Make Card Payments Transparent and Conditional

Transform simple card transactions into shared agreements where customer, merchant, and card processor all understand the rules. Eliminate chargebacks, connect payments to real-world events, and build trust through transparency.

Three Parties, One Shared Truth

Traditional card payments are opaque—customers don't know the merchant's fulfillment rules, merchants don't know the processor's risk models, and processors don't know the real transaction context. Card Payment PayNotes make everything transparent.

Customer

✓ Sees exactly what they're paying for

✓ Knows when payment will be captured

✓ Understands refund conditions

✓ Can track fulfillment progress

Merchant

✓ Sets clear fulfillment terms

✓ Knows payment is guaranteed

✓ Reduces chargeback risk

✓ Automates capture timing

Card Processor

✓ Understands transaction context

✓ Validates fulfillment evidence

✓ Provides trust and guarantee

✓ Reduces dispute resolution costs

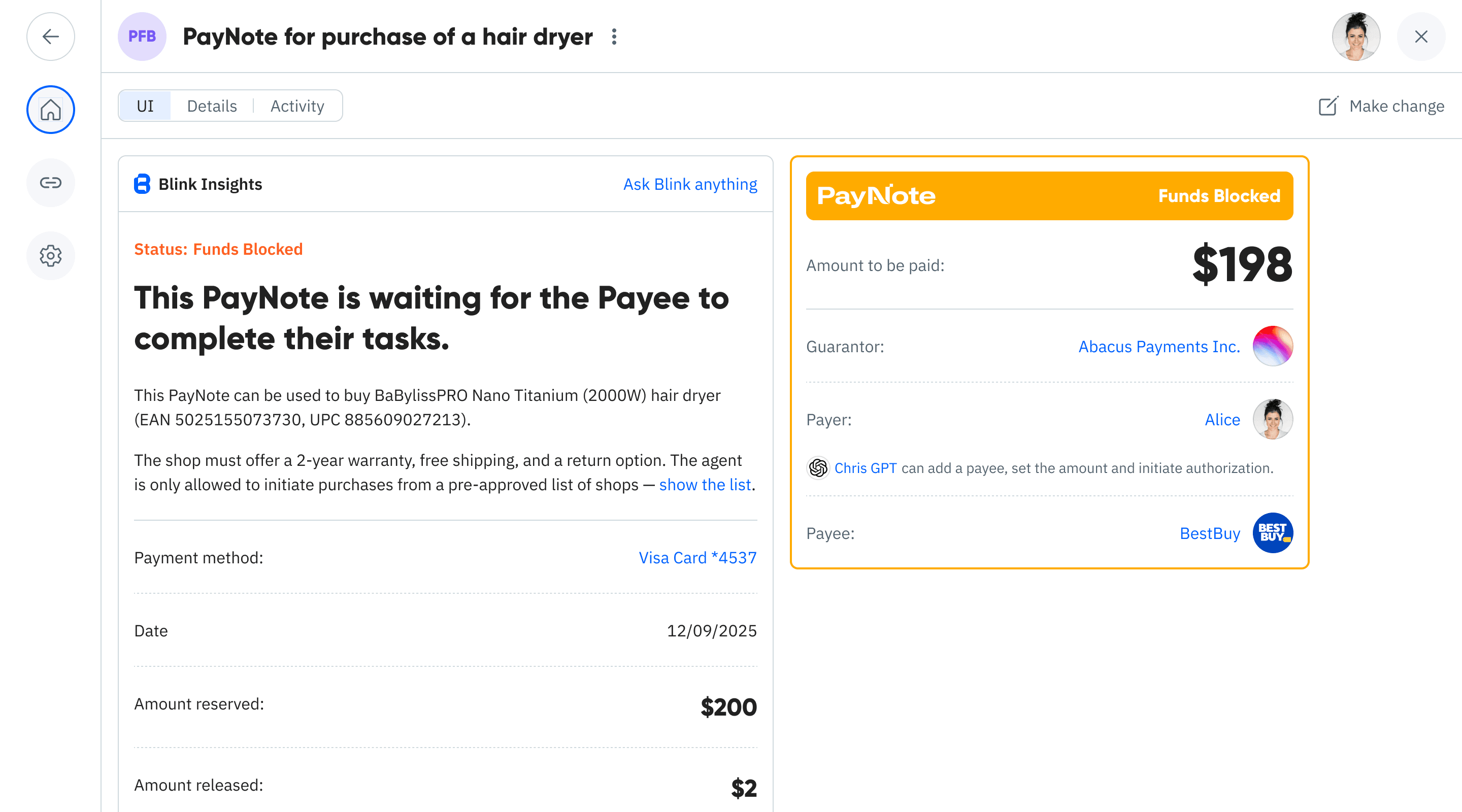

From Authorization to Fulfillment

See how a Card Payment PayNote creates transparency and trust between customer, merchant, and card processor throughout the entire transaction lifecycle.

