Automate B2B Partnerships at Scale

Transform merchant-to-merchant transfers into automated partnerships within your card processor or marketplace. Block funds, set custom rules, and let thousands of B2B relationships settle automatically.

Automated B2B Settlements Within Your Network

Traditional merchant partnerships require manual invoicing, payment processing, and settlement. Merchant Transfer PayNotes automate the entire flow within your card processor, marketplace, or platform ecosystem.

Payer Merchant

✓ Sets partnership terms and rules

✓ Commits funds for automatic settlement

✓ Scales to thousands of partners

✓ Tracks all partnership performance

Payee Merchant

✓ Accepts partnership agreements

✓ Sees guaranteed payment terms

✓ Receives automatic settlements

✓ Monitors real-time performance

Guarantor Platform

✓ Blocks funds to guarantee settlements

✓ Validates partnership conditions

✓ Executes automatic transfers

✓ Provides trust infrastructure

From Partnership Agreement to Automatic Settlement

See how Merchant Transfer PayNotes create automated B2B partnerships with guaranteed settlements, transparent terms, and real-time execution within your platform ecosystem.

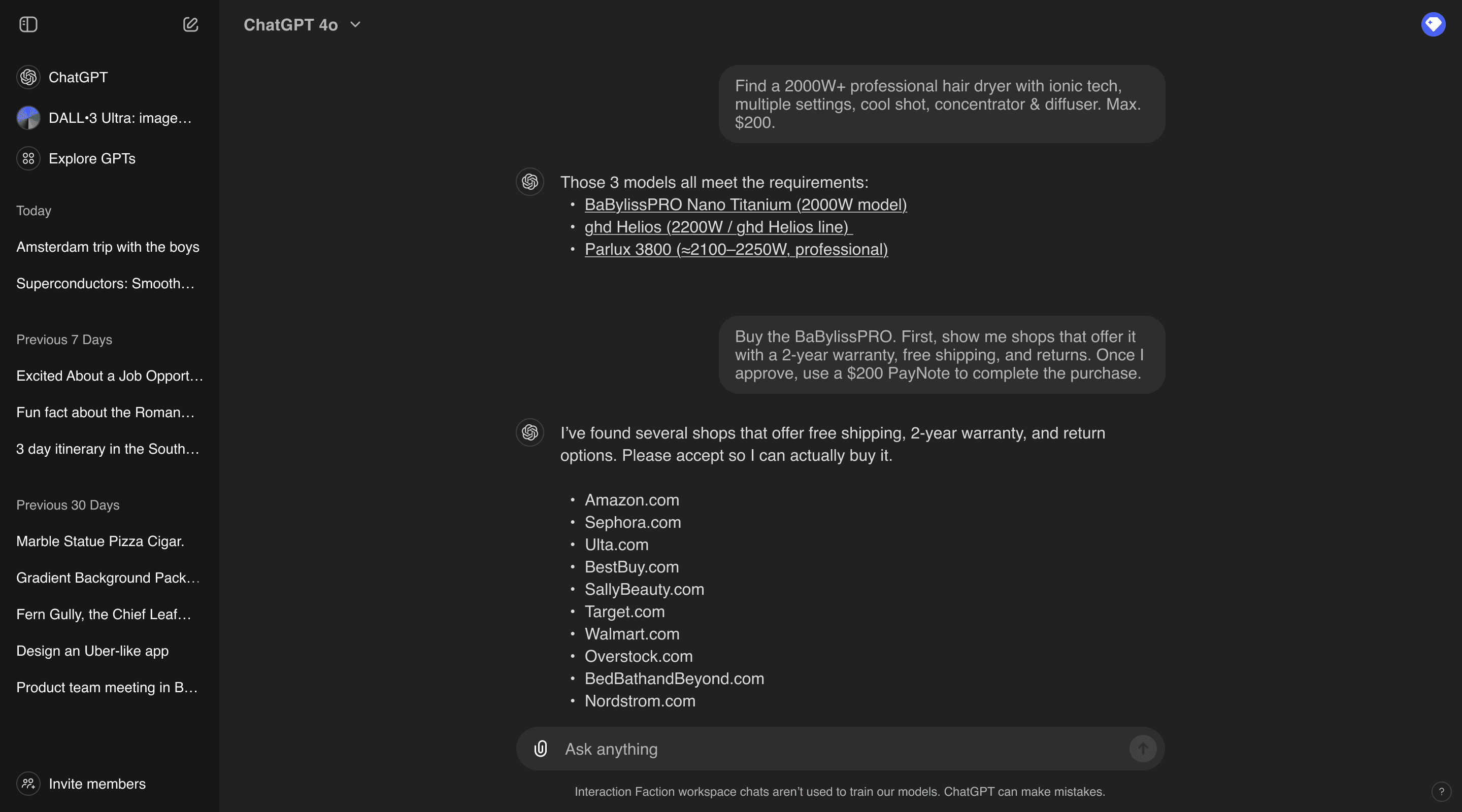

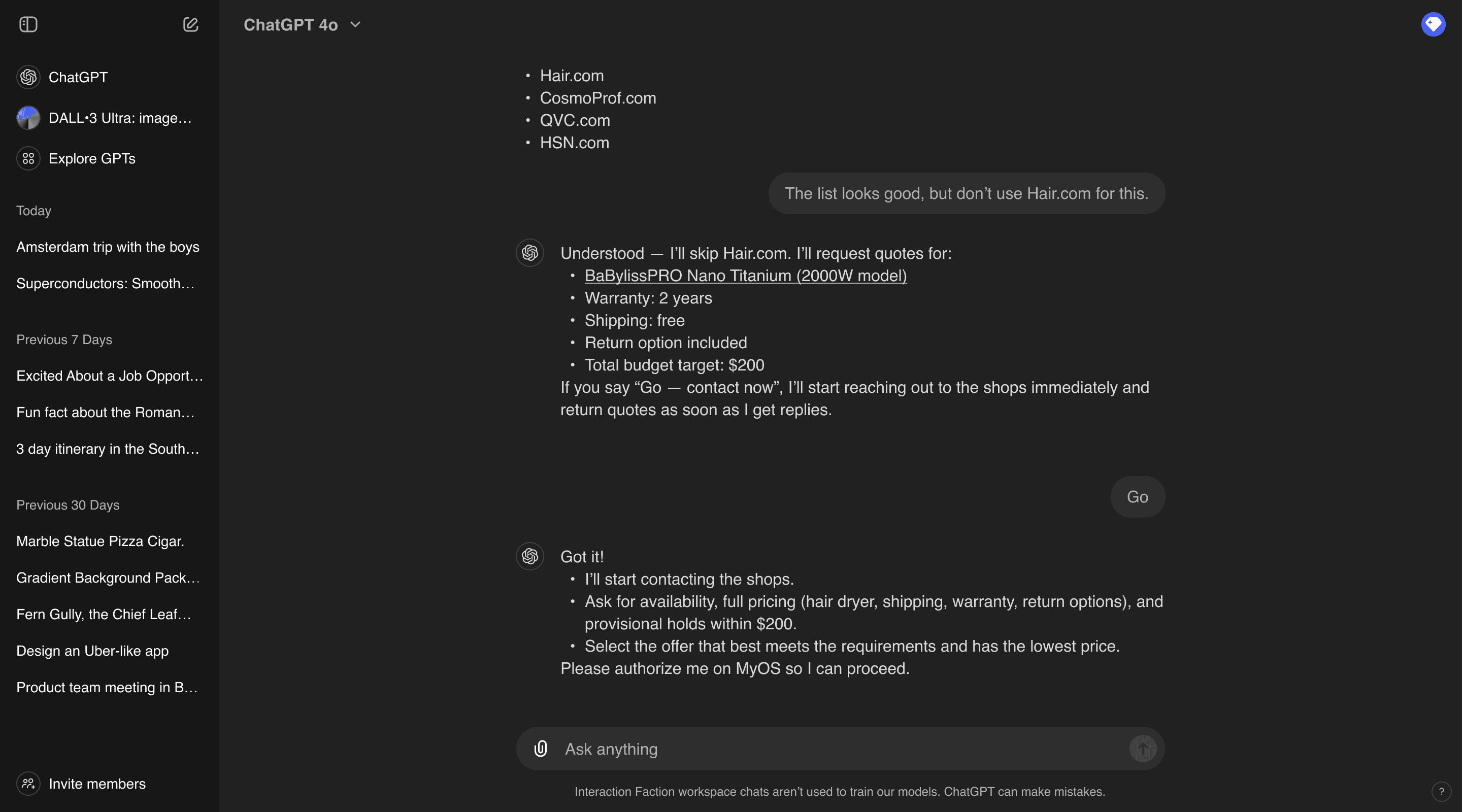

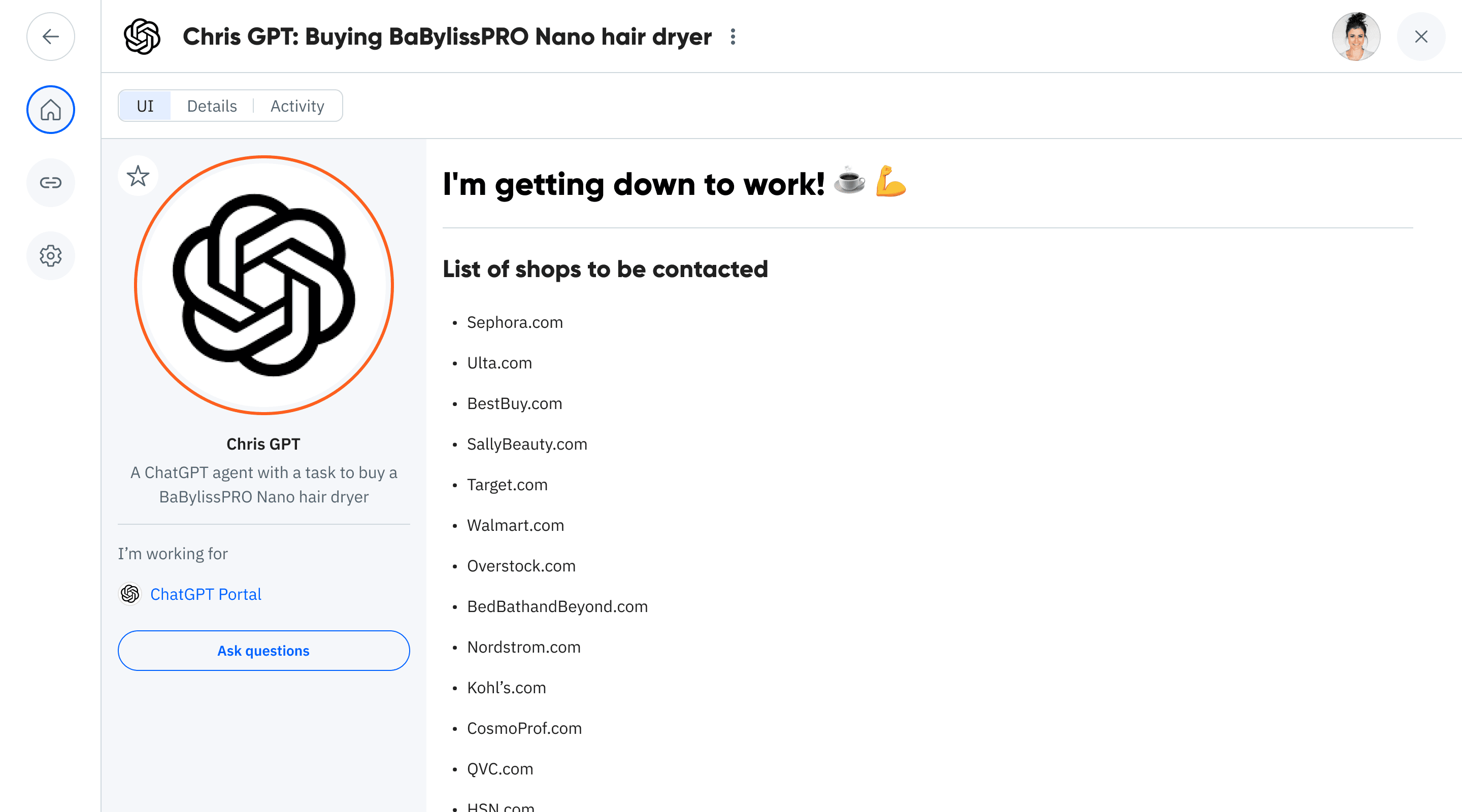

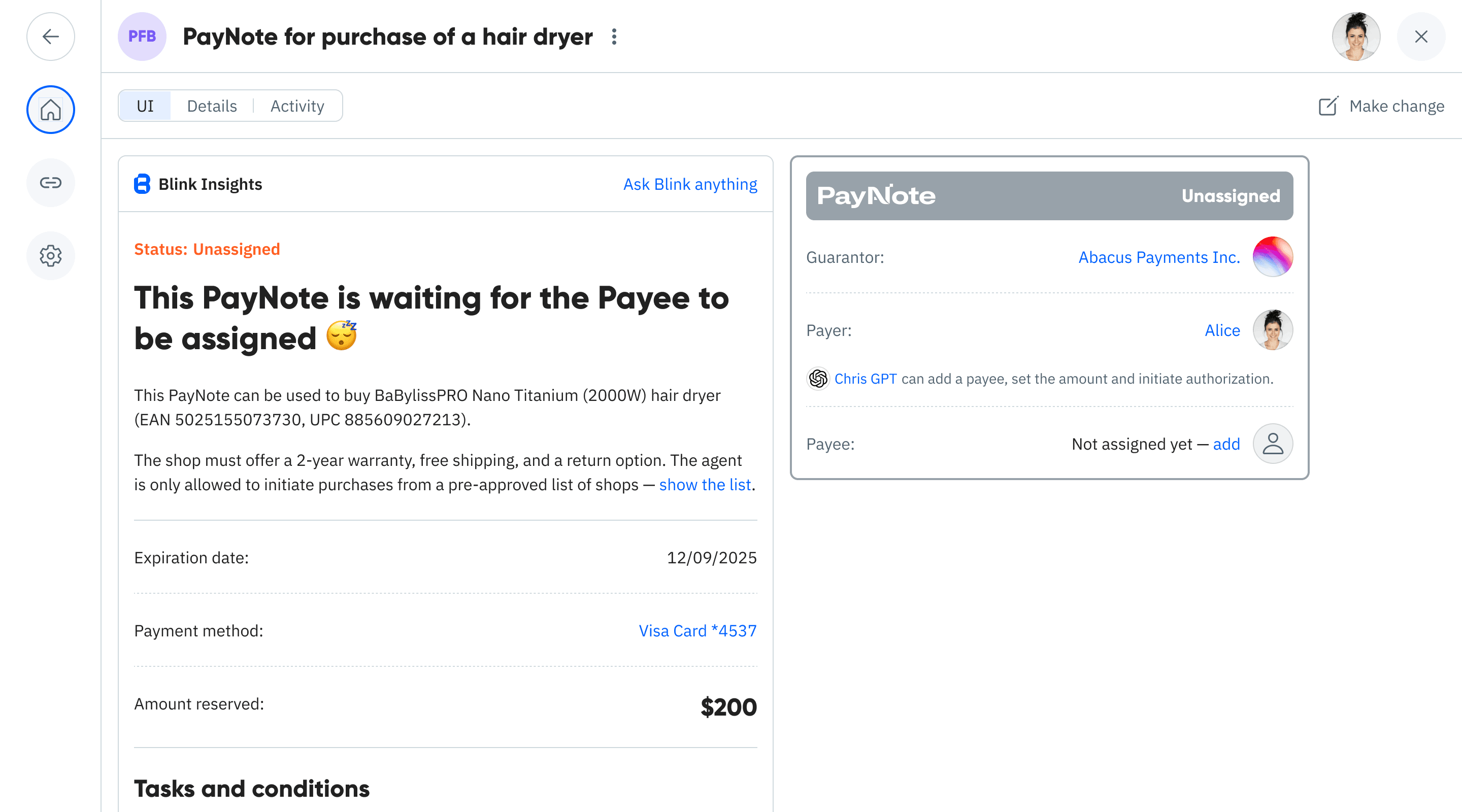

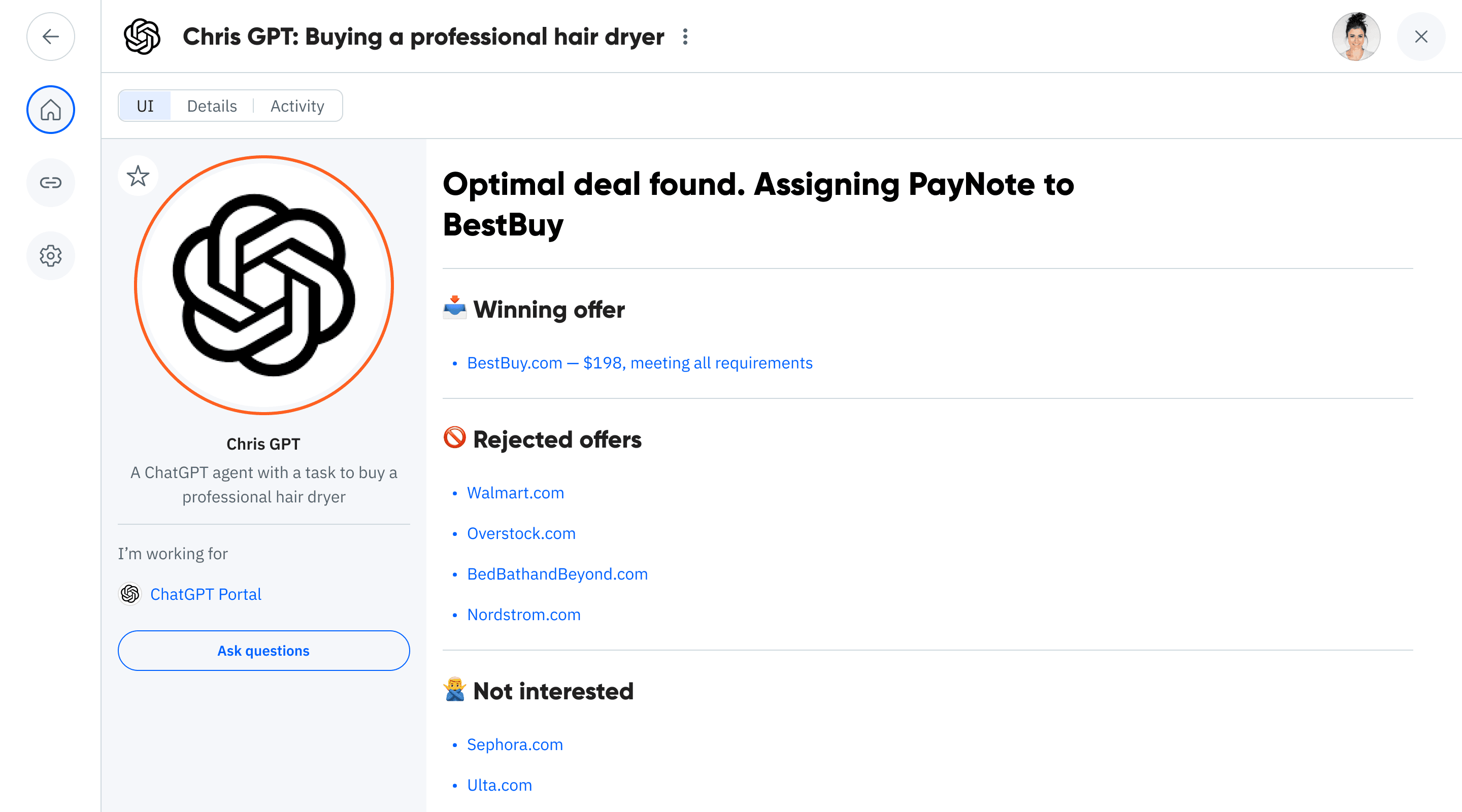

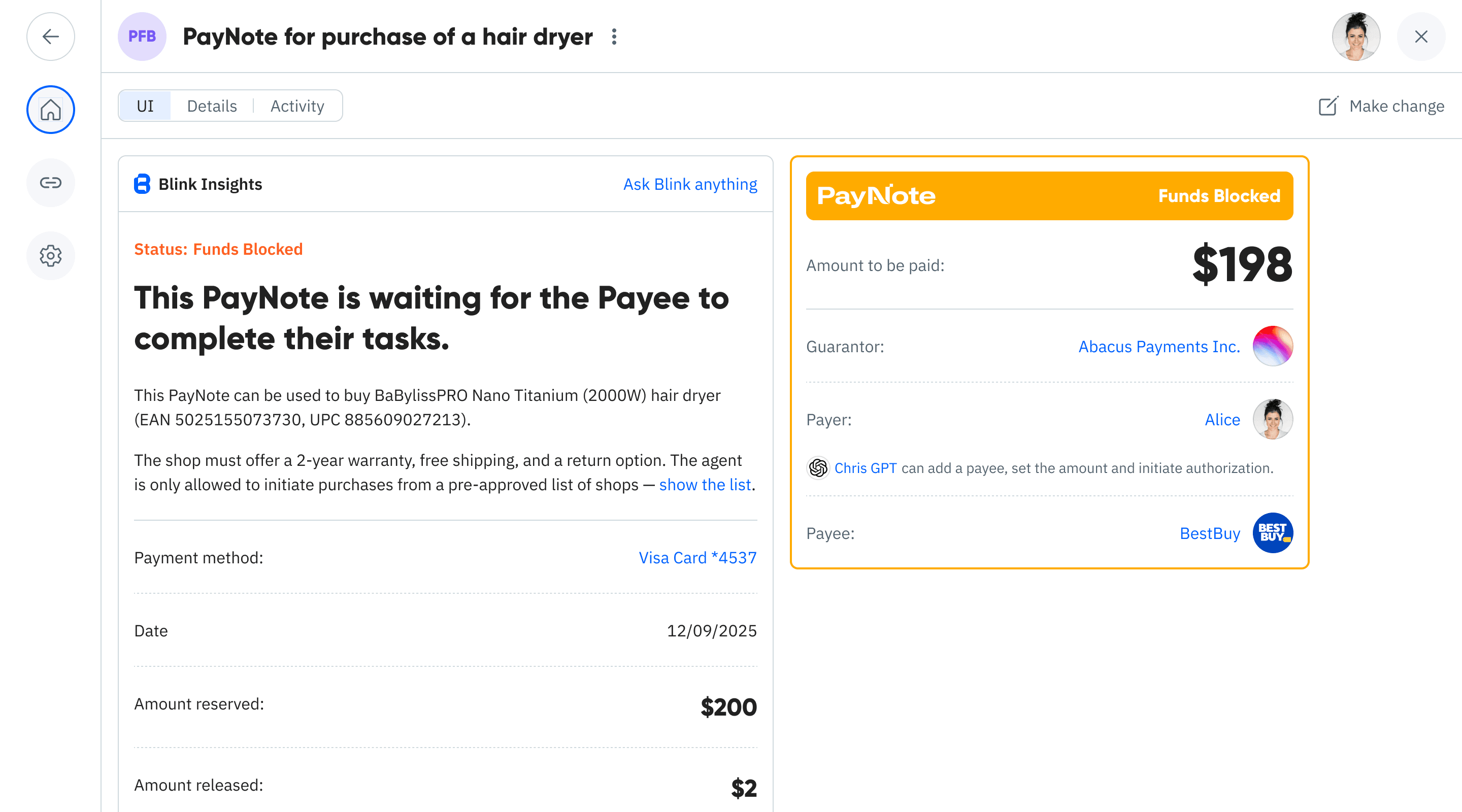

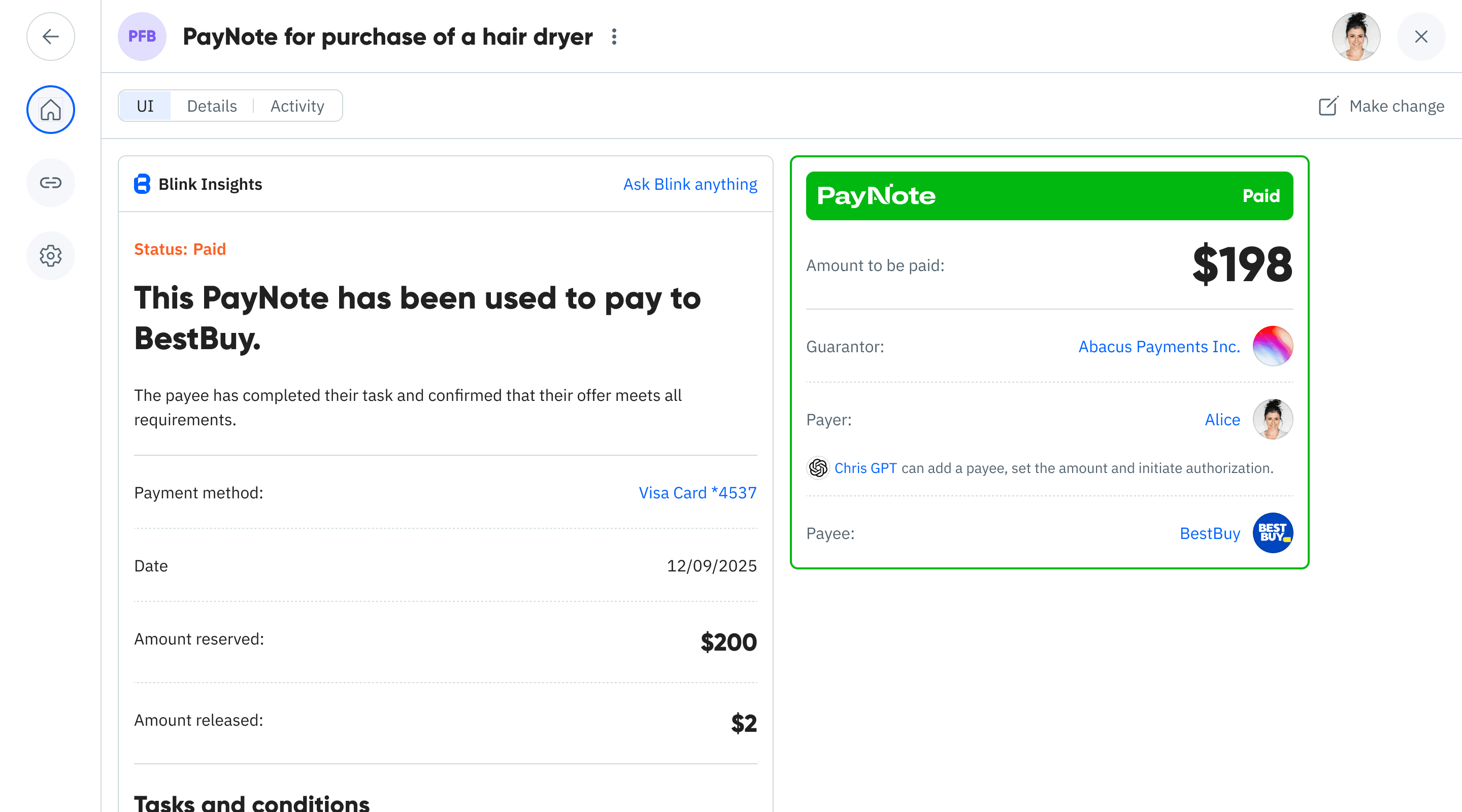

