Anyone Can Be Your Guarantor

The ultimate flexible PayNote where any trusted party can guarantee transfers. From restaurant vouchers to marathon awards, create custom payment agreements with anyone you trust as the guarantor.

Any Trusted Party Can Guarantee Your Transfers

Unlike traditional PayNotes with fixed guarantors (banks, card processors), Custom PayNotes let you choose anyone as your guarantor. Restaurant owners, event organizers, clubs, communities—anyone who can provide value or assets to back the agreement.

Payer

✓ Creates transfer with custom terms

✓ Chooses trusted guarantor

✓ Sets conditions and triggers

✓ Transfers value or assets

Payee

✓ Accepts transfer conditions

✓ Trusts the chosen guarantor

✓ Receives guaranteed value

✓ Can transfer to others or redeem

Custom Guarantor

✓ Can be anyone with assets/value

✓ Backs the PayNote with resources

✓ Validates conditions are met

✓ Honors transfer obligations

From Custom Agreement to Guaranteed Transfer

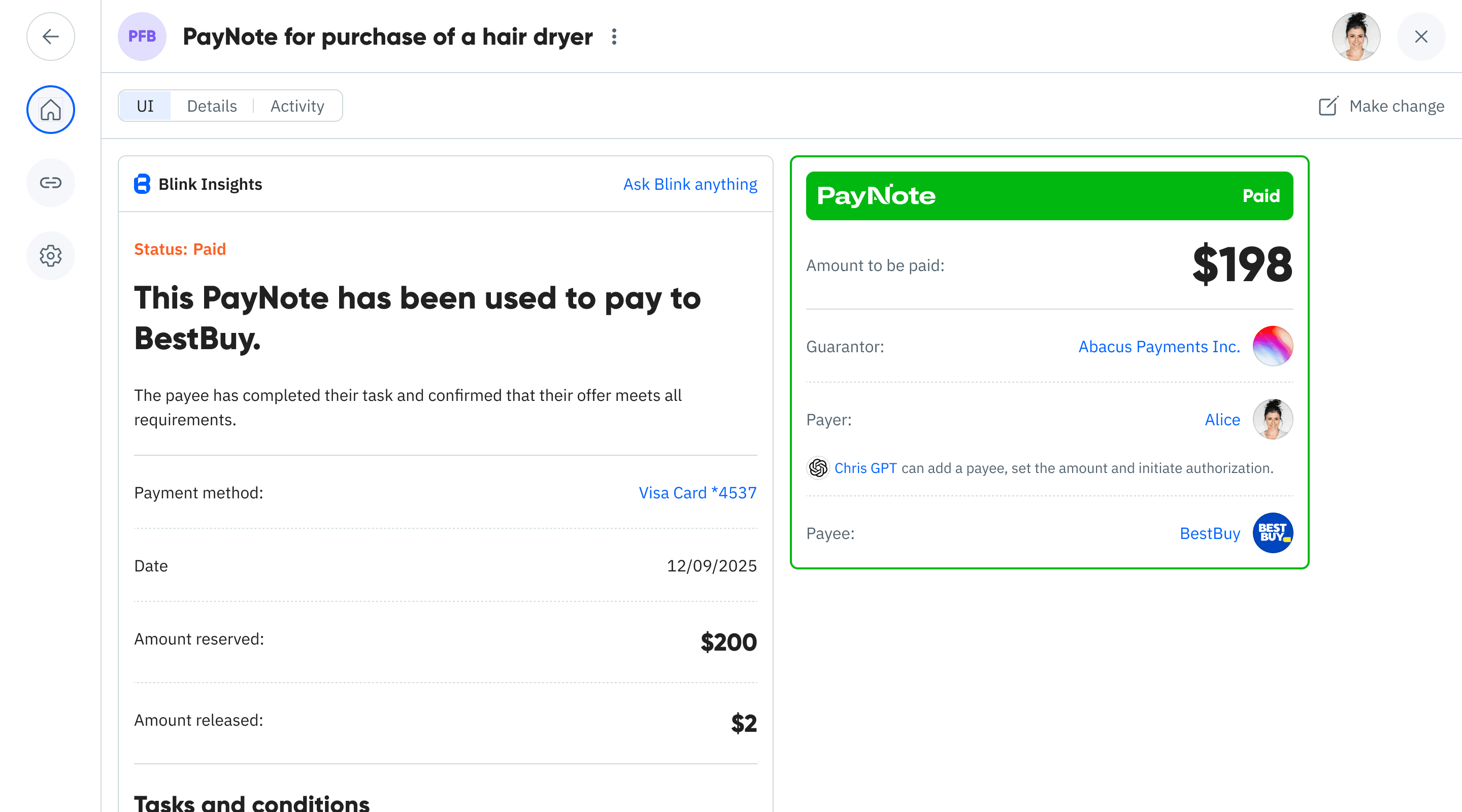

See how Custom PayNotes create flexible agreements with any trusted party as guarantor, enabling unique transfer scenarios that traditional payment systems can't handle.