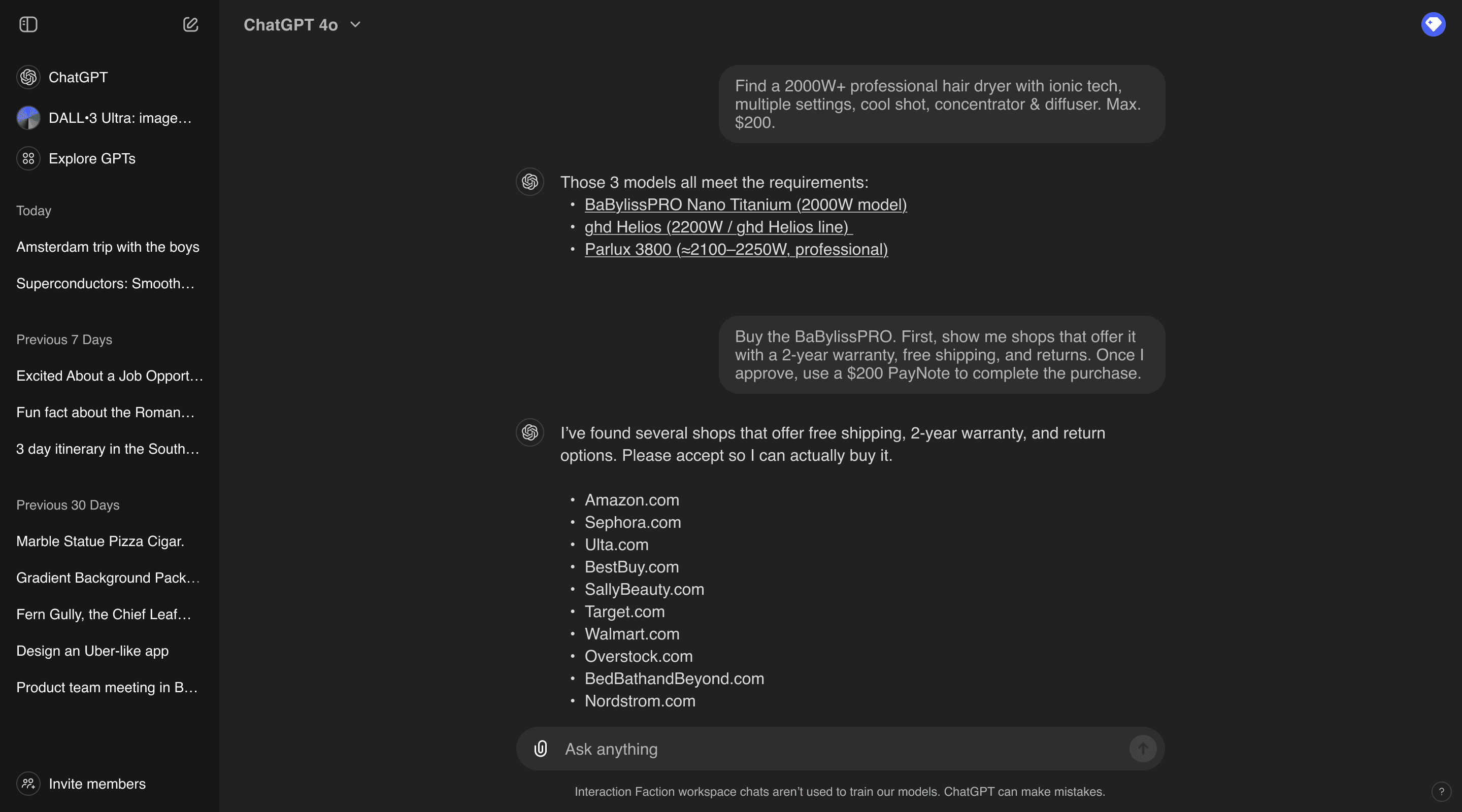

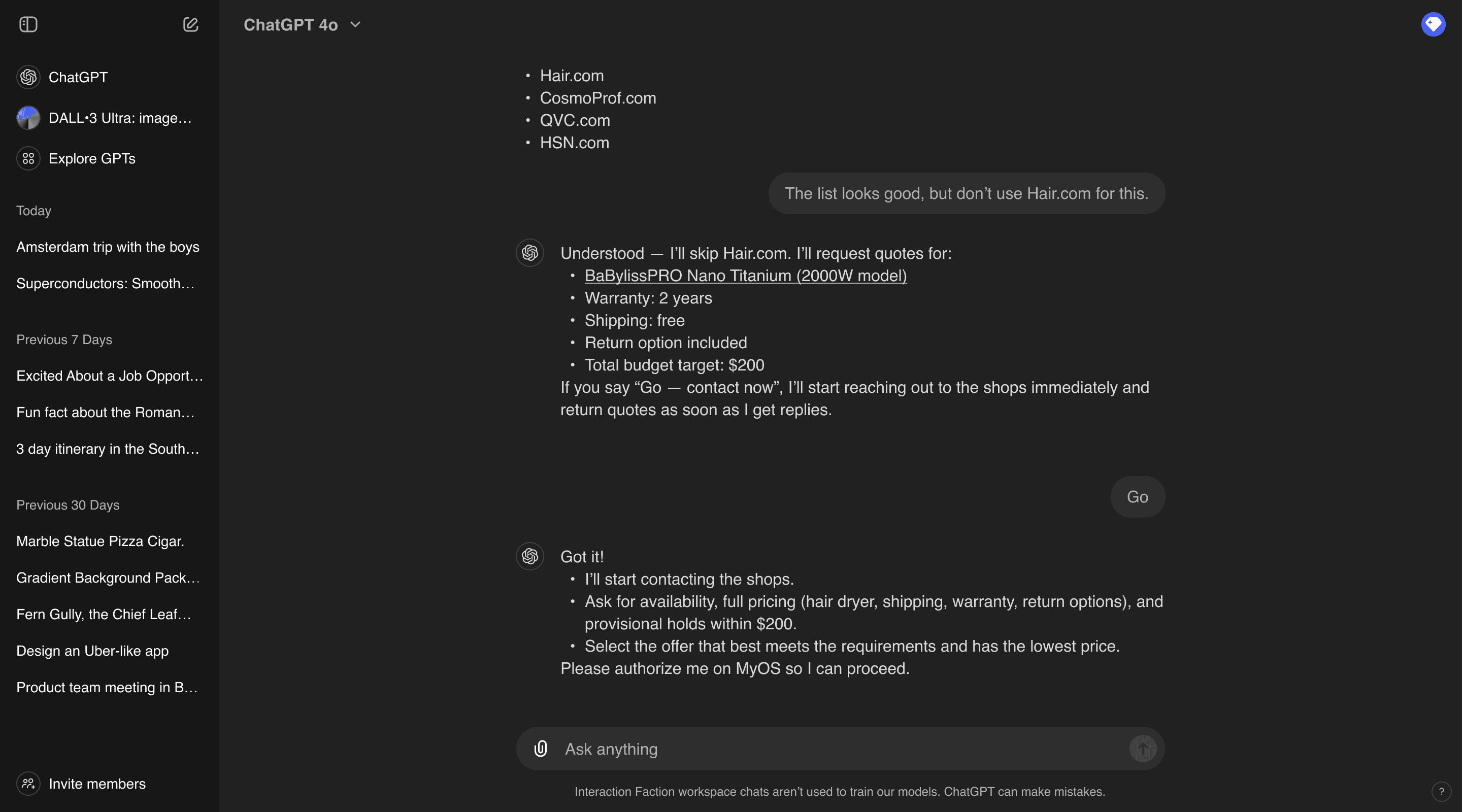

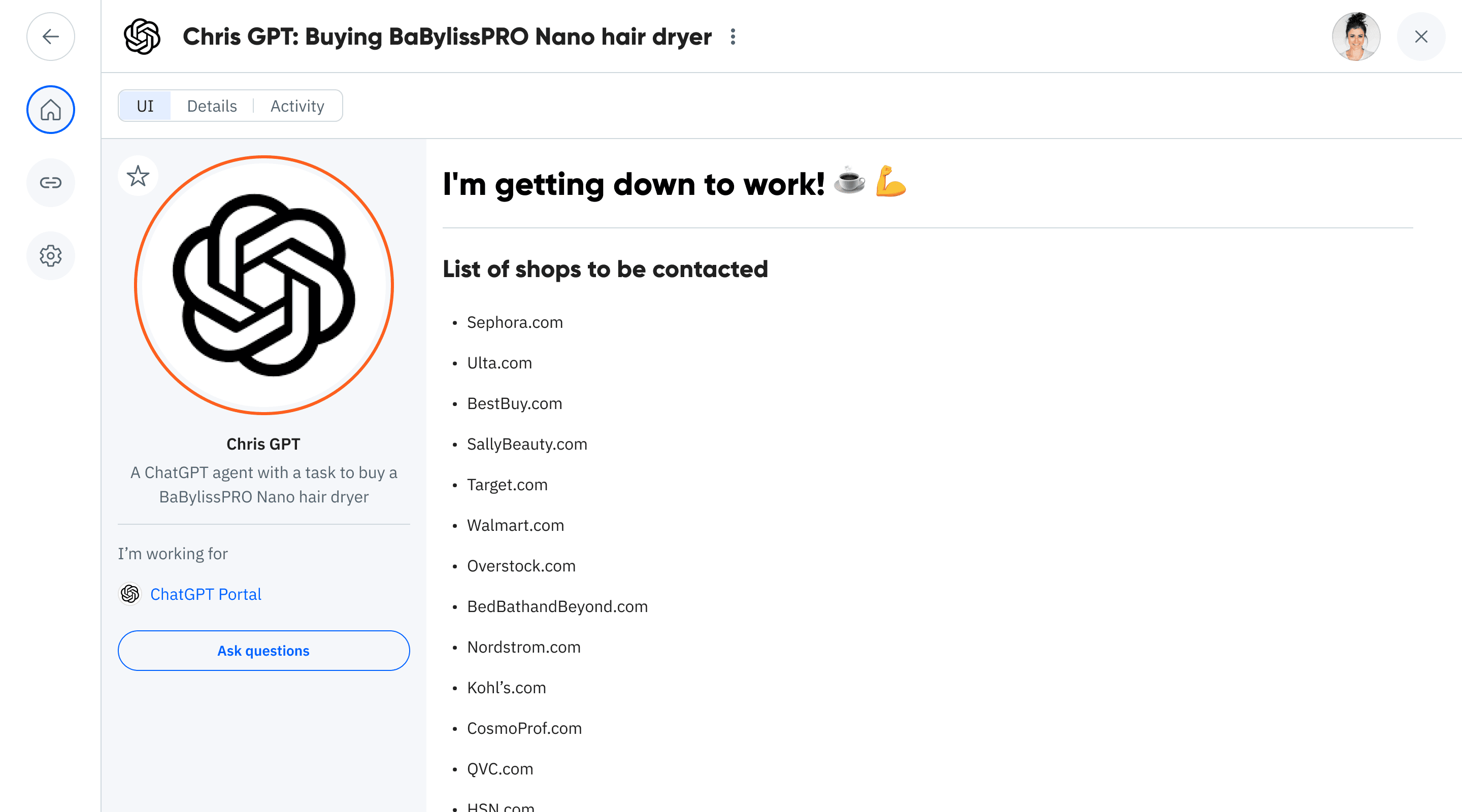

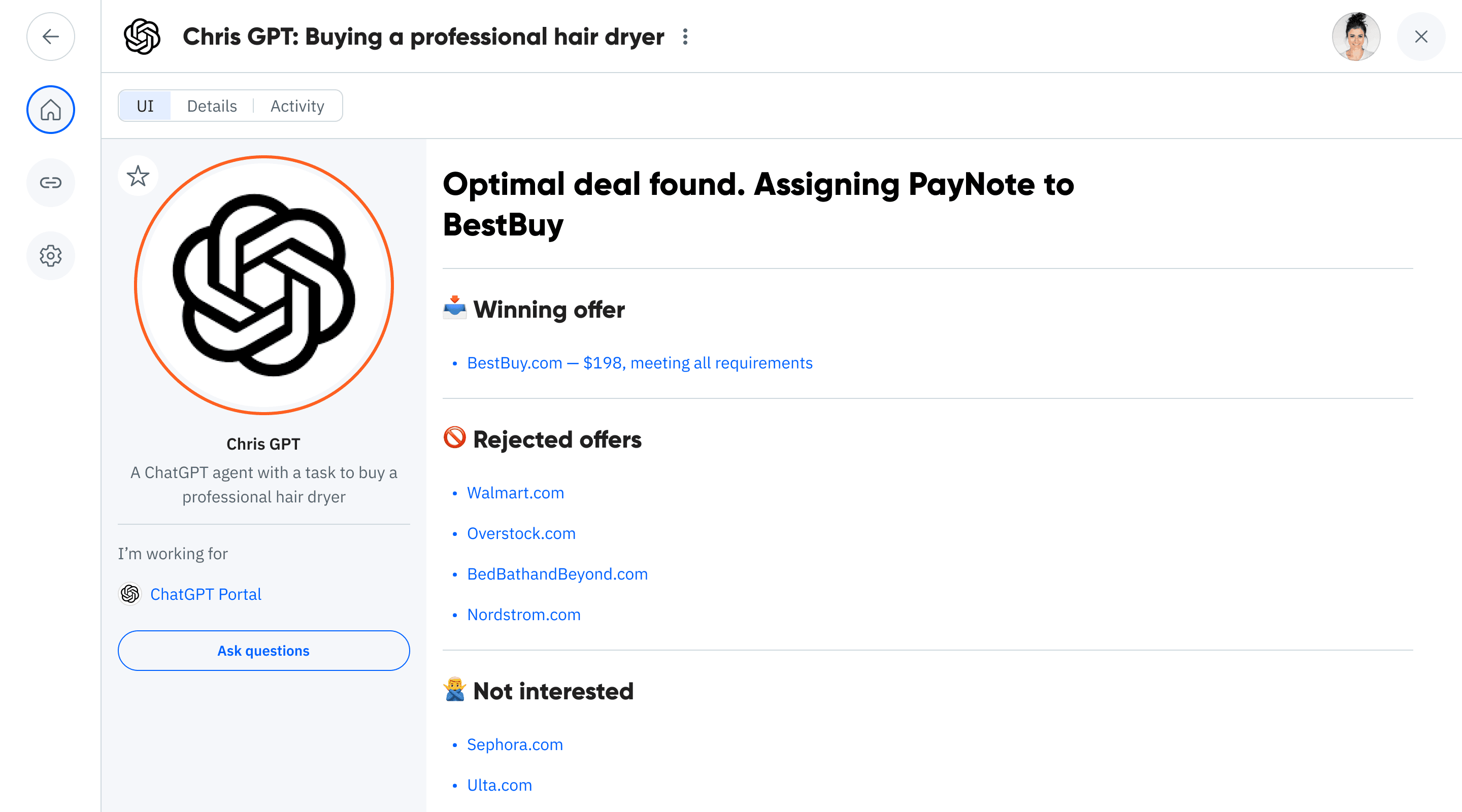

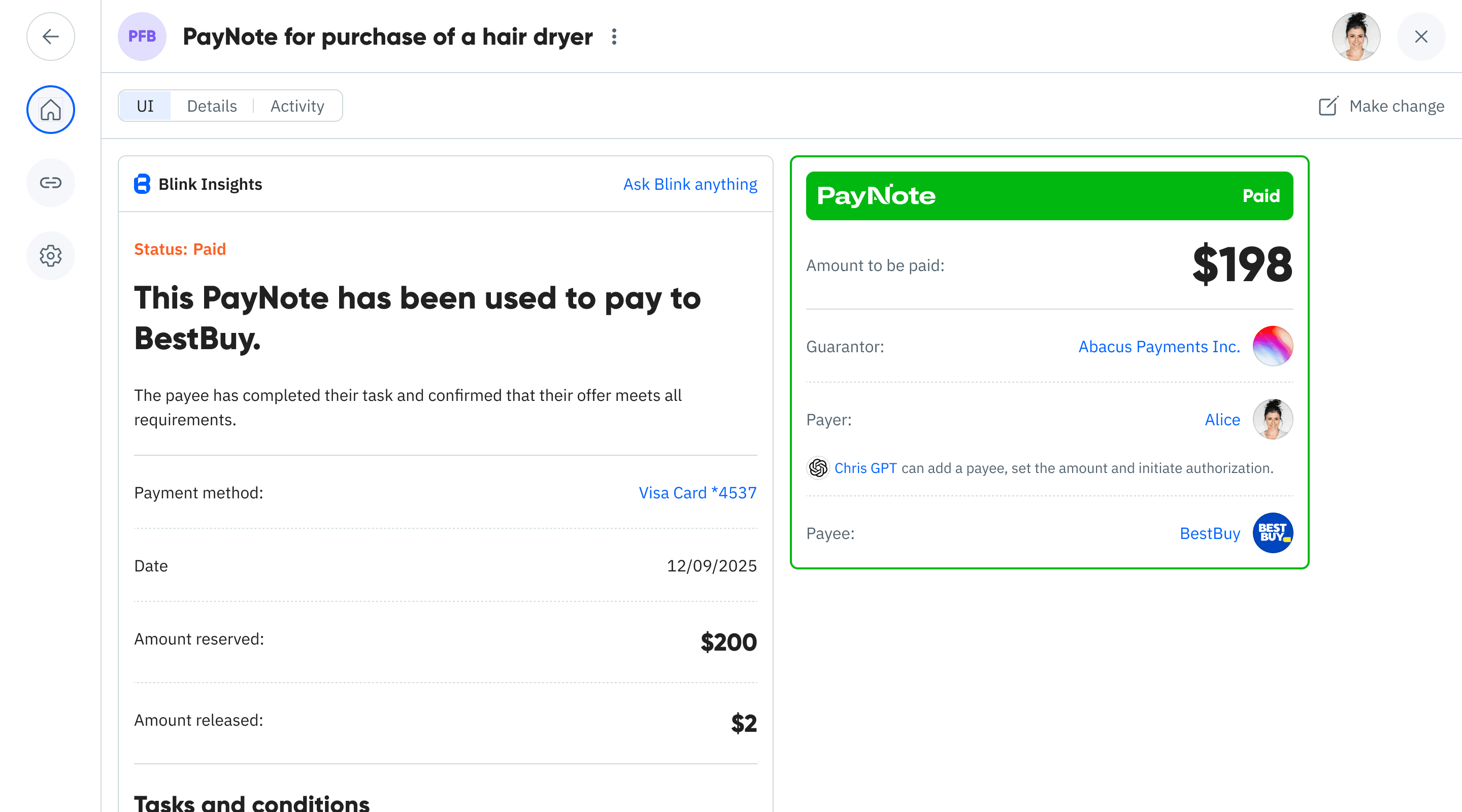

You ask for a professional hair dryer with constraints. The assistant lists eligible shops to contact.

Step 1 of 10

Connect Card Payments to Real-World Events

Shipment Delivered

E-commerce with delivery guarantee

Customer authorizes payment, merchant ships, card processor captures only when delivery is confirmed. No more "where's my package?" disputes.

Lakers Won

Sports betting with event verification

Customer bets on Lakers victory, card processor holds funds, payment captures automatically when official game result is verified. Transparent and instant.

HTLC Password Provided

Crypto-to-fiat bridge payments

Customer buys Bitcoin with card, payment captures when BTC seller provides valid HTLC password. Atomic swaps with traditional payment rails.

Service Completion

Professional services with milestone verification

Customer pays for consulting, card processor captures when deliverables are confirmed complete. Both parties protected throughout the engagement.

Preorder Fulfillment

Product launches with guaranteed delivery

Customer preorders new product, payment captures only when item ships. Merchant gets guaranteed payment, customer gets delivery assurance.