You ask for a professional hair dryer with constraints. The assistant lists eligible shops to contact.

Step 1 of 10

Scale Your B2B Partnerships Automatically

Affiliate Marketing

Automated commission settlements

Shop creates PayNotes for thousands of affiliates. Sales tracked, commissions calculated, payments settled automatically. Scale affiliate programs without manual processing.

Supply Chain Partners

Delivery and fulfillment automation

Retailer partners with logistics companies. Delivery confirmed, payment triggered automatically. No invoicing delays, no payment disputes, instant settlement.

Revenue Sharing

Platform partnerships with custom splits

SaaS platform shares revenue with integration partners. Usage tracked, percentages calculated, partners paid automatically based on contribution metrics.

White Label Partnerships

Technology licensing settlements

Tech company licenses platform to resellers. Usage monitored, licensing fees calculated, payments settled automatically based on usage metrics and terms.

Service Marketplace

Professional services automation

Consulting platform connects clients with experts. Services delivered, quality verified, experts paid automatically. Scale professional services marketplaces.

Referral Networks

Multi-level partnership rewards

Business creates multi-tier referral program. Referrals tracked, bonuses calculated across levels, partners paid automatically based on network performance.

Why Merchant PayNotes Enable Massive Scale

Traditional B2B Partnerships

Manual contracts for each partner

Invoicing and payment processing overhead

Payment delays and disputes

Limited scalability due to manual processes

No transparency in settlement timing

Merchant Transfer PayNotes

Template-based partnerships at scale

Automatic settlement with fund blocking

Instant payments when conditions are met

Unlimited partnerships with same infrastructure

Complete transparency for all parties

The Result: Partnership at Internet Scale

When partnerships are automated through PayNotes, you can scale to thousands of B2B relationships without increasing operational overhead. Every partnership is guaranteed, transparent, and automatic.

Benefits for Platform Operators

Massive Scale

Support thousands of partnerships

One shop can create thousands of affiliate partnerships, each with custom rules. Scale B2B relationships without operational overhead.

Guaranteed Settlements

Fund blocking ensures payment

Partners trust your platform because payments are guaranteed. Blocked funds ensure every settlement succeeds, building stronger partnerships.

Instant Automation

Real-time partnership execution

Conditions met, payments triggered instantly. No manual processing, no delays, no disputes. Partnerships execute at the speed of software.

Full Transparency

Everyone sees the same data

Partners can track performance, see blocked funds, verify conditions. Transparency builds trust and reduces support overhead.

