Guaranteed Instant Payouts with Fund Blocking

Transform push-to-card payouts into guaranteed agreements where merchant, recipient, and card processor all understand the terms. Block funds upfront, execute payouts instantly via Visa Direct and Mastercard Send.

Guaranteed Payouts Through Fund Blocking

Traditional push-to-card payouts can fail due to insufficient funds or card issues. Push-to-Card PayNotes solve this by blocking merchant funds upfront, creating a three-party agreement that guarantees successful payouts.

Merchant

✓ Commits funds upfront for payout

✓ Sets clear payout conditions

✓ Knows payout will succeed

✓ Tracks payout status in real-time

Recipient

✓ Guaranteed to receive funds

✓ Knows exact payout conditions

✓ Receives instant notifications

✓ Can verify fund blocking

Card Processor

✓ Blocks funds to guarantee payout

✓ Validates payout conditions

✓ Executes via Visa Direct/MC Send

✓ Provides trust and guarantee

From Fund Block to Instant Payout

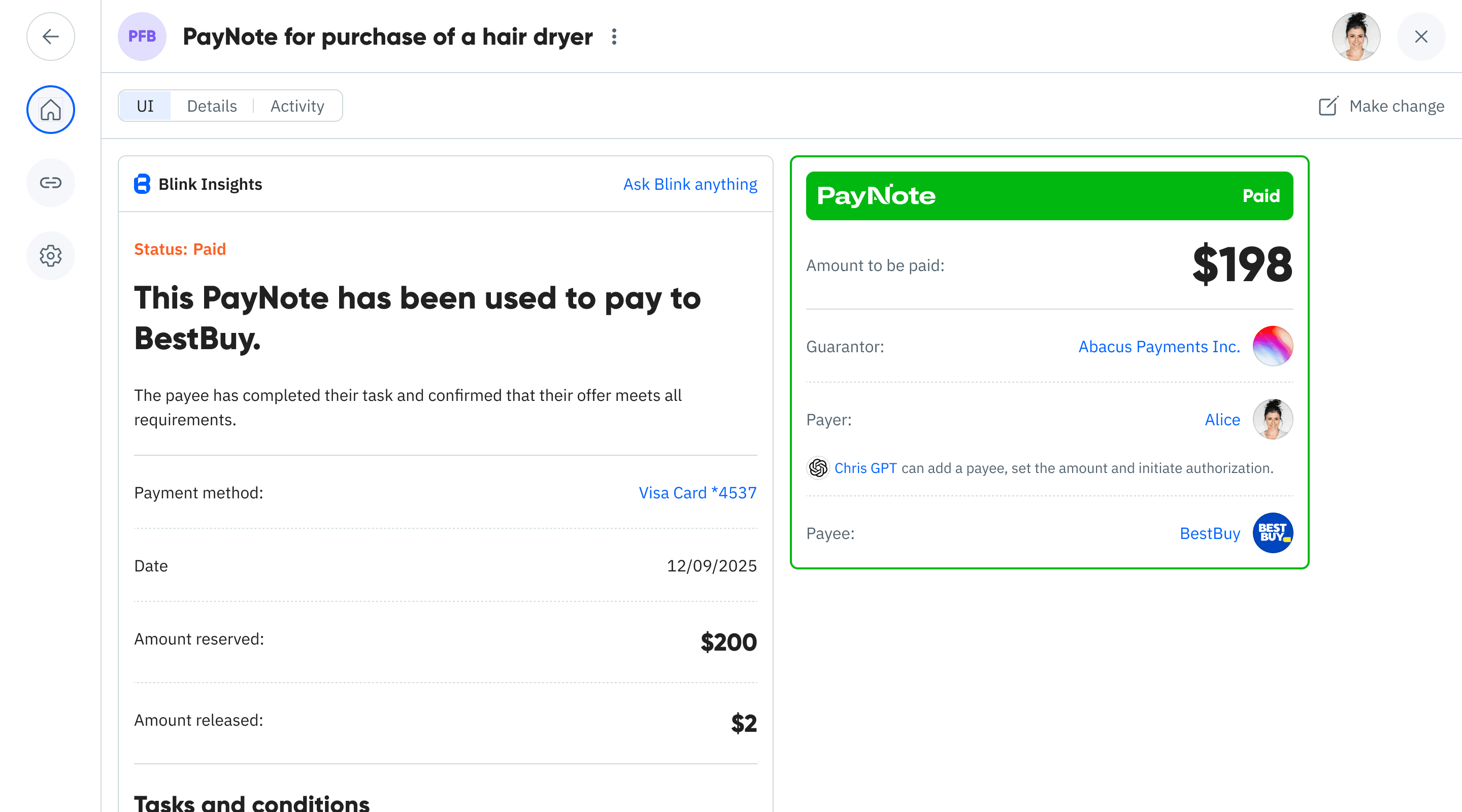

See how a Push-to-Card PayNote blocks merchant funds upfront and executes guaranteed payouts when conditions are met, creating transparency and trust for all parties.

