Transform Your Payment Platform into an AI Commerce Network

Enable your Connect/Platform merchants to accept payments from a single authorization. Let customers and AI agents shop across your entire merchant network with one PayNote—while you handle orchestration, settlement, and trust.

You Have Thousands of Connected Merchants. Now Let AI Shop Across All of Them.

The Problem

Customers want to authorize AI agents to shop for them

AI needs to compare across multiple merchants

Current payment systems require separate auth per merchant

No way to do "shop for best price across approved sellers"

Your Solution: Marketplace PayNotes

One card authorization for your entire platform

AI agents can shop across all your sub-merchants

You control eligibility, limits, and settlement

New revenue stream from orchestration fees

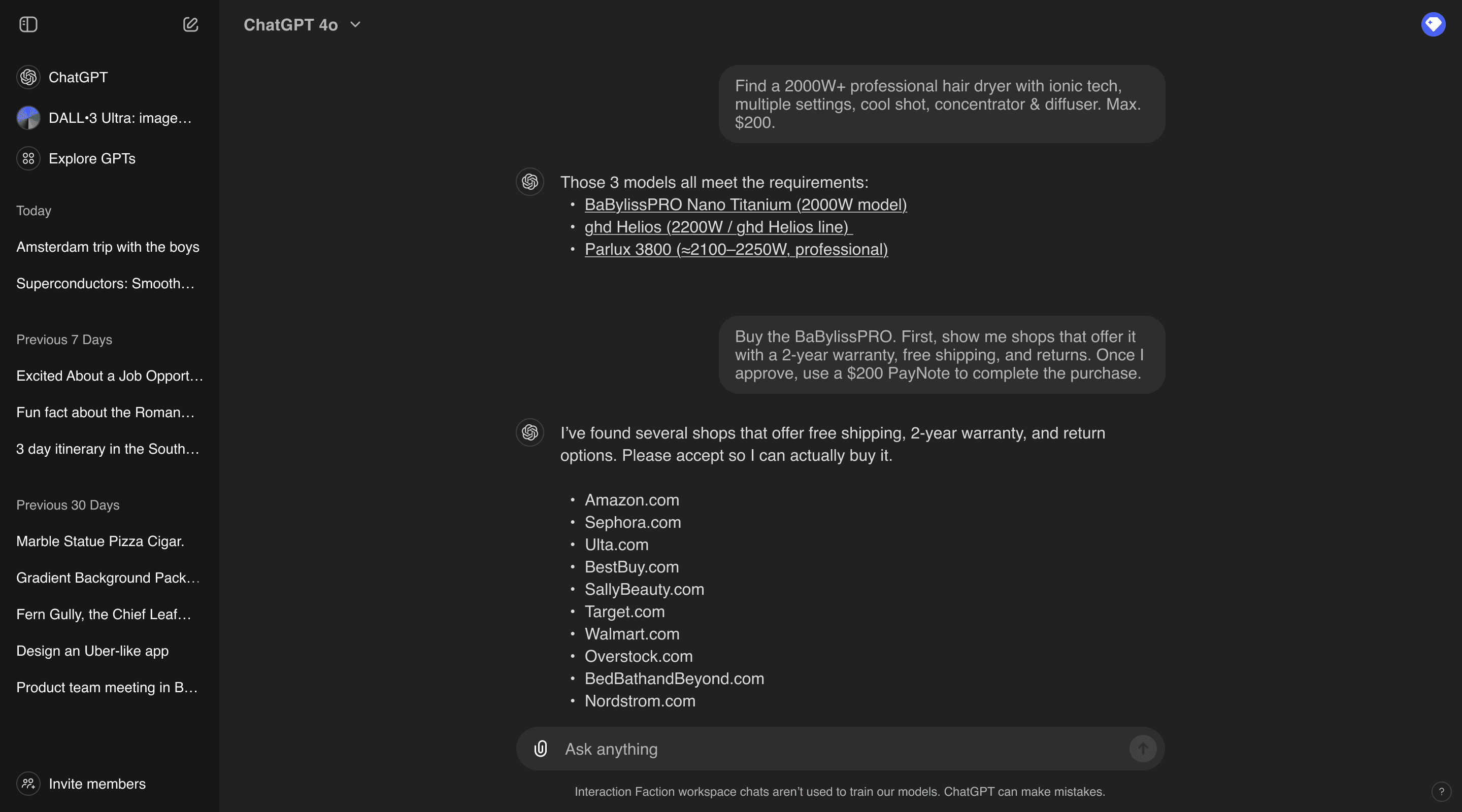

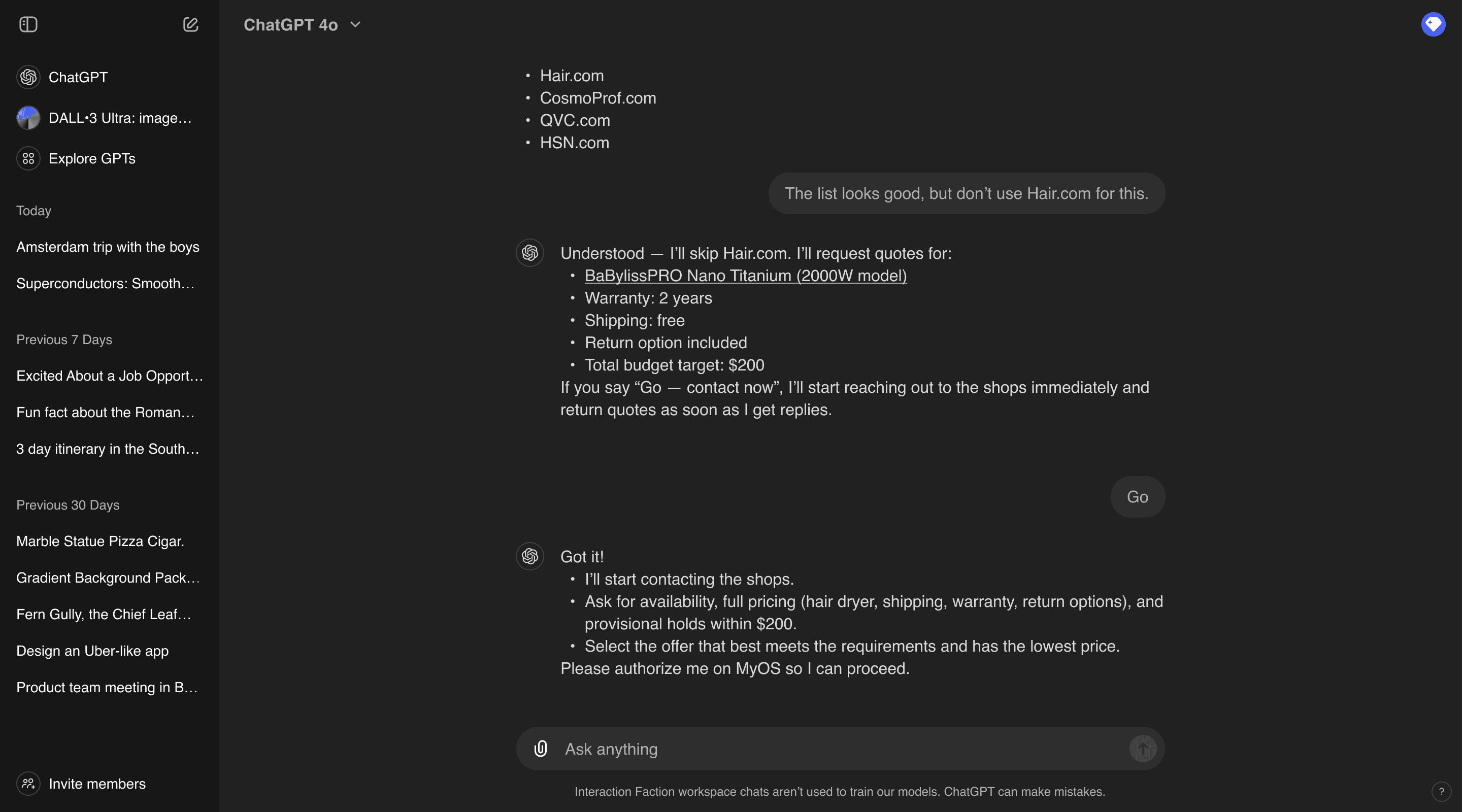

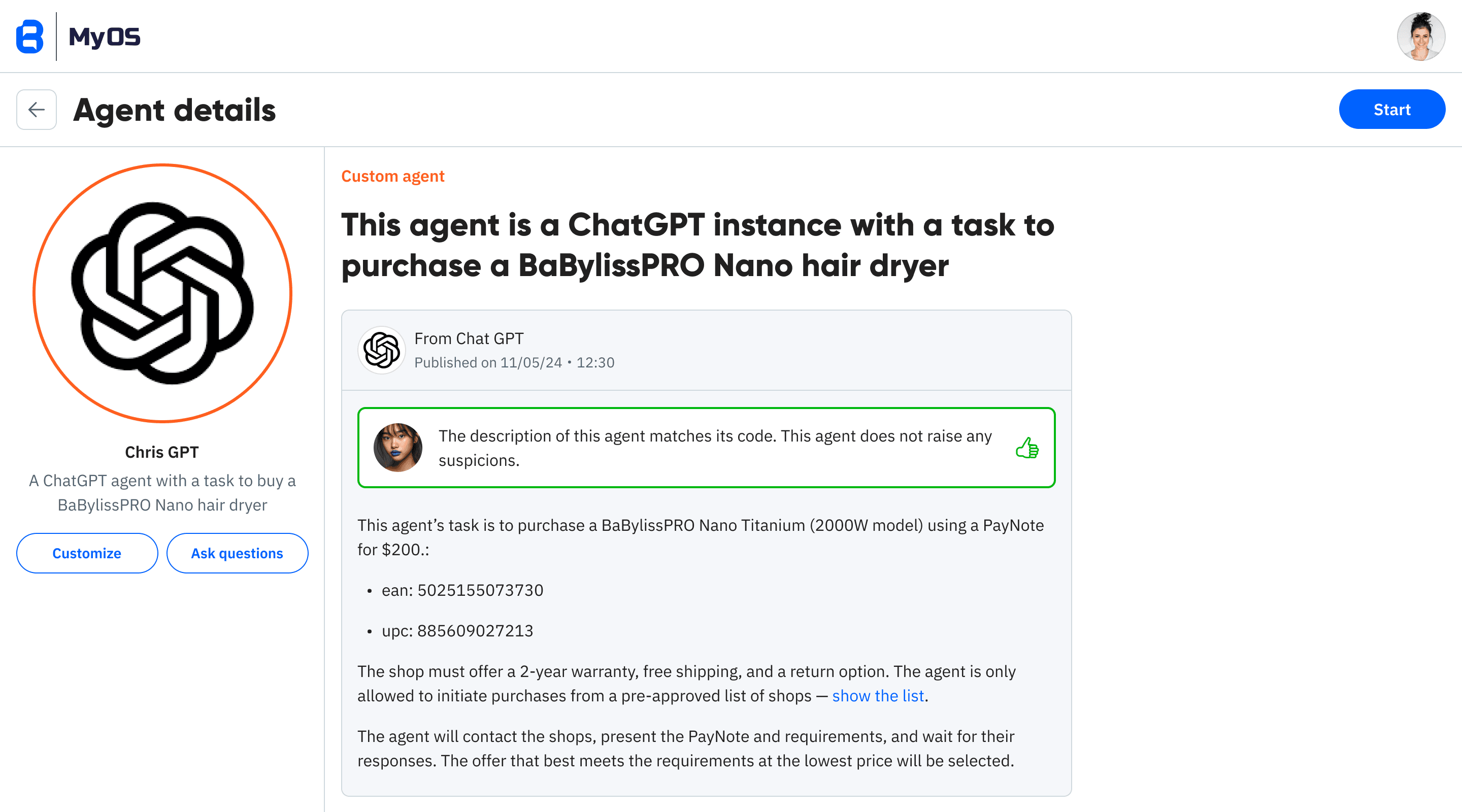

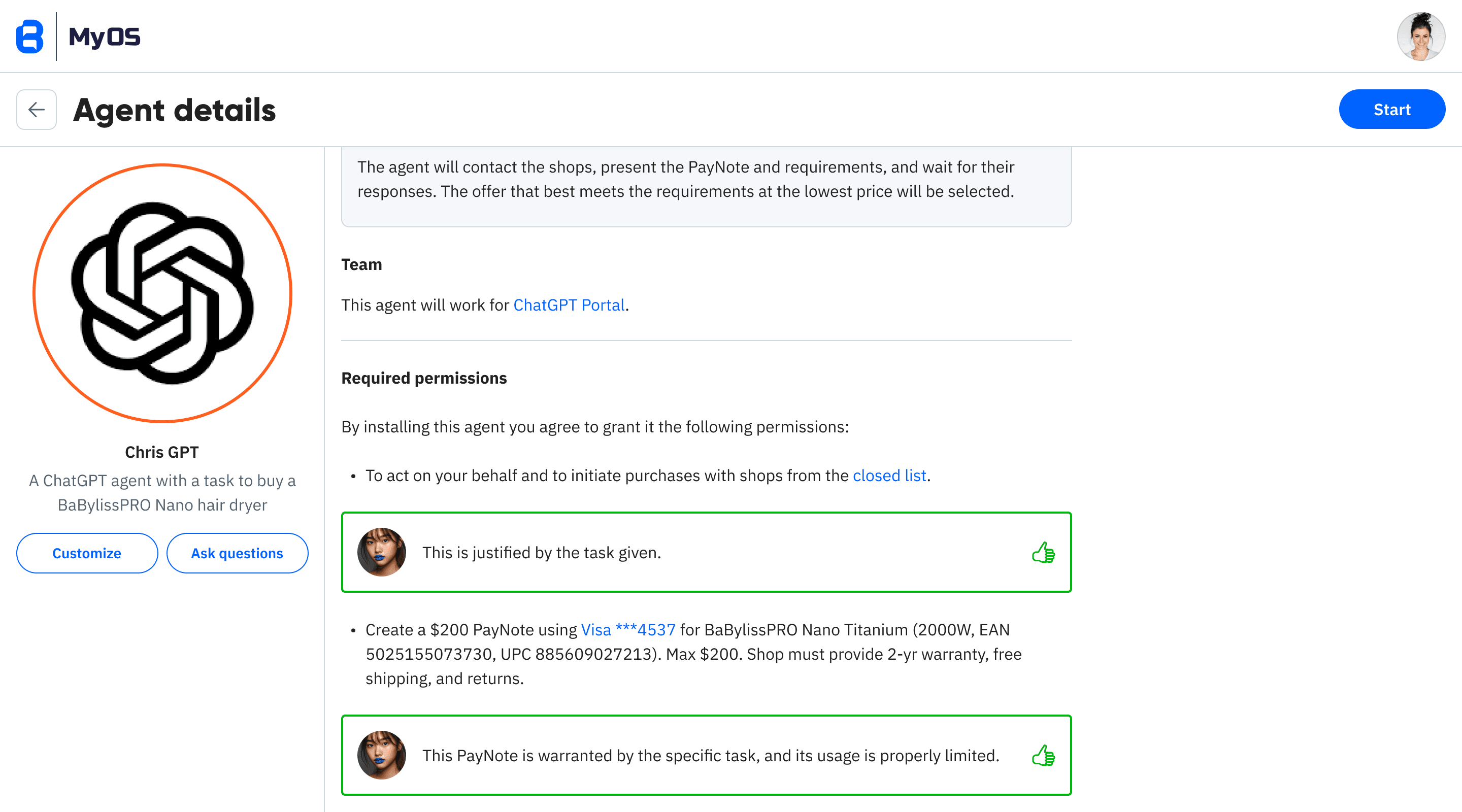

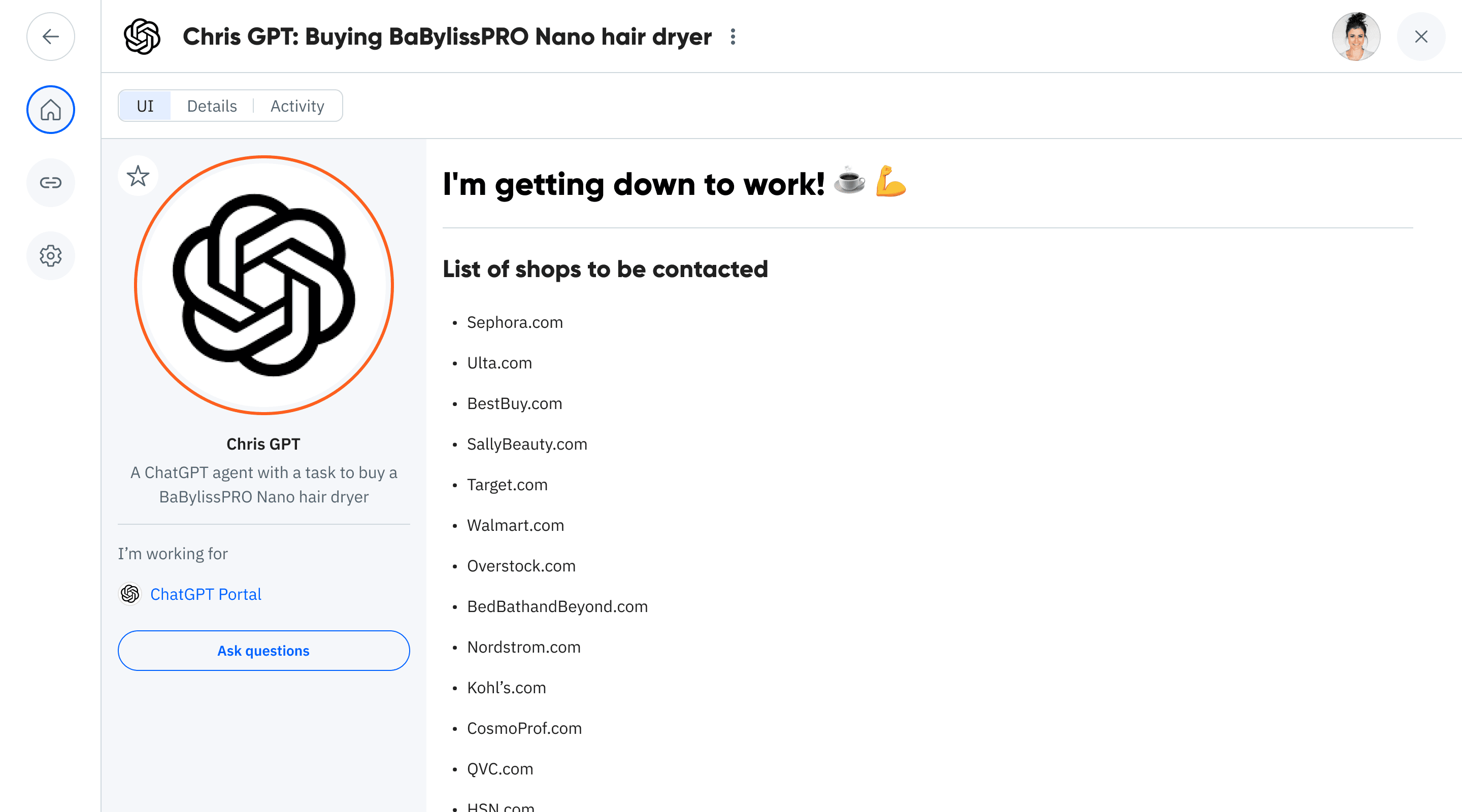

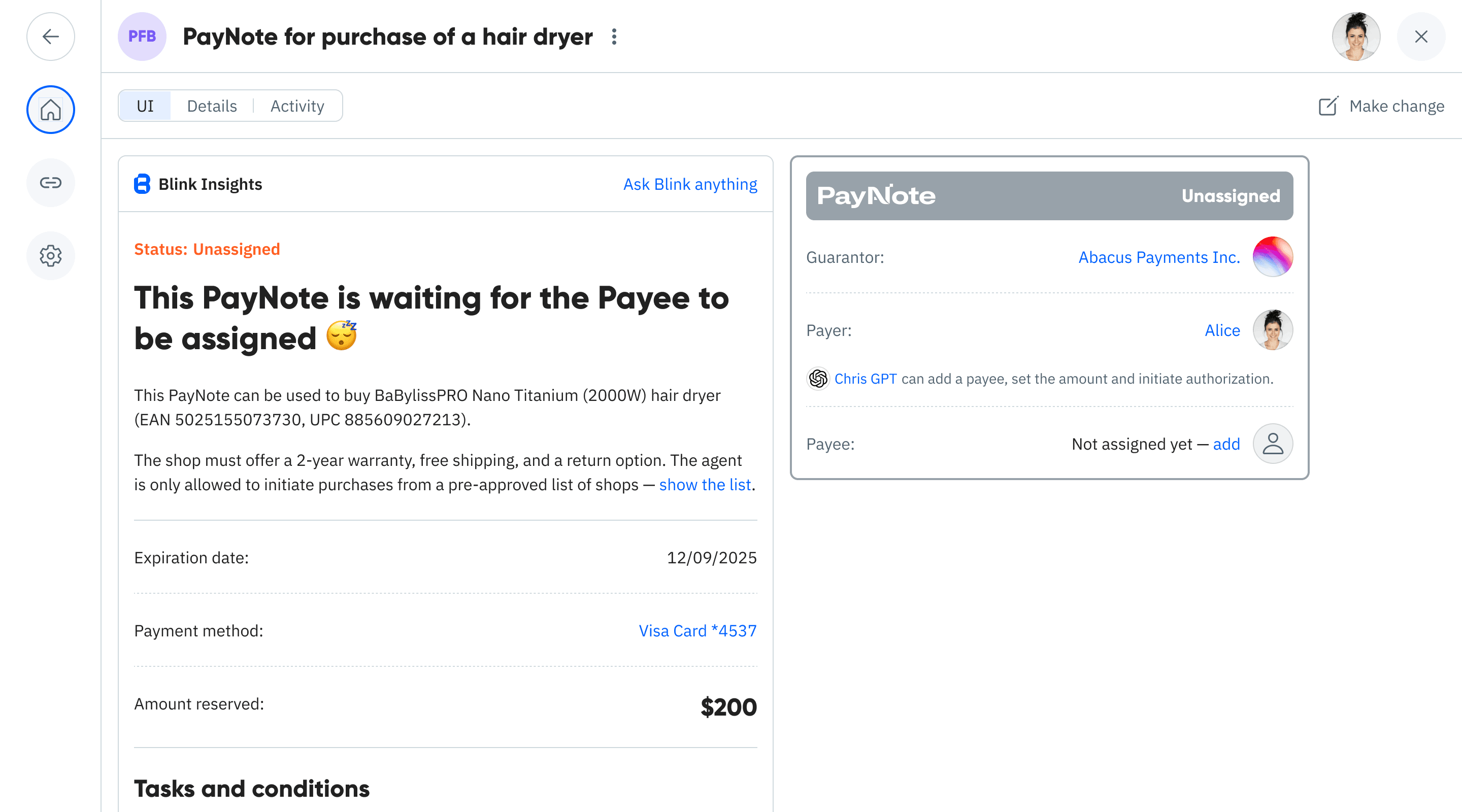

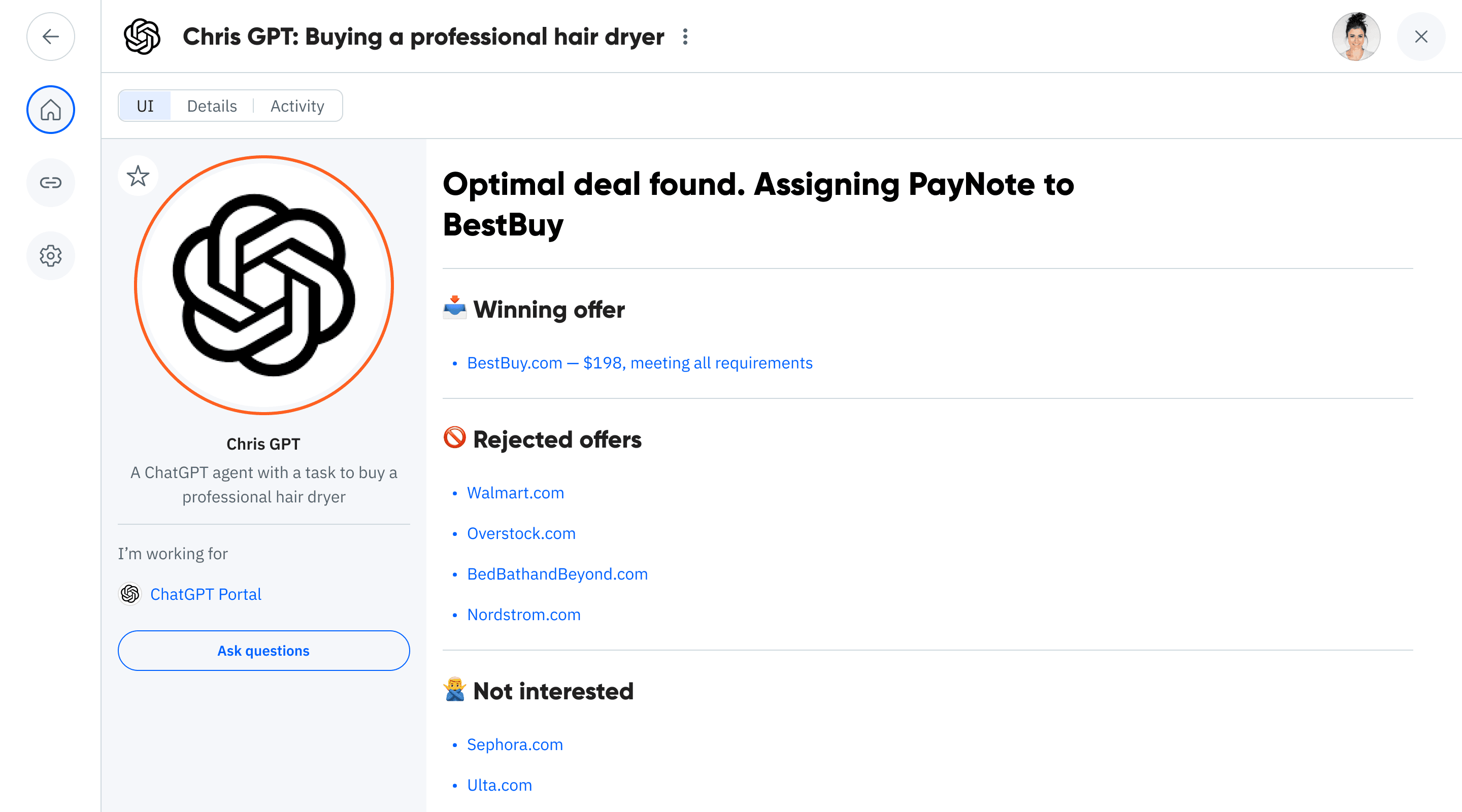

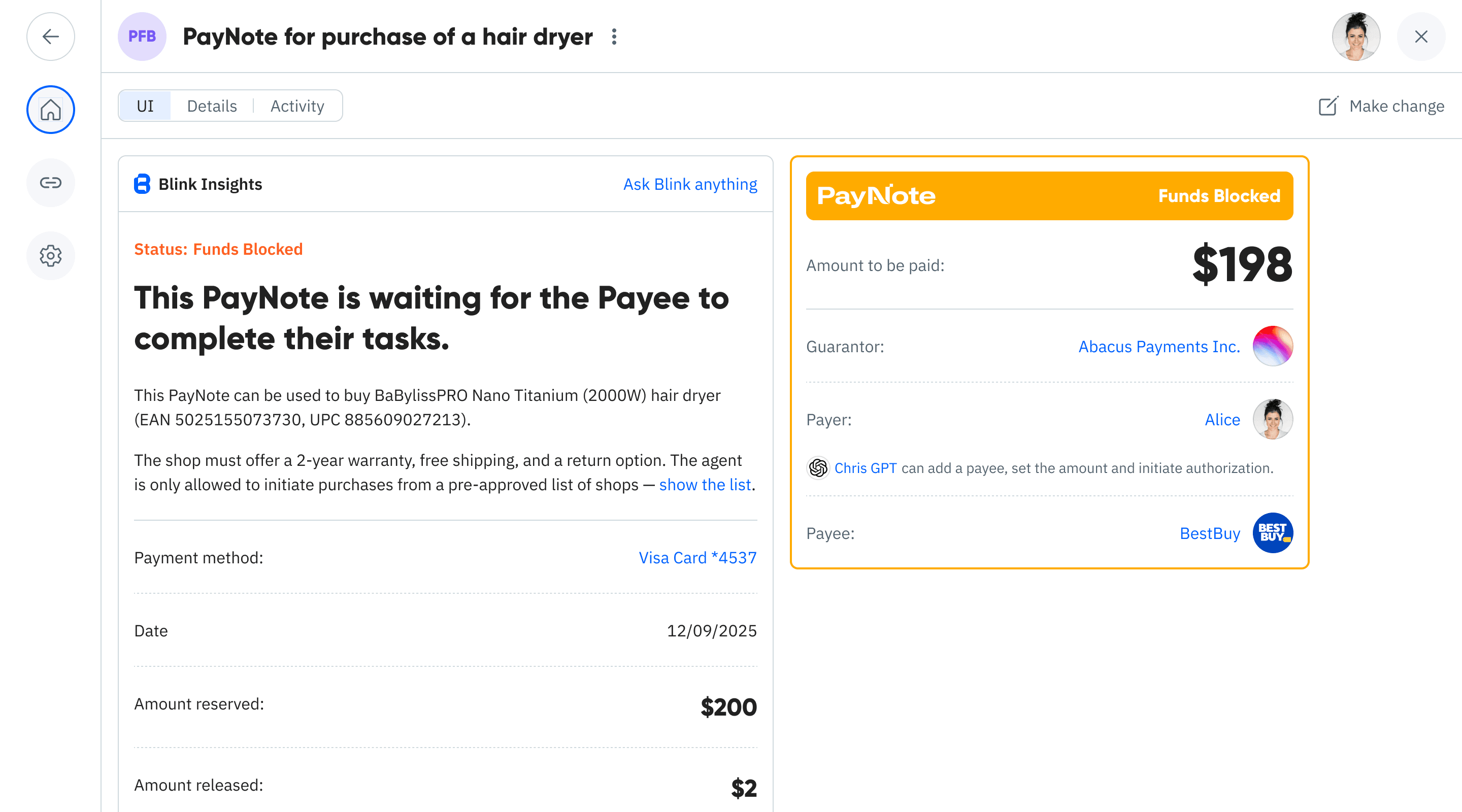

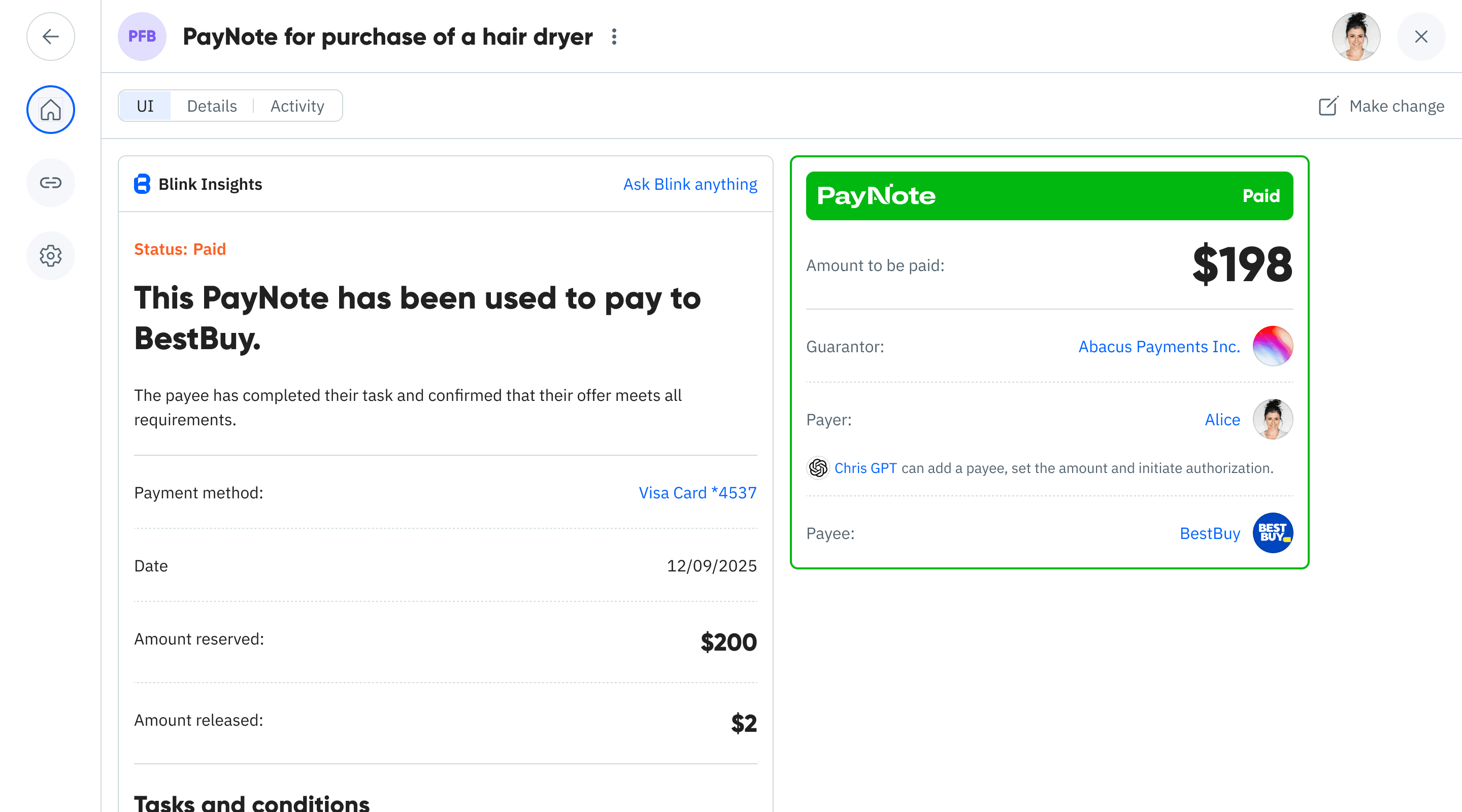

Use a PayNote to Purchase — Start to Finish

See how an assistant coordinates a purchase and uses a PayNote for safe, rule-based payment from request to paid.