Custom Rules

Flexible partnership terms

Different partners, different rules. Revenue sharing, milestone payments, performance bonuses - all automated through custom PayNote logic.

New Revenue Streams

Monetize partnership infrastructure

Charge fees for guaranteed settlements, premium partnership features, and automated processing. Turn infrastructure into revenue.

Benefits for Merchants

Partnership Confidence

Partners trust guaranteed payments

When partners know payments are guaranteed through fund blocking, they're more willing to enter partnerships and perform at higher levels.

Instant Settlements

No waiting for manual processing

Partners receive payments instantly when conditions are met. Better cash flow, stronger relationships, higher performance from partners.

Performance Tracking

Real-time partnership analytics

See which partnerships perform best, track ROI in real-time, optimize partnership terms based on actual performance data.

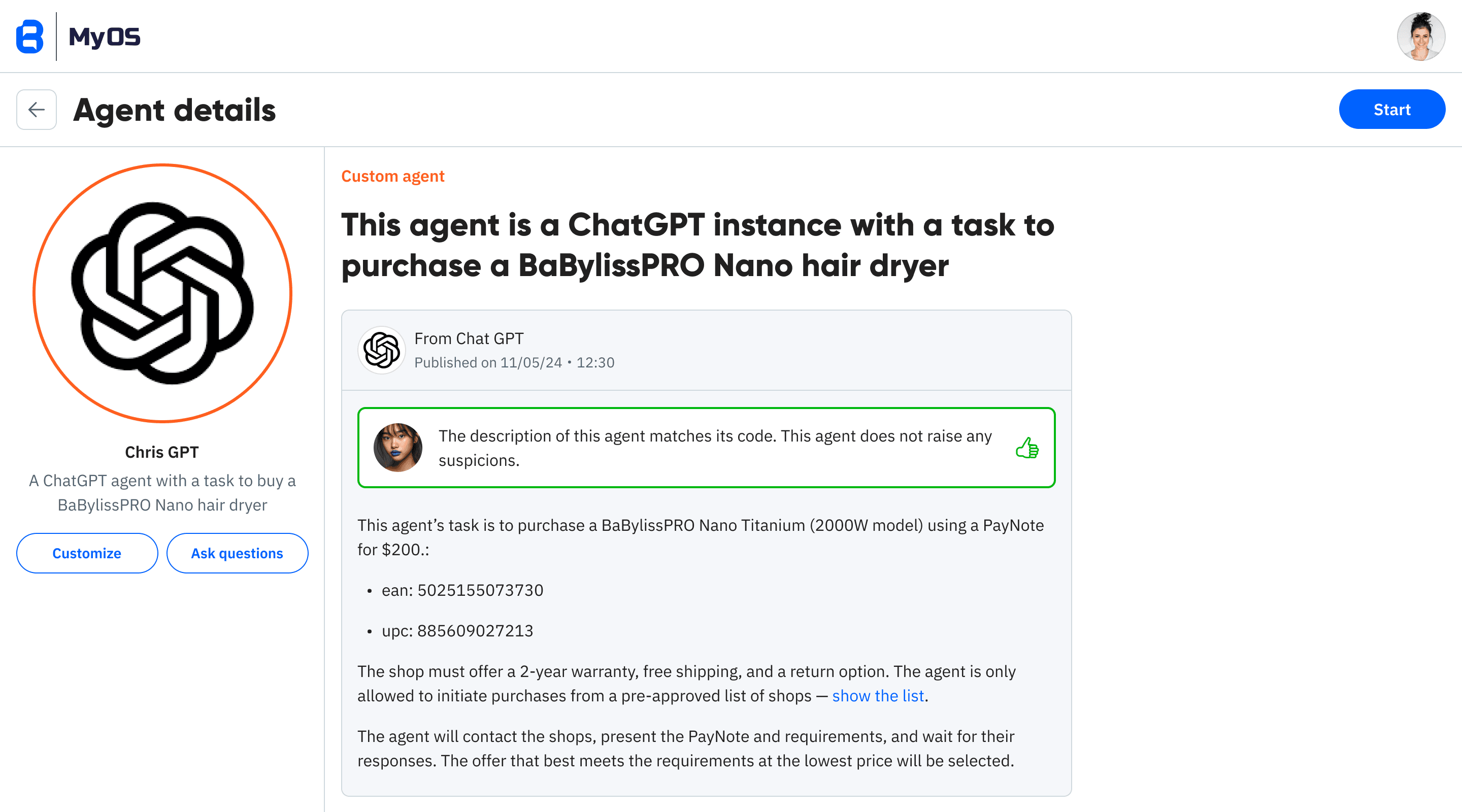

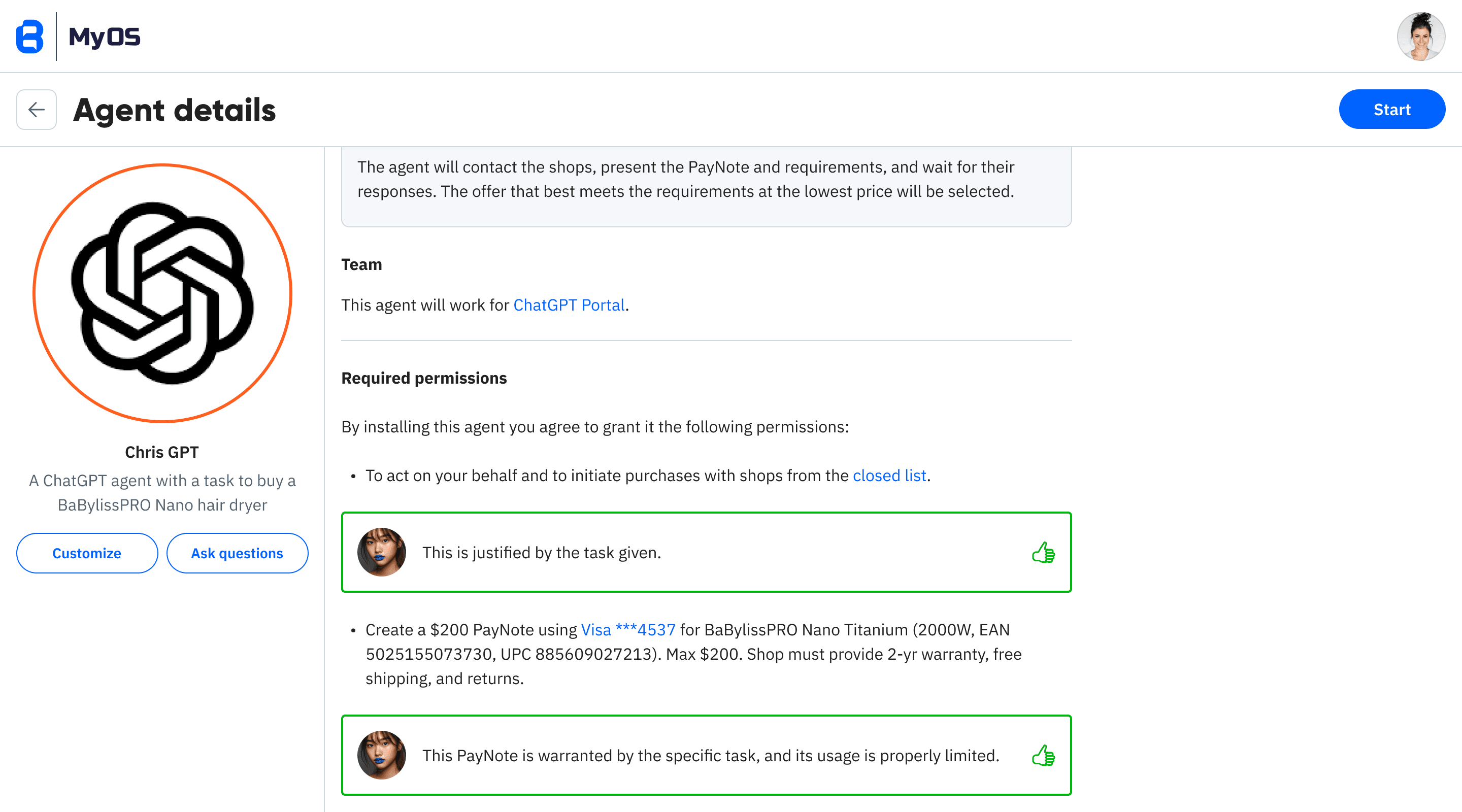

AI-Driven Partnerships

Automated partner management

AI agents can create and manage partnerships within defined boundaries. Scale partnership programs with intelligent automation.

Implementation for Card Processors & Marketplaces

What You Already Have

What PayNotes Add

Partnership Automation Flow

1. Block Funds

Reserve settlement amounts from payer merchant

2. Track Performance

Monitor partnership conditions and metrics

3. Validate Terms

Verify partnership conditions are met

4. Execute Transfer

Automatic settlement to payee merchant

FAQ for Platform Operators

How does fund blocking work for merchants?

When a merchant creates a PayNote, the settlement amount is reserved from their account balance. Funds are held until partnership conditions are met, then transferred automatically.

Can merchants scale to thousands of partners?

Yes, that's the key benefit. One merchant can create template PayNotes and onboard thousands of partners with custom rules, all automated through the same infrastructure.

What happens if partnership conditions aren't met?

Blocked funds are automatically released back to the payer merchant based on expiry conditions. Partners can also modify terms or cancel partnerships before expiry.

How do we price partnership services?

Charge per PayNote creation, percentage of settlements, or monthly fees for partnership automation. Premium pricing for guaranteed settlements and advanced features.

Do we need new compliance procedures?

No, same merchant-to-merchant transfer compliance. PayNotes just add conditional logic and fund blocking. Your existing risk and compliance frameworks apply.

Can partners see fund blocking status?

Yes, complete transparency. Partners can verify funds are blocked, track performance metrics, and see settlement conditions. This builds trust and reduces disputes.

Ready to Scale B2B Partnerships?

Transform merchant transfers into automated partnership infrastructure.

Enable thousands of partnerships with guaranteed settlements and transparent terms.