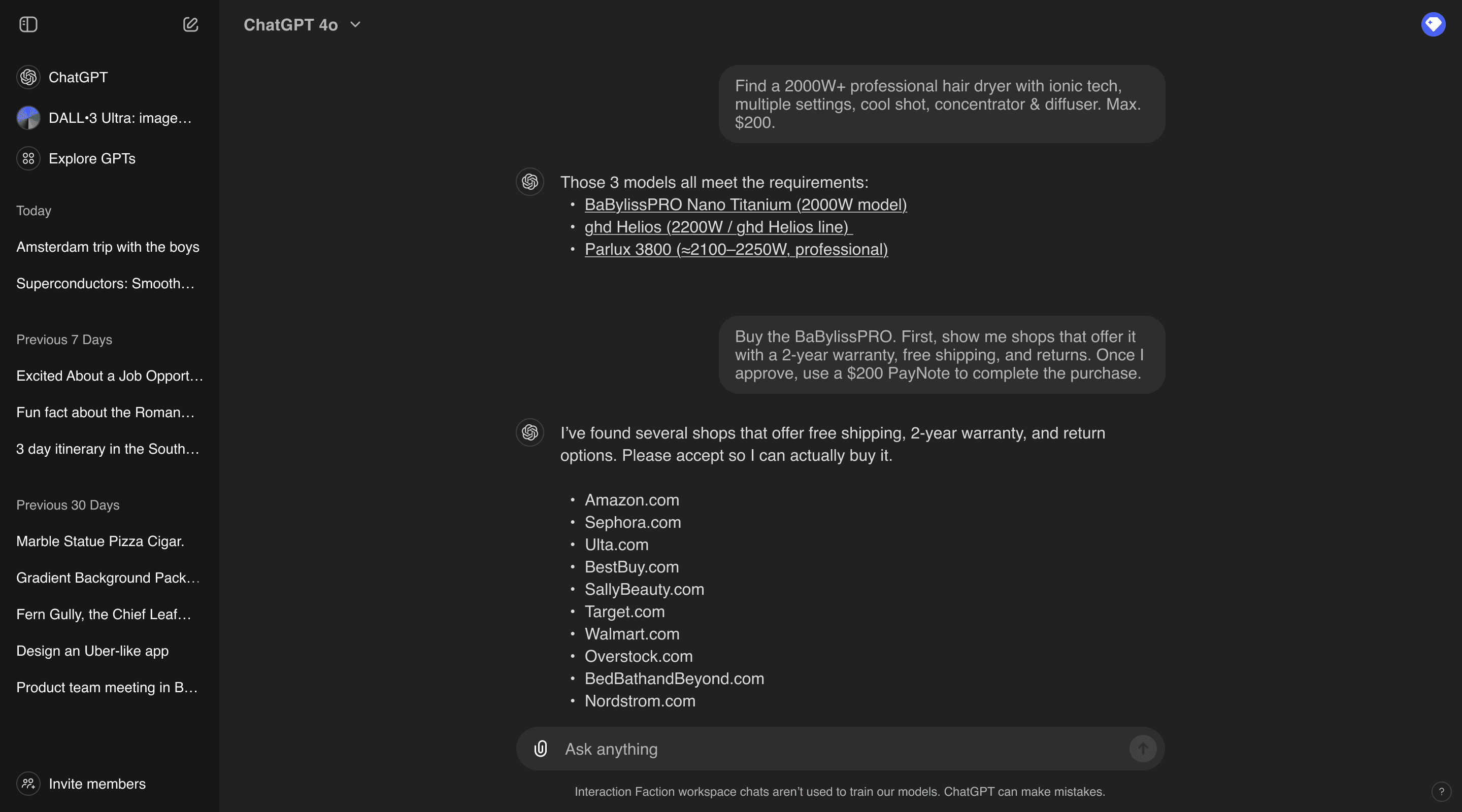

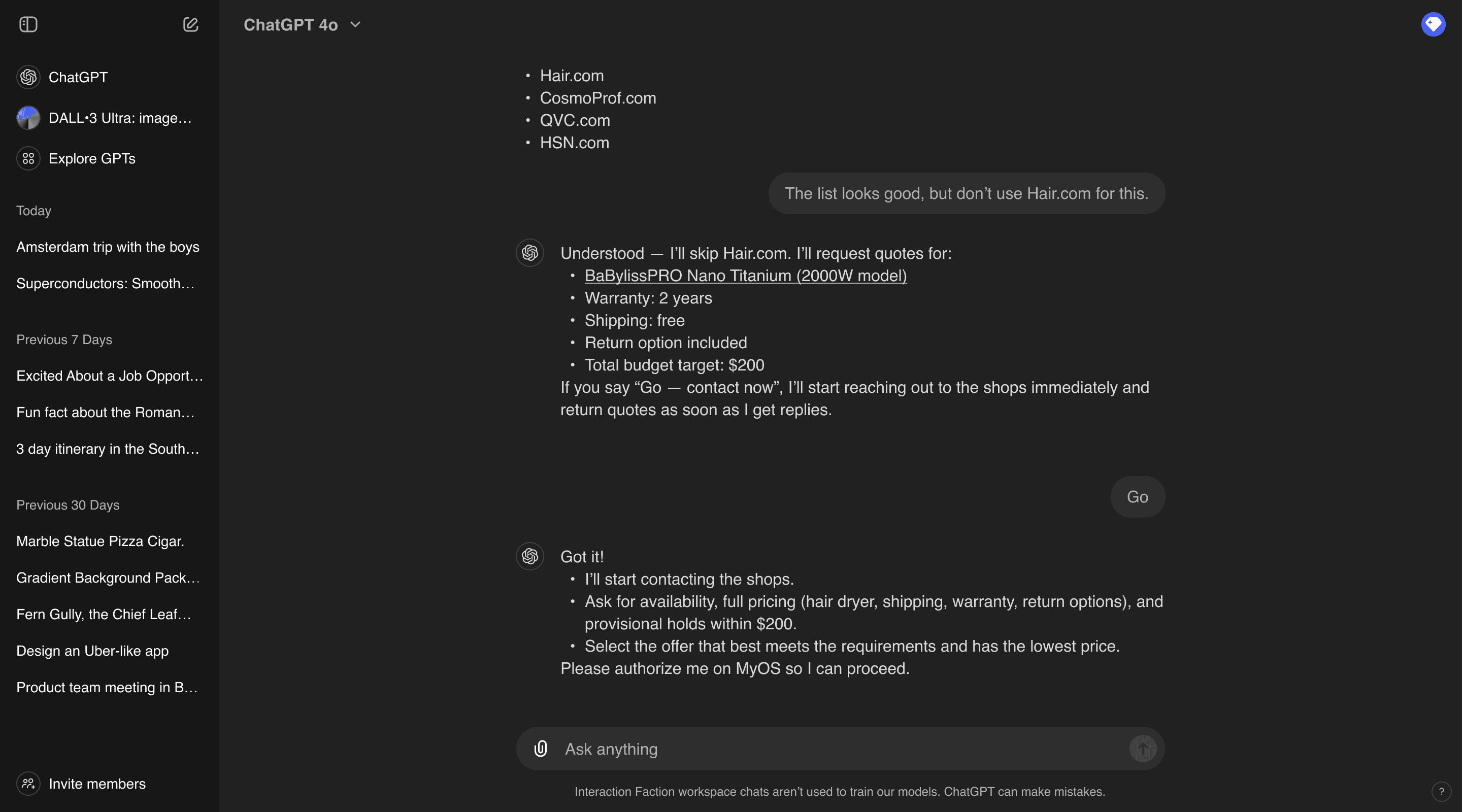