Quality Verification

High-value items with inspection requirements

Customer buys expensive equipment, payment captures after third-party inspection confirms quality and specifications. Trust through verification.

Why This Eliminates Chargebacks

Traditional Card Payments

Customer doesn't know merchant's fulfillment process

Merchant doesn't know customer's expectations

Processor only sees "charge $X to card"

Disputes arise from misaligned expectations

Resolution requires manual investigation

Card Payment PayNotes

All parties see the same payment rules

Customer explicitly agrees to conditions

Processor understands transaction context

Evidence is cryptographically verifiable

Disputes resolve instantly with proof

The Result: Trust Through Transparency

When everyone understands the rules and can verify compliance, disputes disappear. The card processor becomes a trusted partner in the transaction, not just a payment rail.

Benefits for Merchants

Chargeback Protection

Drastically reduce disputes

When customers explicitly agree to payment conditions and fulfillment terms, chargebacks become nearly impossible. Clear evidence protects merchants.

Automated Capture

Perfect timing, every time

No more manual capture decisions. Payment automatically captures when your fulfillment conditions are met. Optimize cash flow without risk.

Higher Conversion

Customers trust transparent payments

When customers can see exactly what they're agreeing to and track fulfillment progress, they're more likely to complete purchases and return.

Flexible Terms

Customize payment conditions per product

Different products need different payment terms. Digital goods capture instantly, physical goods on delivery, services on completion.

Full Transparency

Customer and processor see everything

No hidden terms, no surprise captures. Every step is visible to all parties. Build trust through radical transparency.