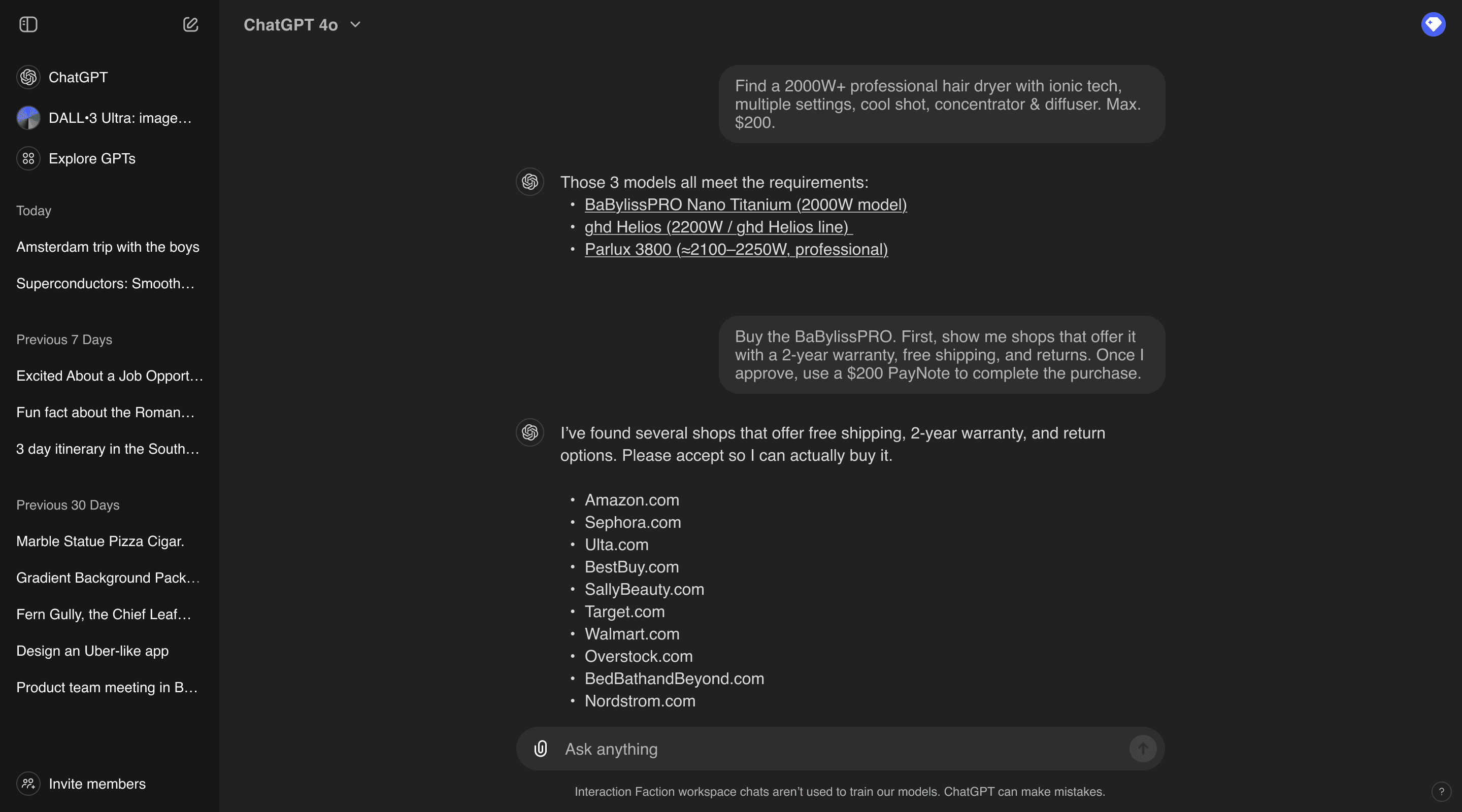

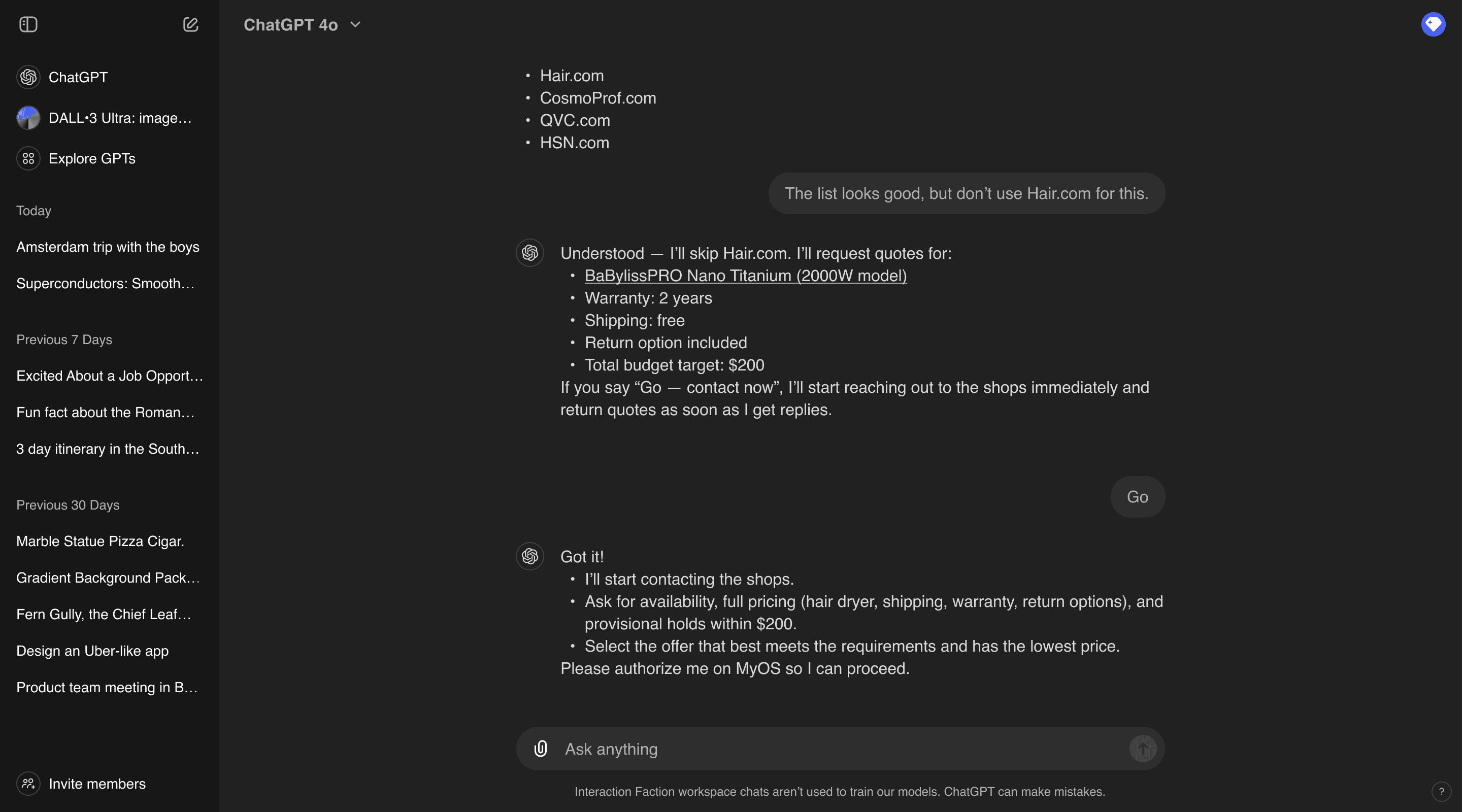

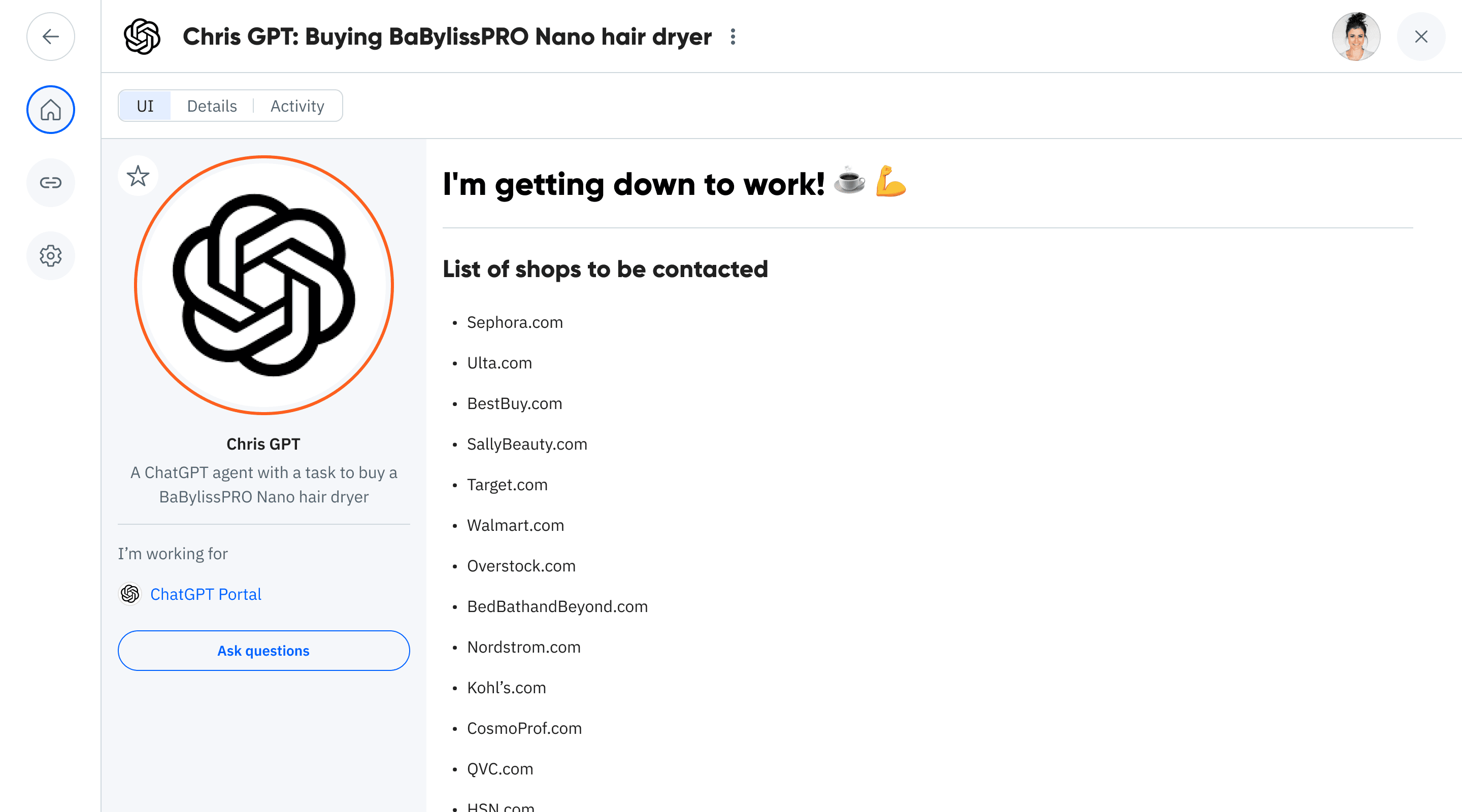

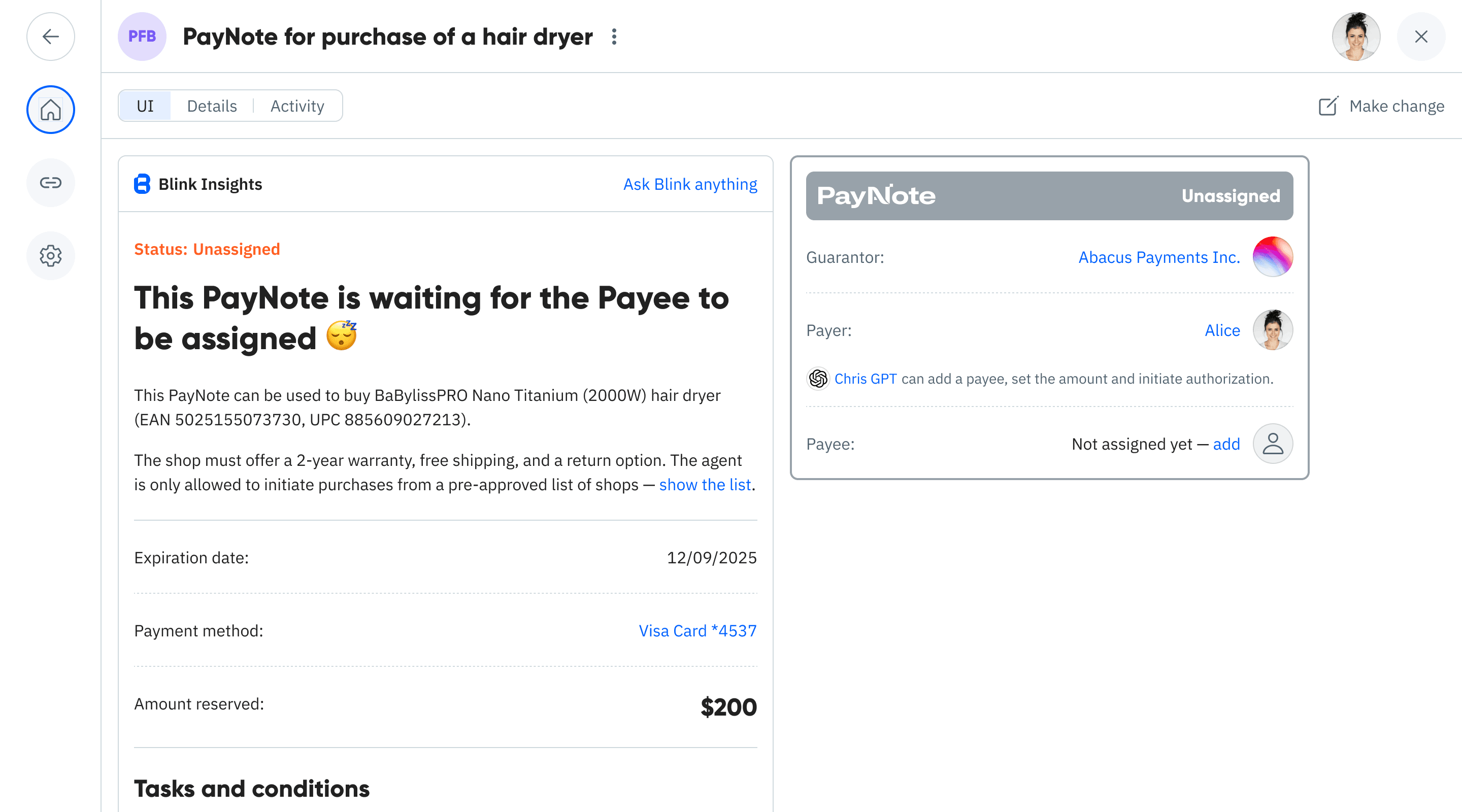

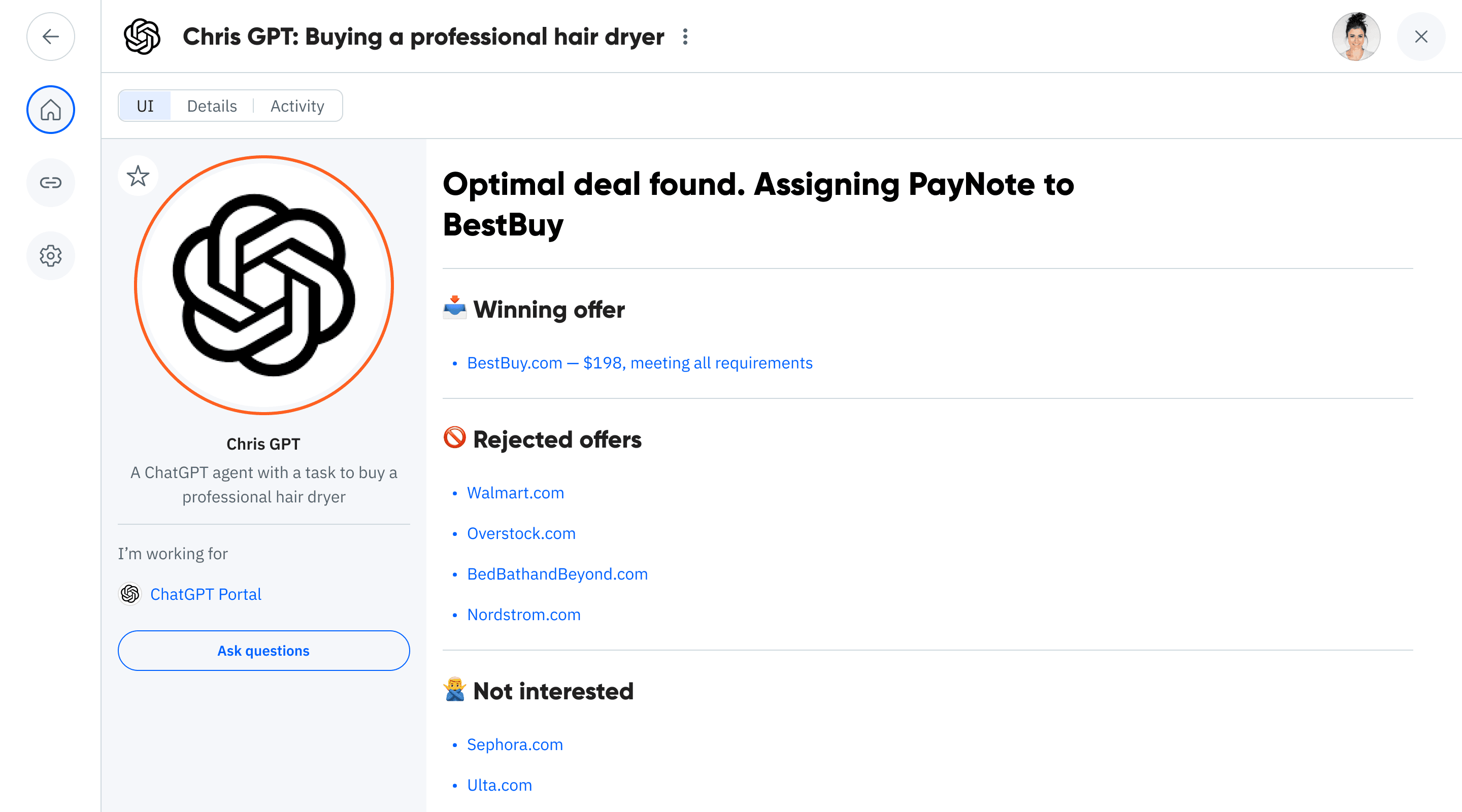

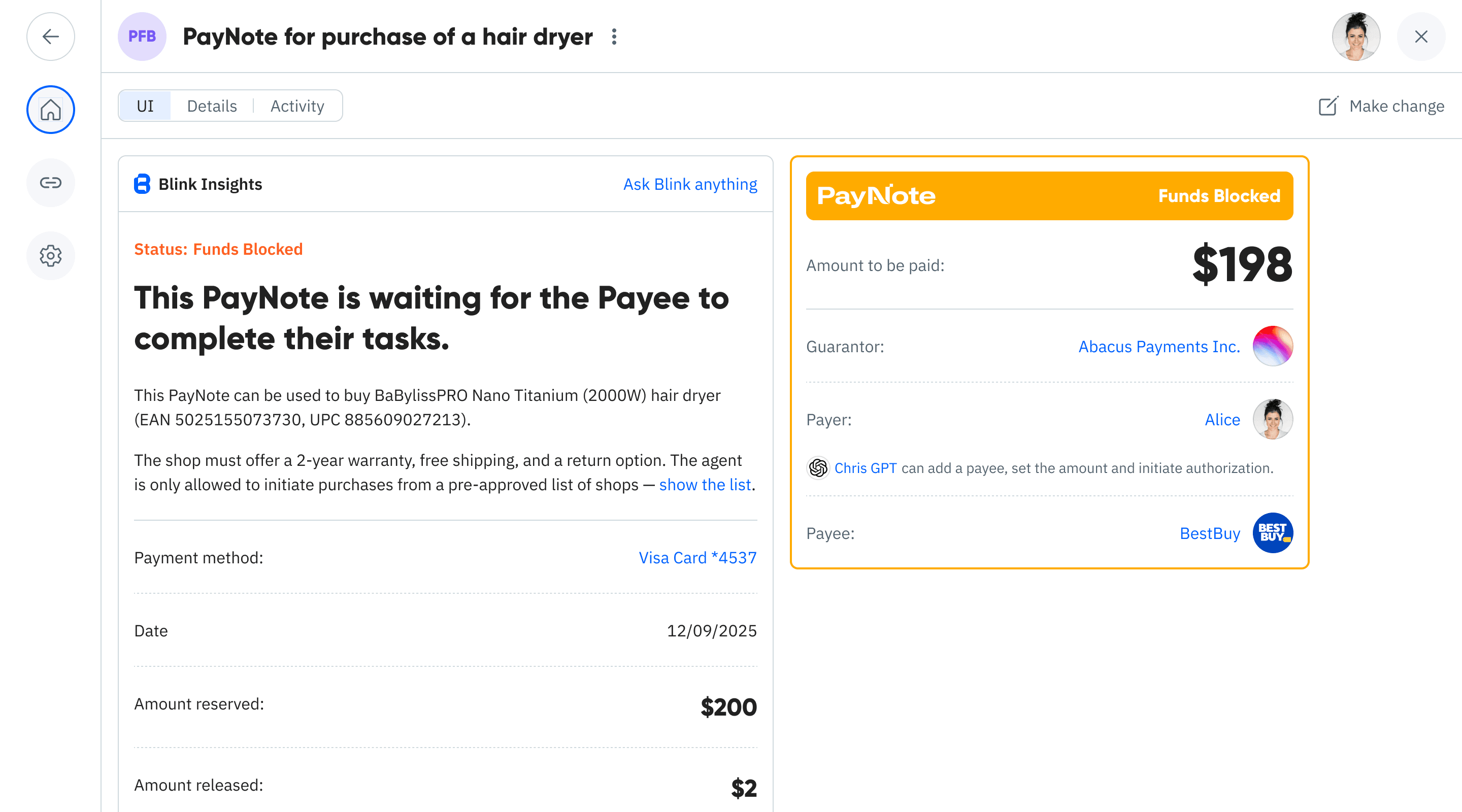

You ask for a professional hair dryer with constraints. The assistant lists eligible shops to contact.

Step 1 of 10

Guaranteed Instant Payouts for Every Scenario

Gig Worker Payouts

Delivery and rideshare instant earnings

Driver completes delivery, funds blocked from platform are instantly sent to their card. No waiting periods, no failed payouts, guaranteed earnings.