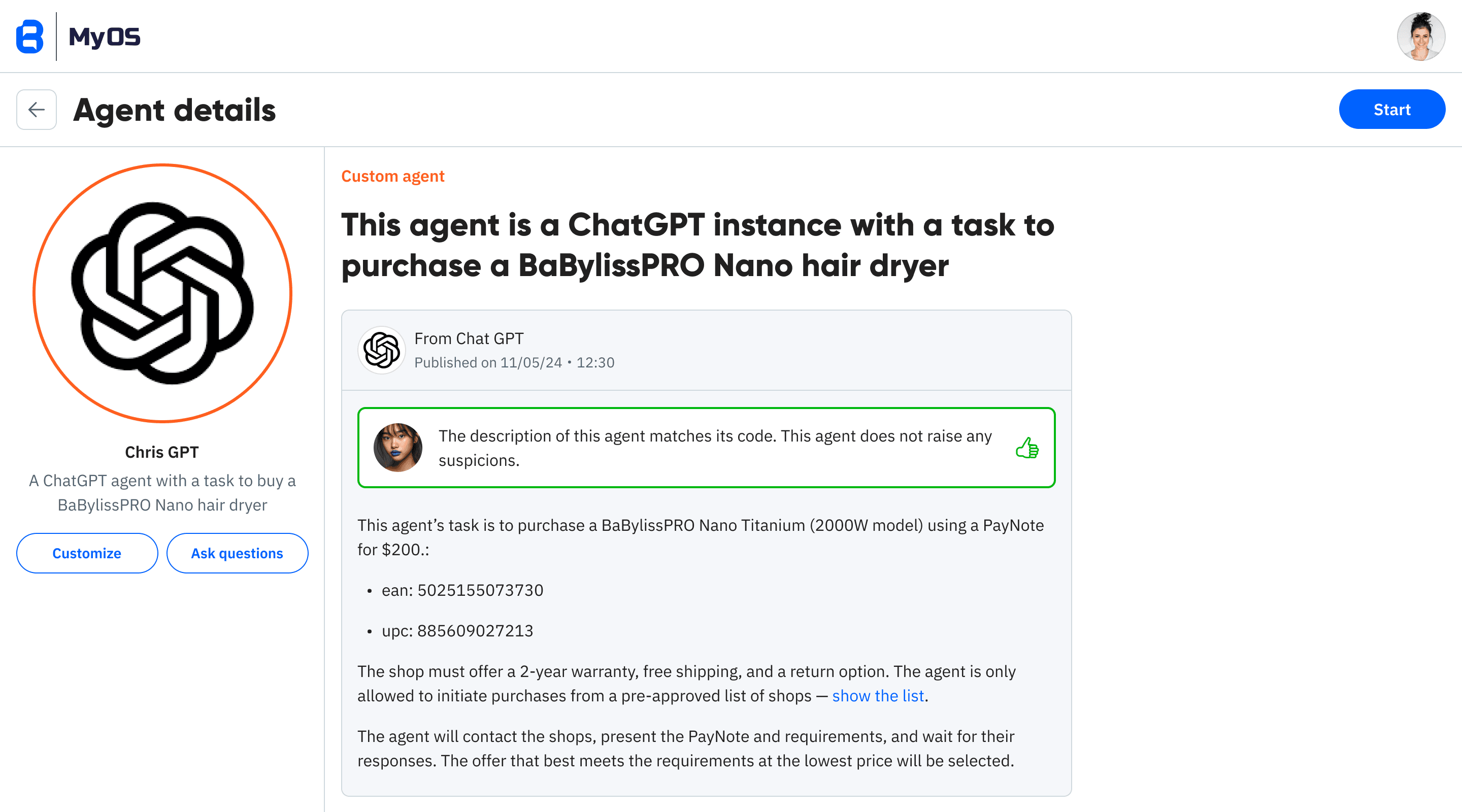

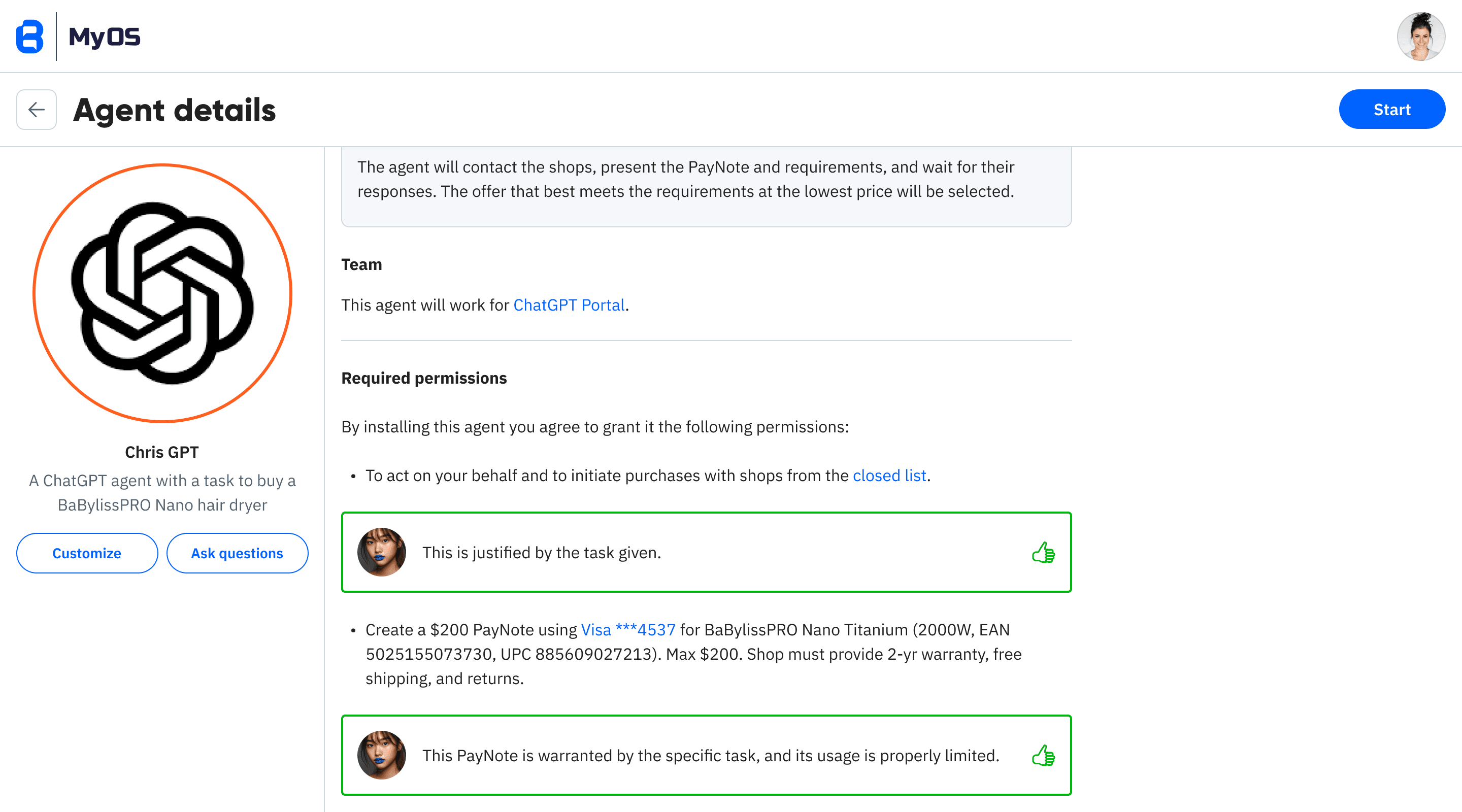