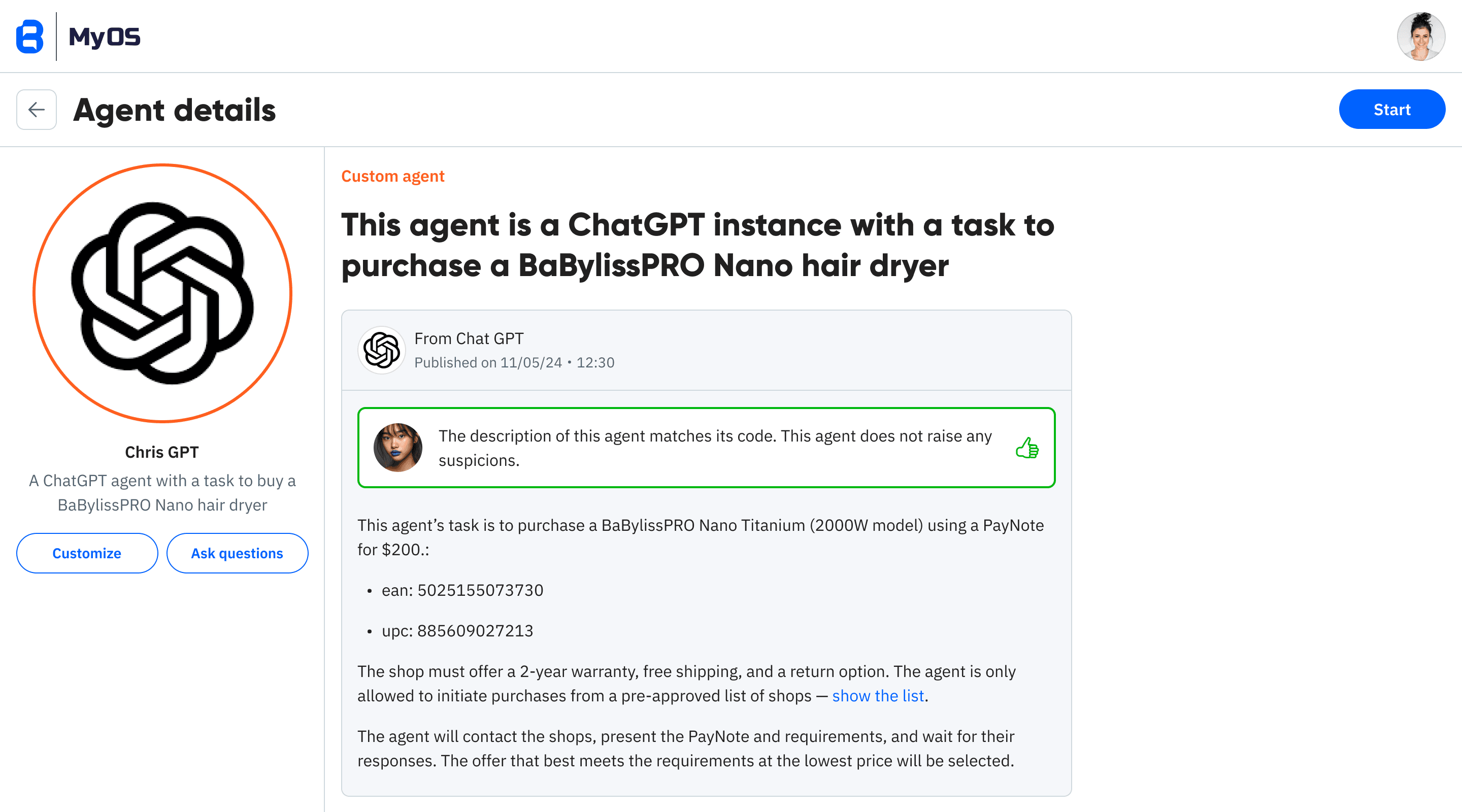

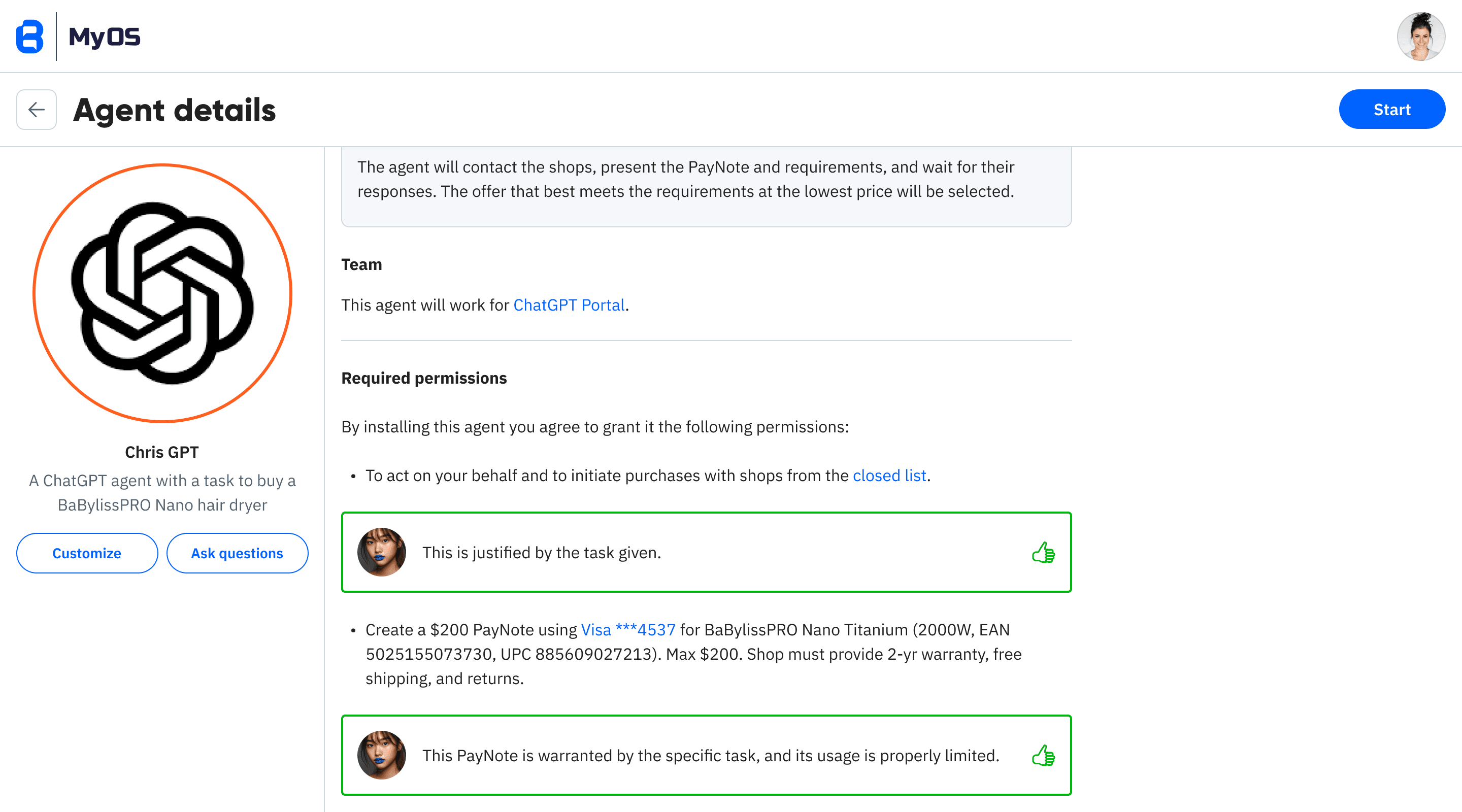

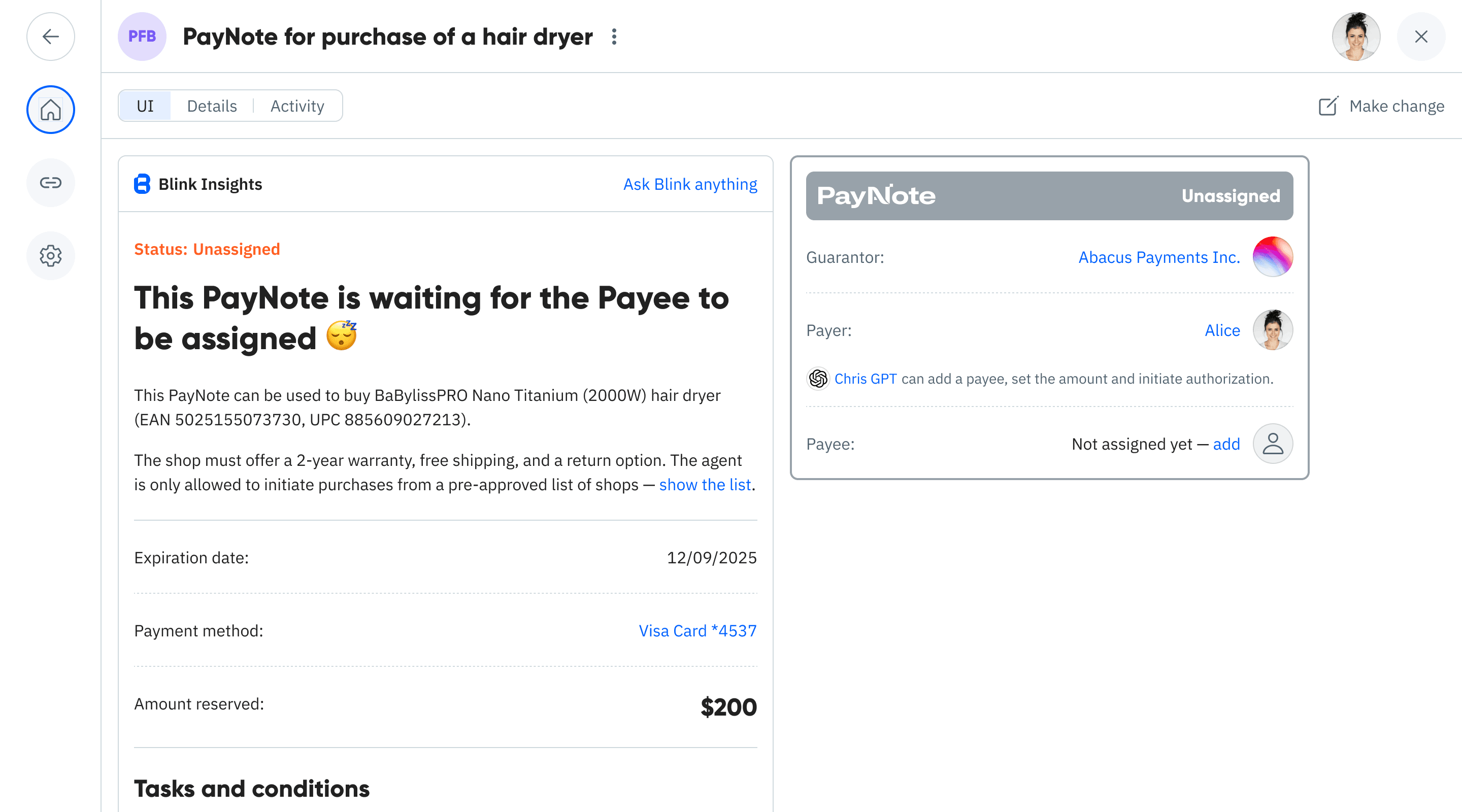

AI Integration

Perfect for AI-driven commerce

AI agents can create and manage PayNotes within defined boundaries. Automated purchasing with human-level trust and verification.

Benefits for Card Processors

Reduce Dispute Costs

80-90% reduction in chargeback volume

When all parties understand and agree to the same terms, disputes become rare. Clear evidence makes resolution instant when they do occur.

Enhanced Risk Management

Better context for every transaction

Understanding what customers are actually buying and when payment should capture helps identify legitimate vs fraudulent transactions.

New Revenue Opportunities

Premium services for conditional payments

Charge premium fees for PayNote processing, evidence validation, and dispute prevention. Merchants pay more for better protection.

Merchant Satisfaction

Happier merchants, better retention

Merchants love reduced chargebacks and automated capture timing. Higher satisfaction leads to better retention and more referrals.

Implementation for Card Processors

What Doesn't Change

What PayNotes Add

FAQ for Card Processors

Do we need card network approval?

No special approval needed. PayNotes use standard auth/capture flows. You're just adding conditional logic to when capture occurs.

How do we validate evidence?

Through webhooks and APIs. Shipping confirmations, service completions, and other evidence arrive as verifiable events that trigger capture.

What about authorization timeouts?

PayNotes handle auth extensions automatically. If fulfillment takes longer than standard auth window, the PayNote manages re-authorization.

Can customers still dispute?

Yes, but disputes resolve faster with clear evidence. PayNotes provide cryptographic proof of agreement and fulfillment for instant resolution.

How do we price this service?

Premium pricing for premium service. Charge 50-100% more for PayNote processing. Merchants gladly pay for chargeback protection.

What about international transactions?

PayNotes work with any card network globally. Same transparency benefits apply whether domestic or cross-border transactions.

Ready to Transform Card Payments?

Turn every card transaction into a transparent, conditional agreement.

Eliminate chargebacks, increase merchant satisfaction, and create new revenue streams.