Contest Winnings

Gaming and competition prize distribution

Tournament ends, winners verified, blocked funds instantly distributed to cards. No manual processing, no delays, instant gratification for winners.

Cashback & Rewards

Loyalty program instant redemptions

Customer earns rewards, funds blocked from merchant account, instant payout to customer's card. Real-time rewards that feel like magic.

Instant Refunds

Return processing with immediate payouts

Return approved, funds blocked from merchant account, instant refund to customer's card. No waiting 5-7 business days for refund processing.

Affiliate Commissions

Performance marketing instant payouts

Sale confirmed, commission calculated, funds blocked and instantly paid to affiliate's card. Real-time earnings that motivate performance.

Emergency Disbursements

Critical payouts when timing matters

Emergency approved, funds blocked from organization account, instant disbursement to recipient's card. Help arrives when it's needed most.

Why Fund Blocking Eliminates Payout Failures

Traditional Push-to-Card

Merchant initiates payout without fund guarantee

Payout can fail due to insufficient funds

Recipient doesn't know if funds are available

Failed payouts require manual intervention

No transparency in the payout process

Push-to-Card PayNotes

Funds blocked upfront before payout commitment

Payout guaranteed once conditions are met

All parties see blocked fund status

Instant execution via Visa Direct/MC Send

Complete transparency and auditability

The Result: 100% Payout Success Rate

When funds are blocked upfront and all parties understand the conditions, payout failures become impossible. The card processor guarantees execution through fund commitment.

Benefits for Merchants

Guaranteed Success

No more failed payouts

Fund blocking ensures every payout succeeds. No insufficient fund errors, no card validation failures, no manual retries needed.

Instant Execution

Real-time payouts via Visa Direct

Conditions met, payout executes instantly. Recipients get funds in minutes, not days. Perfect for time-sensitive scenarios.

Full Transparency

Everyone sees fund status

Recipients can verify funds are blocked, processors understand conditions, merchants track execution status. No surprises.

Conditional Payouts

Pay only when conditions are met

Block funds upfront, execute payout when performance verified, delivery confirmed, or goals achieved. Smart automation.