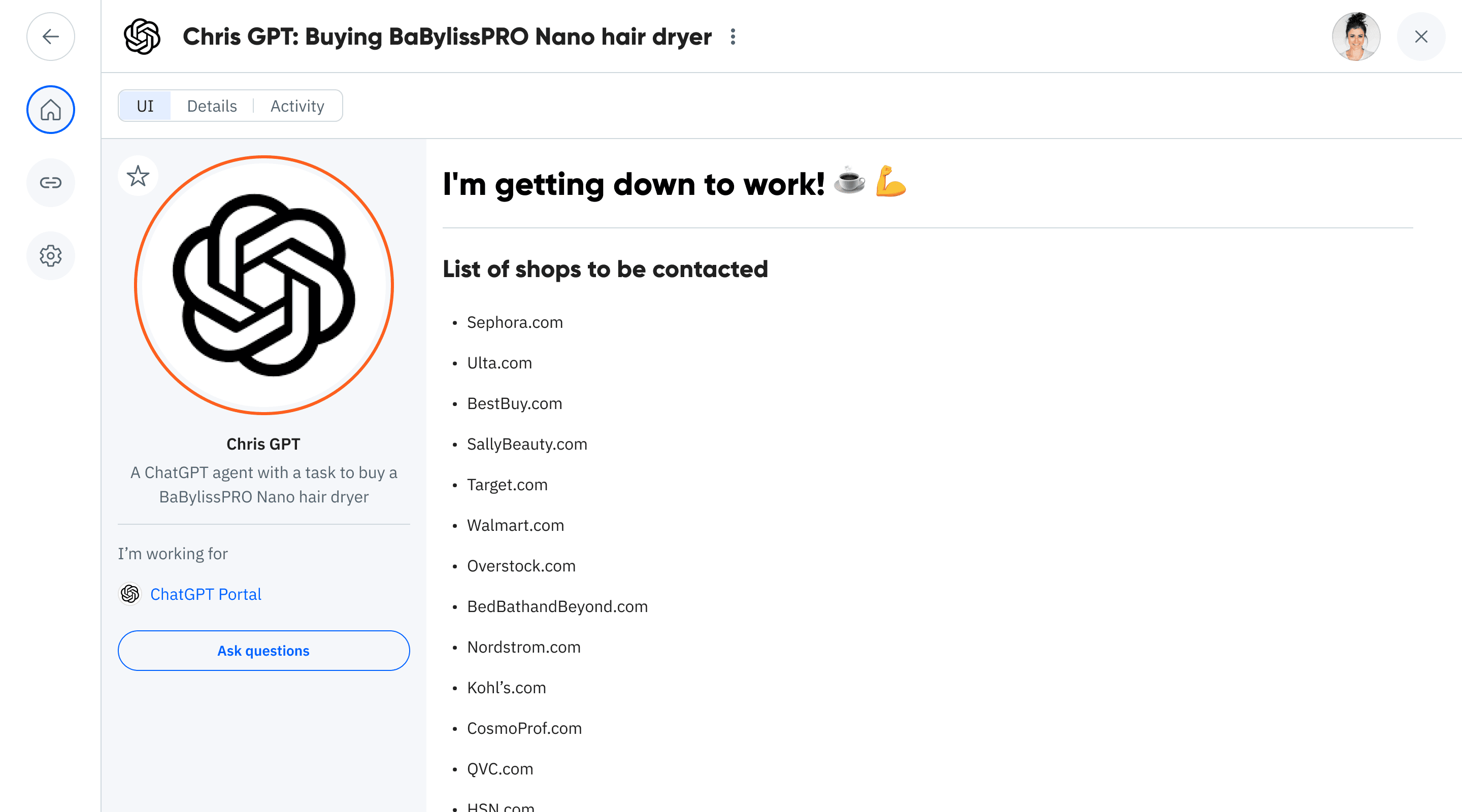