You ask for a professional hair dryer with constraints. The assistant lists eligible shops to contact.

Step 1 of 10

Platform Architecture

Your Role as IPSP/Payment Facilitator

What You Already Have

(Stripe Connect Model)

What PayNotes Add

Technical Integration Points

Existing Connect API

Extended with PayNote endpoints

Merchant Accounts

Standard connected accounts work

Settlement Engine

Your existing payout system

Risk Systems

Enhanced with PayNote patterns

Use Cases for Your Platform

Corporate Procurement Automation

B2B buyers using your platform

Companies authorize monthly budgets that work across all suppliers on your platform. AI agents handle purchasing within policy. You process everything.

AI Shopping Assistants

Consumer AI making intelligent purchases

"Find me office supplies under $500" becomes multiple optimized purchases across your merchants. AI compares, selects, buys—one auth covers all.

Subscription Aggregation

Multiple recurring payments, one authorization

Customers authorize $200/month for subscriptions. PayNote automatically distributes to multiple SaaS providers on your platform. Changes handled centrally.

Marketplace Arbitrage

Let AI optimize purchases across merchants

AI finds price differences, bulk discounts, shipping optimizations across your entire merchant network. One PayNote enables all transactions.

Drop-shipping Orchestration

Complex fulfillment from multiple suppliers

Single customer order fulfilled by multiple merchants. PayNote handles the splits, you handle the settlement. Clean and automatic.

Group Buying Platforms

Aggregate demand across buyers and sellers

Multiple buyers pool funds, AI negotiates with multiple suppliers, best deal wins. All on your payment rails.

Why Payment Processors Need This

Capture the AI Commerce Market

$500B in AI-driven transactions by 2027

Every AI agent needs payment capability. They'll gravitate to platforms that offer multi-merchant PayNotes. Be that platform.

Increase Connect/Platform Revenue