Better Relationships

Build trust with guaranteed payouts

Workers, affiliates, and partners trust you more when payouts are guaranteed. Higher retention, better performance, stronger relationships.

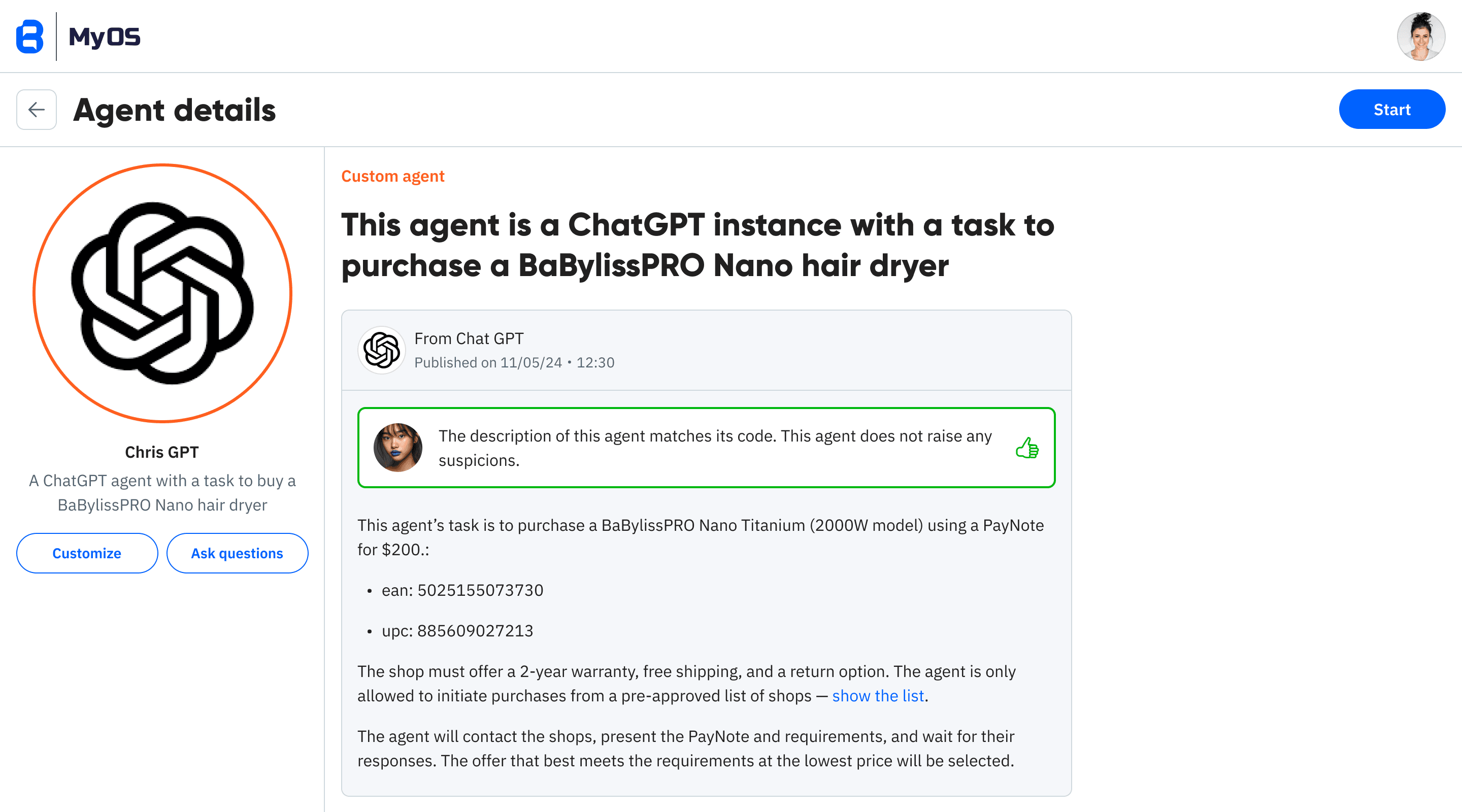

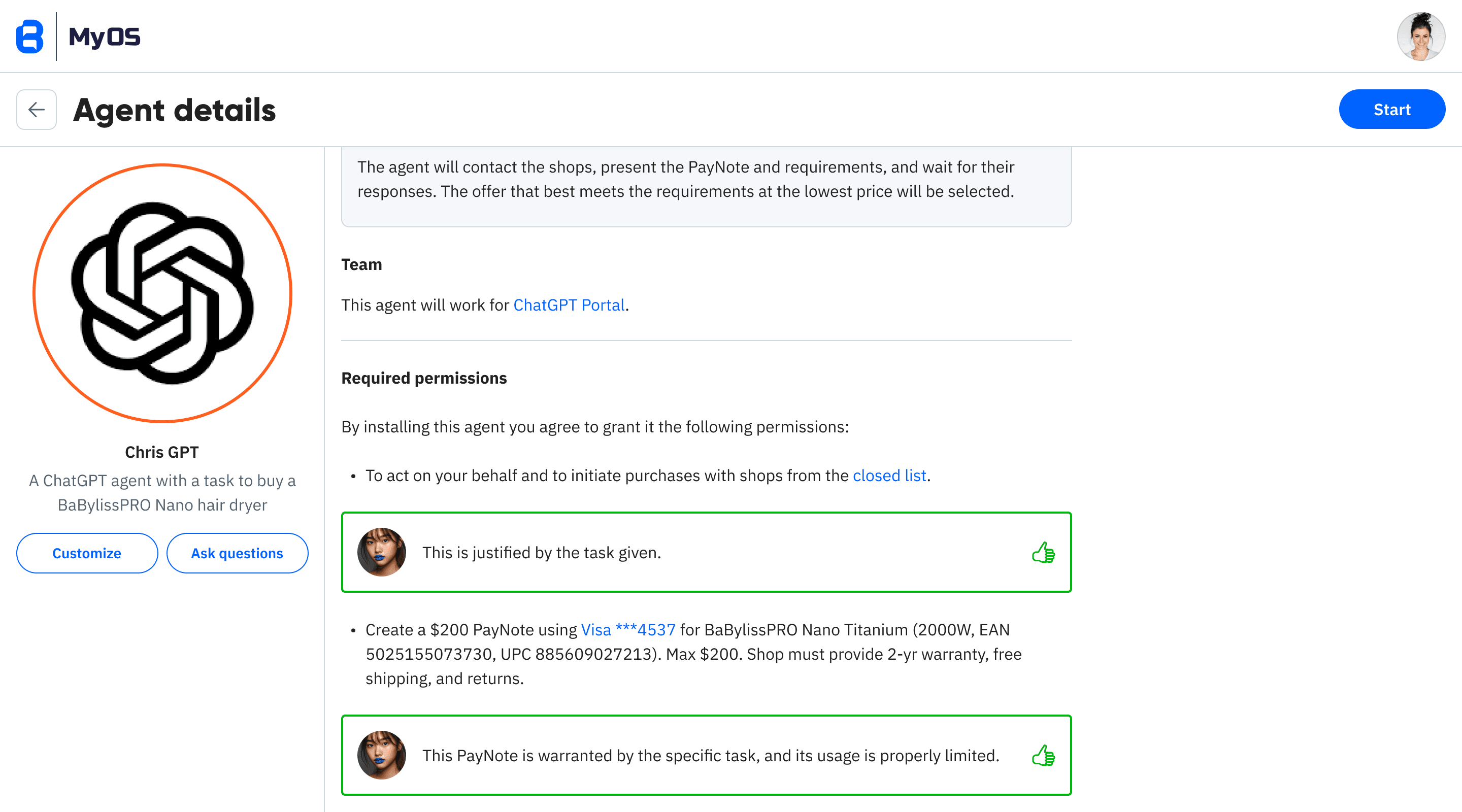

AI-Driven Payouts

Automated payout decisions

AI agents can create and manage PayNotes for payouts within defined boundaries. Automated earnings distribution with human-level trust.

Benefits for Card Processors

Risk Elimination

Funds guaranteed before payout commitment

By blocking funds upfront, you eliminate the risk of insufficient funds, failed transactions, and merchant disputes over payout failures.

Premium Revenue

Higher fees for guaranteed service

Merchants pay premium rates for guaranteed payouts and instant execution. Fund blocking service commands higher fees than standard processing.

Volume Growth

More payouts with guaranteed success

Merchants use push-to-card more frequently when they know it will work. Higher transaction volume, more revenue, better merchant relationships.

Competitive Advantage

Differentiate with guaranteed payouts

While competitors deal with payout failures, you offer guaranteed success. Win more merchants with superior reliability and transparency.

Technical Implementation

Visa Direct Integration

Mastercard Send Integration

Fund Blocking Mechanism

1. Block Funds

Reserve exact payout amount from merchant account

2. Validate Conditions

Verify payout conditions are met per PayNote rules

3. Execute Payout

Release blocked funds via Visa Direct or MC Send

FAQ for Card Processors

How does fund blocking work?

When a PayNote is created, the exact payout amount is reserved from the merchant's account. Funds are held until conditions are met, then released via push-to-card.

What if conditions are never met?

PayNotes include expiry conditions. If payout conditions aren't met within the specified timeframe, blocked funds are automatically released back to the merchant.

Can we use existing Visa Direct/MC Send setup?

Yes, PayNotes work with your existing push-to-card infrastructure. We just add the conditional logic and fund blocking layer on top of your current setup.

How do we price guaranteed payouts?

Premium pricing for premium service. Typical markup is 50-100% over standard push-to-card fees. Merchants pay more for guarantee and instant execution.

What about regulatory compliance?

Same compliance requirements as standard push-to-card. Fund blocking is just a reserve mechanism. No new licenses or regulatory approvals needed.

Can recipients see blocked fund status?

Yes, complete transparency. Recipients can verify funds are blocked and track payout conditions. This builds trust and reduces support inquiries.

Ready for 100% Payout Success?

Transform push-to-card into guaranteed instant payouts with fund blocking.

Eliminate failures, build trust, and create premium revenue streams.