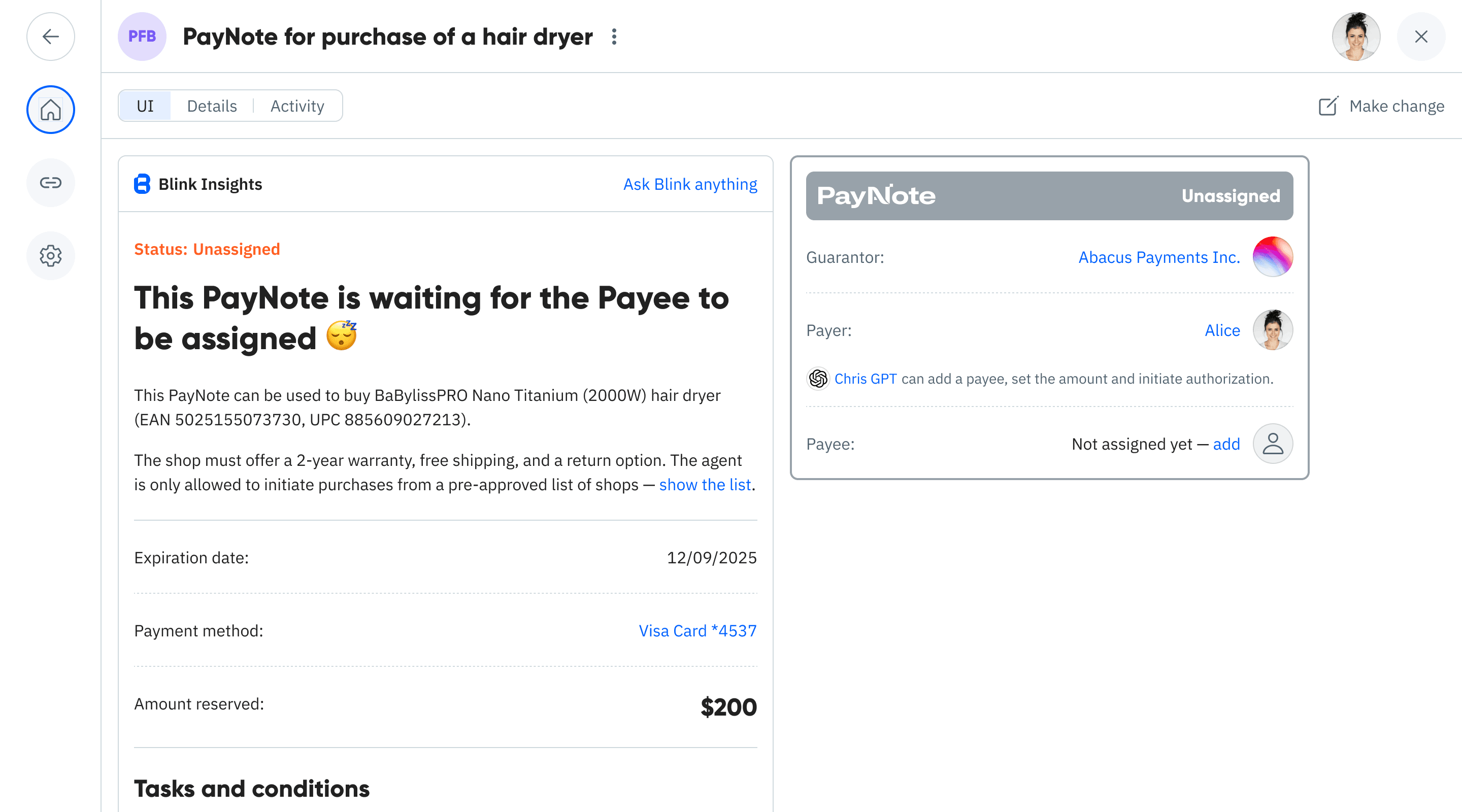

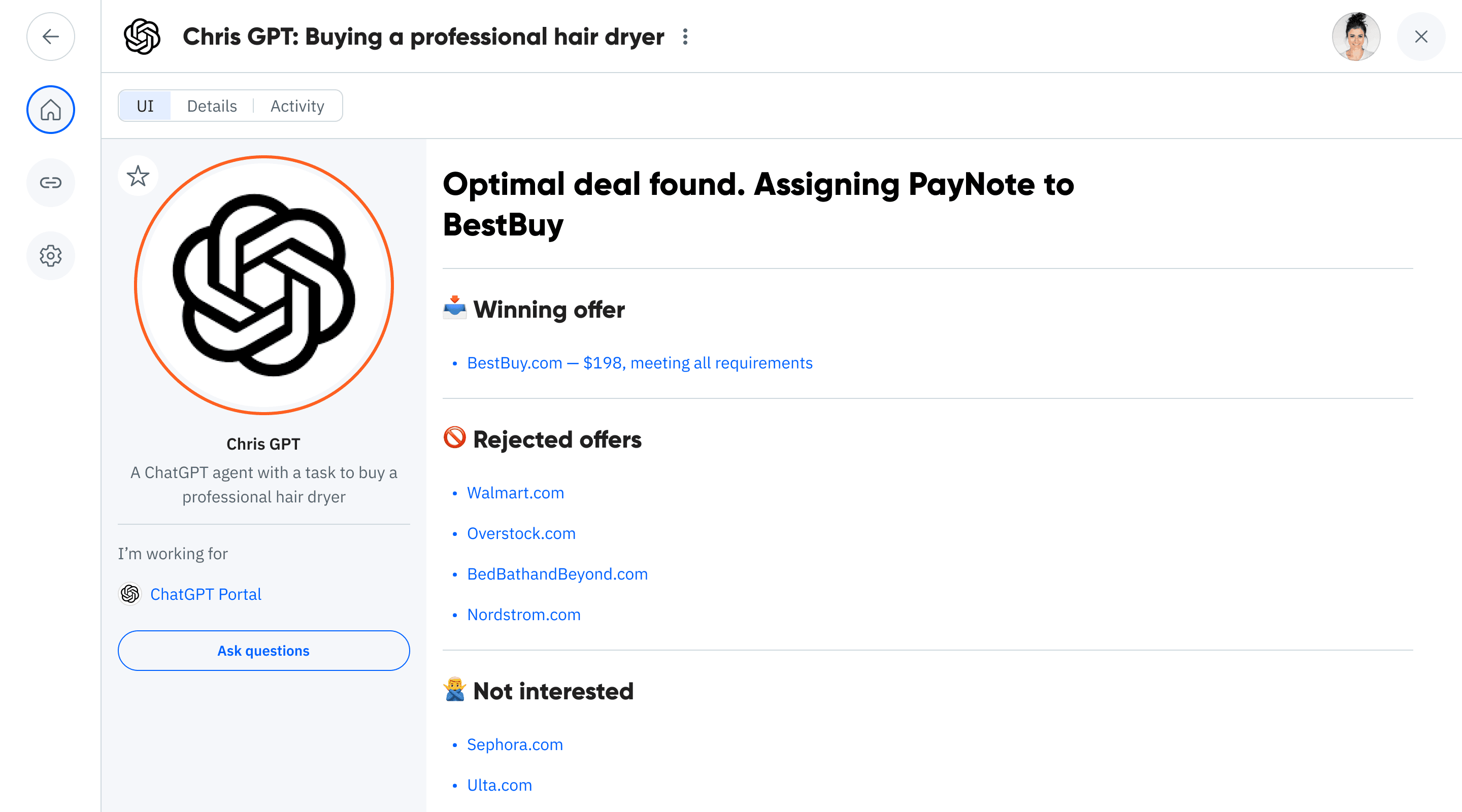