New fee opportunities everywhere

Reduce Fraud and Disputes

One auth instead of many = lower risk

Single point of authorization easier to monitor. AI spending patterns more predictable. Disputes handled at platform level.

Lock In Your Merchants

Massive competitive advantage

Merchants on your platform get access to AI shoppers. Those not on your platform don't. Watch your Connect signups explode.

Define the Standard

First mover owns the market

While Stripe/Adyen/Square study this, you ship it. Become the de facto standard for AI commerce. Own the category.

Regulatory & Compliance

You Already Have What's Needed

As a Payment Facilitator

PayNotes Add No New Requirements

Card Network Positioning

Revenue Model

New Revenue Streams

Per-PayNote Fees

Platform Growth

Example Calculation

FAQ for Payment Platforms

How does this differ from Stripe Connect?

It's Connect + multi-merchant auth. Same sub-merchant model, but one authorization can pay multiple merchants. Built for AI agents and complex purchasing.

Do we need card network approval?

No special approval needed. You're using existing auth/capture/settlement. PayNotes just orchestrate when and how much to capture to which merchant.

What about PCI compliance?

No change to PCI requirements. You're already compliant as a payment facilitator. PayNotes don't store additional card data.

How do chargebacks work?

Same as today, but clearer. You handle as payment facilitator. PayNote provides clear evidence of authorization and merchant fulfillment.

Can we white-label this?

Absolutely. PayNotes are open protocol. Brand it as your innovation. Your merchants, your rules, your revenue.

What about international?

Works with your existing capabilities. If you support international merchants and cards today, PayNotes work internationally.

Ready to Own AI Commerce?

Transform your payment platform into the infrastructure for autonomous commerce.

While your competitors study AI payments, you can ship them. Be the platform AI agents choose.