes. 90% fewer customer service calls. Zero manual verification. Evidence is cryptographic, verifiable, and arrives automatically.

Ship Features Your Customers Actually Want

Developer-friendly, fully portable

PayNotes are Blue documents that run identically anywhere. No vendor lock-in. Your developers can extend and customize. Open source examples included.

Bank-Grade Security Built In

Every action is signed, attributed, and auditable

Actor Policy enforcement, role-based permissions, device signatures—enterprise security from day one. Full audit trail with hash-chained timeline for regulators.

Differentiate Without Risk

Offer escrow-like services without escrow complexity

Become the trusted intermediary for complex transactions. Use the systems you trust, add the intelligence your customers need.

Legal & Compliance

KYC/AML Unchanged

You still know every customer and screen every counterparty

PayNotes don't alter identity requirements. Same onboarding, same verification, same monitoring. We add logic, not new compliance burden.

Money Moves on Your Rails

Wires, ACH, SEPA, RTP remain your settlement layer

No new payment networks, no e-money regulations, no custody requirements. PayNotes orchestrate; your existing systems execute.

Authority & Signatures Preserved

Board approvals, multi-sig, device binding all captured

Every authorization is an event. Role-based operations map to your existing authorities. Full attribution for every action.

Complete Regulatory Export

Hash-chained timeline with optional VC signatures

Export the complete audit trail in regulator-friendly formats. Every decision, every trigger, every execution—immutable and verifiable.

Why Not Blockchain? Why Not Classical?

Classical System

(Email, PDFs, Manual Escrow)

Hidden and Slow

No Guarantees

Blockchain

Heavy and Public

Regulatory Misalignment

Bank Transfer PayNotes

(Blue Protocol)

Smart and Private

Your Rails, Enhanced

Risk, Liability & Controls

Smart Actor Policy Framework

Business authority mapped to operations

CFO authorizes amounts. Treasury specifies payees. Both must approve for release. Every role, every permission, cryptographically enforced.

Clear Liability Model

Same as today's wires, but smarter

Bank executes per PayNote rules. Guarantor ensures compliance. Timeline shows exactly why each decision was made. No ambiguity, no disputes.

Enterprise Security at Every Step

Multi-factor, multi-device, multi-signature

Device signatures, OTP, SSO, hardware keys—all captured as events. Step-up authentication when needed. Complete attribution chain.

Automatic Safety Valves

Timeouts, expiry, and auto-reversion

PayNotes auto-expire if conditions aren't met. Funds revert to payer. No money in limbo. Clear time bounds on every agreement.

FAQ (For the Decision Maker)

Do we hold customer funds?

No. PayNotes are instruction contracts that tell you when to move money via your existing rails. No custody, no float, no new regulatory burden.

Do we need new licenses or approvals?

No. Your existing licenses cover everything. PayNotes are smart instructions, not a new payment method. KYC/AML and settlement unchanged.

Will we be locked into a platform?

No. PayNotes are Blue documents—open protocol that runs identically anywhere. Use our infrastructure, your infrastructure, or both. Zero lock-in.

How is customer data protected?

Complete privacy control. Evidence payloads can be encrypted. Timelines store only hashes. Selective disclosure for audits. You control what's visible.

What if conditions are disputed?

Cryptographic proof settles everything. Every condition has verifiable evidence. Every decision has an immutable record. Disputes resolve instantly with proof.

Can we start with just one use case?

Absolutely. Most banks start with construction payments or simple escrow. Expand to other use cases as you gain confidence. Full control over rollout pace.

Ready to Transform Bank Transfers?

Turn your existing rails into the smart payment infrastructure your customers need.

Your customers want conditional payments. Your competitors are exploring this. Be the first to deliver.