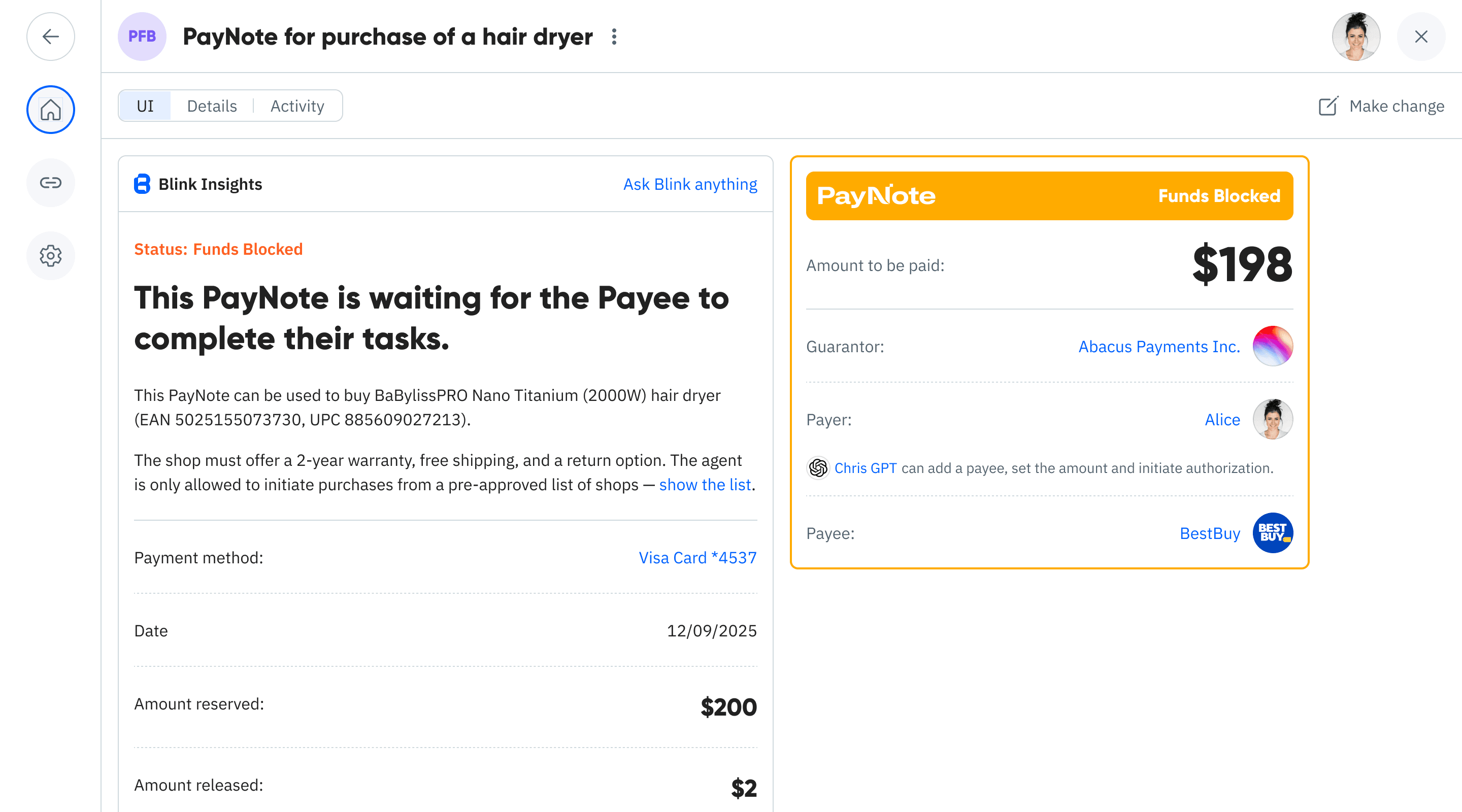

You ask for a professional hair dryer with constraints. The assistant lists eligible shops to contact.

Step 1 of 10

Unlimited Creative Possibilities

Restaurant Vouchers

Restaurant as guarantor for transferable dining credits

Restaurant issues vouchers as PayNotes. Customers can transfer vouchers between each other or redeem at the restaurant. Restaurant guarantees the dining value.

Marathon Awards

Event organizer guarantees prize transfers

Runner creates PayNote promising part of potential winnings to supporter. Marathon organizer guarantees transfer if runner wins. Transparent sports betting.

Gift Cards 2.0

Store-backed transferable gift balances

Store issues gift cards as PayNotes. Recipients can transfer partial amounts to others, split gifts, or combine multiple gift PayNotes before redemption.

Club Memberships

Club-guaranteed transferable memberships

Golf club issues membership PayNotes. Members can transfer guest passes, sell remaining membership time, or gift access to friends. Club guarantees access rights.

Event Tickets

Organizer-backed transferable event access

Concert venue issues tickets as PayNotes. Fans can safely transfer tickets, split group bookings, or resell at guaranteed face value. Venue validates authenticity.

Subscription Sharing

Service provider guarantees shared access

Netflix family plan as PayNotes. Family members can transfer unused months, share with friends temporarily, or sell remaining subscription time. Netflix guarantees access.

Restaurant Vouchers: A Deep Dive

How Restaurant Vouchers Work

Restaurant creates $100 voucher PayNote

Customer buys voucher, owns transferable dining credit

Voucher can be split, combined, or transferred to others

Restaurant guarantees dining value when redeemed

All transfers are transparent and verifiable

Benefits for All Parties

Restaurant: Guaranteed cash flow, customer loyalty

Customers: Flexible, transferable dining credits

Recipients: Guaranteed value, no fraud risk

Network: Creates dining credit economy

Platform: Transaction fees on all transfers

The Result: Liquid Value Economy

Custom PayNotes turn any business asset into liquid, transferable value. Restaurant meals, event tickets, memberships—all become tradeable digital assets backed by trusted guarantors.

Why Become a Custom Guarantor?

New Revenue Streams

Monetize your assets and reputation

Charge fees for guaranteeing PayNotes, earn from increased transaction volume, and create new revenue from existing assets and customer relationships.

Customer Loyalty

Build stronger customer relationships

Customers who hold your PayNotes are more likely to return and refer others. Create a community around your guaranteed value propositions.

Market Expansion

Reach customers through transfers

When customers transfer your PayNotes to others, you gain new potential customers who experience your value through the guarantee system.

Trust Infrastructure

Become a trusted authority

Position yourself as a reliable guarantor in your industry. Build reputation that can be leveraged for other business opportunities and partnerships.

Cash Flow Management

Predictable revenue from guarantees

Receive upfront payments for issuing guaranteed PayNotes. Better cash flow management and reduced uncertainty in revenue planning.

Network Effects

Benefit from ecosystem growth

As more people use PayNotes you guarantee, the value of your guarantee increases. Network effects amplify your business value and reach.

Implementation Flexibility

What You Can Guarantee

Transfer Mechanisms

Custom PayNote Lifecycle

1. Create

Guarantor creates custom PayNote with specific terms

2. Transfer

PayNote holders can transfer full or partial value

3. Validate

Guarantor validates authenticity and conditions

4. Redeem

Holder redeems value from guarantor

FAQ for Custom Guarantors

What can I guarantee as a custom guarantor?

Anything of value you can deliver: services, products, access rights, future earnings, digital assets, or even reputation-based commitments. The key is having the ability to honor the guarantee.

How do I handle PayNote transfers between users?

Transfers happen automatically on the PayNote network. You only need to validate authenticity when someone redeems the PayNote with you. All transfers are transparent and auditable.

What if I can't fulfill a guarantee?

PayNotes include fallback mechanisms and insurance options. You can also set expiry dates, usage limits, and conditions that protect both you and PayNote holders from unforeseen circumstances.

How do I price my guarantee services?

Consider the value you're guaranteeing, the risk involved, and the convenience you're providing. Most guarantors charge 2-5% of the guaranteed value plus any premium for transferability and flexibility.

Are there legal requirements for being a guarantor?

Requirements vary by jurisdiction and what you're guaranteeing. For most service-based guarantees, standard business licenses apply. Consult legal counsel for complex financial guarantees.

Can I limit how my PayNotes are transferred?

Yes, you can set transfer restrictions, usage conditions, geographic limits, and expiry dates. You control the terms of your guarantee while maintaining the benefits of transferability.

Ready to Create Custom PayNotes?

Turn your assets into liquid, transferable value with custom guarantees.

From restaurant vouchers to marathon awards—create unique payment experiences.